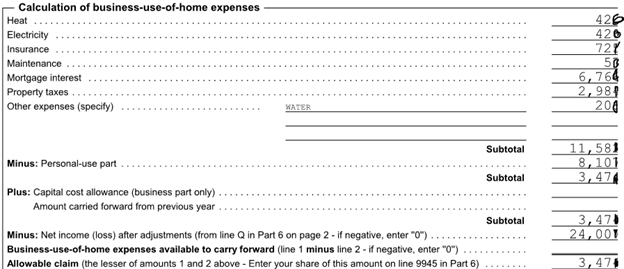

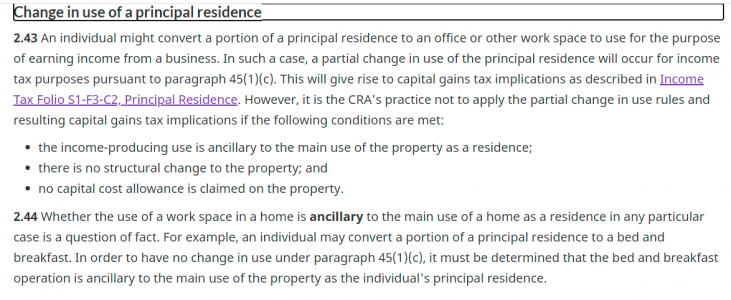

如果是自己的房子,而且你在家办公时,在运用Business use of home expense 报税时,里面包括了你房子的capital cost allowance,因此以后你卖房子时,会影响到Capital Gain.Gain.我是自雇在家办公。想问T2125表中Business use of home expense 报税的话,自用与办公是多少比例,以后卖房收益是可以亨受免税的呢?以前报税是按30%用于办公的,后来才了解以后卖房受影响,哪位可以帮忙解答一下?谢谢。

“The capital gain and recapture rules will apply if you deduct CCA on the business use part of your home and you later sell your home.”

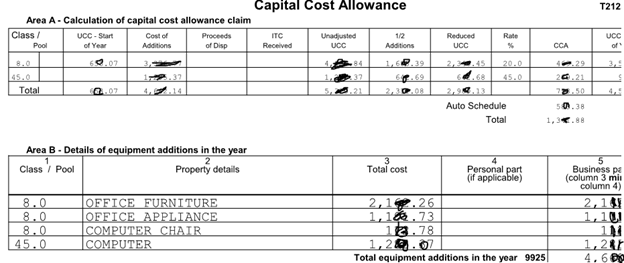

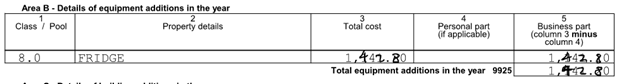

“Since these properties may wear out or become obsolete over time, you can deduct their cost over a period of several years. This yearly deduction is called a capital cost allowance (CCA).”

Claiming capital cost allowance (CCA) - Canada.ca

Information for businesses and professional activities on how to claim CCA, classes of depreciable property, personal use of property, treatment of capital gains, non-arm's length transactions, and more.