The current American interest rate FED (base rate) is 0.500 %: 2015-12-16

美国今天刚把央行隔夜利率增加了 0.25 % ( 过去8年都是 0.25%) 到现在是 0.5% 跟加拿大的一样。

两国贷款情况不一样的,加拿大是2%加上基准利率,也就是2.5%,但银行没有跟进降息这么多,现在基本上是2.7%。美国则是3%加上0.5%,为3.5%。

今天还没有更新前的wikipedia:

https://en.wikipedia.org/wiki/Prime_rate

Use in different banking systems[edit]

United States and Canada[edit]

Main article:

U.S. prime rate

Historically, in North American

banking, the prime rate was the actual interest rate, although this is no longer the case. The prime rate varies little among banks and adjustments are generally made by banks at the same time, although this does not happen frequently. The prime rate is currently 3.25% in the

United States[1] and 2.7% in Canada.

[2]

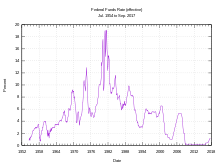

Historical chart of the effective Federal Funds Rate

In the United States, the prime rate runs approximately 300

basis points (or 3 percentage points) above the

federal funds rate, which is the interest rate that banks charge each other for overnight loans made to fulfill reserve funding requirements. The Federal funds rate plus a much smaller increment is frequently used for lending to the most creditworthy borrowers, as is LIBOR, the

London Interbank Offered Rate. The

Federal Open Market Committee (FOMC) meets eight times per year to set a target for the federal funds rate.

Prior to December 17, 2008, the

Wall Street Journal followed a policy of changing its published prime rate when 23 out of 30 of the United States' largest banks changed their prime rates. Recognizing that fewer, larger banks now control most banking assets—i.e., it is more concentrated—the

Journalnow publishes a rate reflecting the base rate posted by at least 70% of the top ten banks by assets.