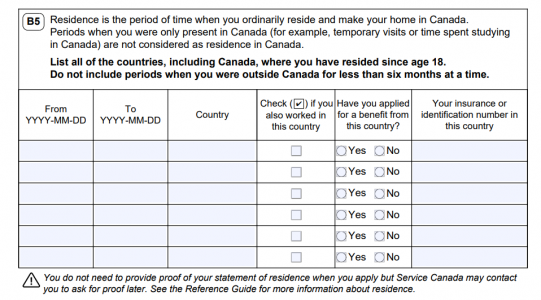

根据上面的文子,和我在政府官网上查到的,必须符合以下几个条件,按所需条件排列,缺一不可,才可以领取OAS:我看service canada 上的官方文件 并没有说 从 永久居民开始算起。 see below:

To be eligible for the Old Age Security (OAS) pension you must be at least 65 years of age and meet the

legal status and residence requirements:

Legal status: If living in Canada, you must be a Canadian Citizen or legal resident at the time we

approve your OAS application; if living outside Canada, you must have been a Canadian Citizen or legal

resident of Canada when you left.

Residence: If living in Canada, you must have resided in Canada for at least 10 years since age 18; if

living outside Canada, you must have resided in Canada for at least 20 years since age 18. If you do not

meet the 10 or 20 year residence requirement, you may still be eligible for the OAS pension if you have

lived or worked in a country with which Canada has a social security agreement.

1. I am 64 years of age or older (if your answer is yes)

2. I was born in Canada (if your answer is yes or no)

3. I am a Canadian citizen or legal resident (if your answer is yes)

4. I have only lived in Canada since age 18 (if your answer is yes)

因此我个人认为是从永久居民开始计算的。举个例子, 比如有个人55岁时来加拿大科研或读书,此人在65岁时申请移民成功,成为永久居民,但此人仍然需要在成为永久居民10年后才有资格领取OAS。虽然在成为永久居民之前,此人有合法的居留权,但仍然是非居民身份,此人的SIN 卡第一位数字是9,此人的CPP, EI 等的扣除和永久居民是不一样的,如果有定期存款在银行,银行会预扣25%的税。

因为此人的SIN 卡号码是9 字开头的,因此Service Canada 不会在此人64岁时寄OAS 申请表格给此人。

OAS 是只有公民和永久居民才有资格领取的福利。