- 首页

-

菜单

- 家园币

-

比特币

Financial Markets by TradingView

您正在使用一款已经过时的浏览器!部分功能不能正常使用。

- 主题发起人 生态美

- 发布时间 2008-02-27

更多选项

导出主题(文本)回复: 想去加国做住家保姆

478-481楼,想了解 已经在加拿大 做住家保姆,然后要转移民的

http://www.ccue.com/www/etel/category/2110

我找了几个网站,是多伦多的 移民公司的,半年前曾经咨询过,最近因为要递交材料了,所以又要打电话 都咨询一遍,还有问朋友的推荐。

但是 真正做过 住家保姆转移民的 还是不多的,因为本身案例就少.

今天在 cic 上看到的,07年通过这个移民的 是 7000多人,世界各地的,08年的还没有统计数据. On.是最多的,2000多个. 不知道中国人比例多少,所以移民公司 接到 住家保姆的case 少 也是可以理解的,但是 装b 就很让人讨厌了.

http://forum.iask.ca/showtopic-251780.aspx

12楼 有一些黑移民中介,具体怎么黑 没什么接触 自己看

http://www.ccue.com/www/etel/category/2110

今天break 时间,我挨着打了一遍这里面的电话,还没打完,明天继续咨询。 有些公司的广告多,之前也曾经咨询过. 有些公司的名字完全陌生. 根据我的感觉,我来说一下 各公司对住家保姆转移民的案例了解.

一般都是代表接电话,然后转给 顾问.

很多代表 住家保姆业务不了解. 有一些不知道live in care giver是什么. 包括一些 大牌,cics注册的.

有些公司说不做这个 ,结果是 说不做从中国转来加拿大的.因为国内做这个的都有猫腻,中介费贵. 这里有一些中介公司也作 从国内转过来,中介费很多收 1w 加币. 他们也没做过到了后 再转的.

有的顾问问,不是已经过来了吗,还有什么问题,我很尴尬.

我一般上来头3个问题里,就会问到怎么收费,有一家居然说,没有这么问得,让过去谈. 我就算过去谈,你也得多少跟我说点什么啊,什么都不说,就让我过去.

收费问题,大部分都差不多,差不了200块,属于低价位的,中价位的比低价位 的一般多收500,再高点的 就很离谱了,双倍, ok,您贵,但您不够专业,我知道答案的问题 您都不知道怎么说,so ...

有一些公司很好,说没做过,很实在,那以后 如果有其他业务,也可以商谈。但有些公司就扯淡,什么 你雅思过了几分了? 给你办技术移民什么的,我直接晕倒,您把住家保姆 官方文字弄明白了在谈成吗?

因为 中介太多了,就sheppard上就很多家,打了很多都未接电话,而且名字都很陌生,实在想不通 还有这样做生意的,而且大家都说 骗人的公司多,我想这类公司 有一般可能性 属于骗子中介。有的公司就忙死.

有些公司 态度很好,说话中的信息 能给你的感觉是 他们有经验 ,成功过,收费实在,公司案例多,但好像太忙了.

如果太忙得公司,也会出错,我看好的一家公司,有朋友跟我说,填表出现错误,就是因为太忙,所以我有点犹豫,虽然找 移民公司给做,但 本人也要过目这些资料,来核实信息.

有的公司 给你的信息,让你觉得还可以,但某几个比较重要的问题上 答案绝对是错误的,所以 又有所怀疑他们之前没做过.很难判断. 所以要查一下他们的底,就怕收了钱 不办事.

还有一家公司,说不接受新客人,我就不明白了,又不是家庭医生,难道不是敞开门作生意吗? 呵呵

还有 如果选定要去面谈的,就准备一些问题,记录在纸上,直接问,看他们的答案是否 让人感觉还不错。 基本就是一些关于移民的细节问题。还有 他们一般老板 或者什么 都会是律师,或者移民顾问,好像律师可以直接递,而移民顾问 需要有cics的号,这个明着要 到时候,真的 他们也不怕查。http://www.csic-scci.ca/find/all.html 会员列表

差不多,下2个礼拜 就签合同.

补充一下

我给那些移民公司打电话

第一遍 由于时间紧促,我挑了大约10家

第2遍 就是选几家要去面谈的 最后定了3家

也google 了一下信誉方面的

478-481楼,想了解 已经在加拿大 做住家保姆,然后要转移民的

http://www.ccue.com/www/etel/category/2110

我找了几个网站,是多伦多的 移民公司的,半年前曾经咨询过,最近因为要递交材料了,所以又要打电话 都咨询一遍,还有问朋友的推荐。

但是 真正做过 住家保姆转移民的 还是不多的,因为本身案例就少.

今天在 cic 上看到的,07年通过这个移民的 是 7000多人,世界各地的,08年的还没有统计数据. On.是最多的,2000多个. 不知道中国人比例多少,所以移民公司 接到 住家保姆的case 少 也是可以理解的,但是 装b 就很让人讨厌了.

http://forum.iask.ca/showtopic-251780.aspx

12楼 有一些黑移民中介,具体怎么黑 没什么接触 自己看

http://www.ccue.com/www/etel/category/2110

今天break 时间,我挨着打了一遍这里面的电话,还没打完,明天继续咨询。 有些公司的广告多,之前也曾经咨询过. 有些公司的名字完全陌生. 根据我的感觉,我来说一下 各公司对住家保姆转移民的案例了解.

一般都是代表接电话,然后转给 顾问.

很多代表 住家保姆业务不了解. 有一些不知道live in care giver是什么. 包括一些 大牌,cics注册的.

有些公司说不做这个 ,结果是 说不做从中国转来加拿大的.因为国内做这个的都有猫腻,中介费贵. 这里有一些中介公司也作 从国内转过来,中介费很多收 1w 加币. 他们也没做过到了后 再转的.

有的顾问问,不是已经过来了吗,还有什么问题,我很尴尬.

我一般上来头3个问题里,就会问到怎么收费,有一家居然说,没有这么问得,让过去谈. 我就算过去谈,你也得多少跟我说点什么啊,什么都不说,就让我过去.

收费问题,大部分都差不多,差不了200块,属于低价位的,中价位的比低价位 的一般多收500,再高点的 就很离谱了,双倍, ok,您贵,但您不够专业,我知道答案的问题 您都不知道怎么说,so ...

有一些公司很好,说没做过,很实在,那以后 如果有其他业务,也可以商谈。但有些公司就扯淡,什么 你雅思过了几分了? 给你办技术移民什么的,我直接晕倒,您把住家保姆 官方文字弄明白了在谈成吗?

因为 中介太多了,就sheppard上就很多家,打了很多都未接电话,而且名字都很陌生,实在想不通 还有这样做生意的,而且大家都说 骗人的公司多,我想这类公司 有一般可能性 属于骗子中介。有的公司就忙死.

有些公司 态度很好,说话中的信息 能给你的感觉是 他们有经验 ,成功过,收费实在,公司案例多,但好像太忙了.

如果太忙得公司,也会出错,我看好的一家公司,有朋友跟我说,填表出现错误,就是因为太忙,所以我有点犹豫,虽然找 移民公司给做,但 本人也要过目这些资料,来核实信息.

有的公司 给你的信息,让你觉得还可以,但某几个比较重要的问题上 答案绝对是错误的,所以 又有所怀疑他们之前没做过.很难判断. 所以要查一下他们的底,就怕收了钱 不办事.

还有一家公司,说不接受新客人,我就不明白了,又不是家庭医生,难道不是敞开门作生意吗? 呵呵

还有 如果选定要去面谈的,就准备一些问题,记录在纸上,直接问,看他们的答案是否 让人感觉还不错。 基本就是一些关于移民的细节问题。还有 他们一般老板 或者什么 都会是律师,或者移民顾问,好像律师可以直接递,而移民顾问 需要有cics的号,这个明着要 到时候,真的 他们也不怕查。http://www.csic-scci.ca/find/all.html 会员列表

差不多,下2个礼拜 就签合同.

补充一下

我给那些移民公司打电话

第一遍 由于时间紧促,我挑了大约10家

第2遍 就是选几家要去面谈的 最后定了3家

也google 了一下信誉方面的

最后编辑: 2009-01-22

回复: 想去加国做住家保姆

http://www.cic.gc.ca/english/resources/publications/annual-report2008/section3.asp

其中

Live-in Caregivers

The Live-in Caregiver Program allows individuals residing in Canada to employ qualified foreign workers in their private residence when there are not enough Canadians and permanent residents to fill the available positions. Live-in caregivers must be qualified to provide care for children, the sick or elderly, or persons with a disability. Initially, successful candidates are granted temporary resident status and a work permit, and after two years, they are eligible to apply for permanent resident status.

住家保姆项目是被允许 当找不到合适的加拿大人或者移民来填补合适的空缺 来雇用合格的外国工人 在他们的私人住所居住. 住家保姆必须合格的照顾 孩子,病人或者老人,或者残疾人.

开始阶段 合格的住家保姆会被颁发临时身份和工作签证,2年后,他们又资格申请pr。

In 2007, there were 6,117 persons admitted under the Live-in Caregiver Program, exceeding the planned range of 3,000 to 5,000 announced in the 2007 levels plan.

2007年,由6117人通过 住家保姆项目,超过计划范围3000-5000在2007年宣布的计划

http://www.cic.gc.ca/english/resources/publications/annual-report2008/section3.asp

其中

Live-in Caregivers

The Live-in Caregiver Program allows individuals residing in Canada to employ qualified foreign workers in their private residence when there are not enough Canadians and permanent residents to fill the available positions. Live-in caregivers must be qualified to provide care for children, the sick or elderly, or persons with a disability. Initially, successful candidates are granted temporary resident status and a work permit, and after two years, they are eligible to apply for permanent resident status.

住家保姆项目是被允许 当找不到合适的加拿大人或者移民来填补合适的空缺 来雇用合格的外国工人 在他们的私人住所居住. 住家保姆必须合格的照顾 孩子,病人或者老人,或者残疾人.

开始阶段 合格的住家保姆会被颁发临时身份和工作签证,2年后,他们又资格申请pr。

In 2007, there were 6,117 persons admitted under the Live-in Caregiver Program, exceeding the planned range of 3,000 to 5,000 announced in the 2007 levels plan.

2007年,由6117人通过 住家保姆项目,超过计划范围3000-5000在2007年宣布的计划

最后编辑: 2009-01-21

回复: 想去加国做住家保姆

下面这个link是我先生给我看的,时间是近期的了。08年4月的。

http://www.cic.gc.ca/english/resources/manuals/ip/ip04e.pdf

大体看了下,内容和以前的差不多。我会在近期内,把主要的给大家翻译一下.

IP 4

Processing Live-in Caregivers

in Canada

IP 04 Processing Live-in Caregivers in Canada

2008-04-24 1

Updates to chapter ............ 3

1. What this chapter is about ...... 4

2. Program objectives ....... 4 项目目标

3. The Act and Regulations ............ 4 法规条例

4. Instruments and Delegations ...... 4

4.1. Instruments and delegations.................. 4

4.2. Delegated powers ................ 5授予权力

4.3. Delegates/Designated officers ....................... 5

5. Departmental policy ................ 5 部门政策

5.1. Responsibility for processing by the visa office .......... 5

5.2. Responsibility for processing in Canada............. 5

5.3. Issuance or renewal of work permits in Canada......6发行或续期工作签证在加拿大

5.4. Mandatory employment contract................................

5.5. Validation of a job offer ................................... 6

5.6. Eligibility for permanent residence ........................ 6

5.7. Admissibility requirements ......................... 7

5.8. Quebec applicants .............................. 7

5.9. Parallel processing of family members ............... 7家庭成员同时进行

5.10. Responding to representations ......................回应申述

6. Definitions ..................................................................

6.1. Bridge extension ........................ 7

6.2. Employment contract .............. 8

6.3. Family member ...............................

6.4. Live-in caregiver...........................................

7. Processing an employment contract....................

8. Procedures for issuance/renewal of work permits, study permit... 9

8.1. Applications for work permits ....................

8.2. Requirements for issuance of work permits.......................

8.3. If all requirements are met ........................

8.4. If requirements are not met: Live-in caregiver has left work .... 10

8.5. If requirements are not met: Live-in caregiver is between..... 10

8.6. Refusal of an application for a work permit..................... 拒签

8.7. Issuance of study permits .........................

9. Processing applications for permanent residence..............

9.1. General guidelines .................... 一般准则

9.2. Applications..................... 11

9.3. Fees ............................

9.4. Assessing eligibility to become a member of the live-in caregiver cla.....12

9.5. Acceptable evidence of two years’ employment..........2年雇用记录

9.6. Checking for pending criminal charges......... 13

9.7. Granting approval-in-principle (applicants determined to be members of

live-in caregiver class)............................

9.8. Refusing applicants determined not to be members of live-in caregiver class

(ineligible applicants)................. 13

9.9. Applications in Quebec ............... 13

9.10. Assessing admissibility requirements ............ 14

9.11. Criminal and security checks ................... 14

9.12. Medical examinations................ 14

9.13. Processing of family members.................. 14

9.14. Family members not subject to examination........ 15

9.15. Ineligible family members..................................

9.16. Finalizing approved cases................................. 最后批准

9.17. Finalizing refused cases...................... 最后拒绝

10. Tracking the application...................

Appendix A Sample letters........................

Appendix B Fact sheet on employment standards legislation ... 24

http://www.cic.gc.ca/english/resources/manuals/ip/ip04e.pdf

下面这个link是我先生给我看的,时间是近期的了。08年4月的。

http://www.cic.gc.ca/english/resources/manuals/ip/ip04e.pdf

大体看了下,内容和以前的差不多。我会在近期内,把主要的给大家翻译一下.

IP 4

Processing Live-in Caregivers

in Canada

IP 04 Processing Live-in Caregivers in Canada

2008-04-24 1

Updates to chapter ............ 3

1. What this chapter is about ...... 4

2. Program objectives ....... 4 项目目标

3. The Act and Regulations ............ 4 法规条例

4. Instruments and Delegations ...... 4

4.1. Instruments and delegations.................. 4

4.2. Delegated powers ................ 5授予权力

4.3. Delegates/Designated officers ....................... 5

5. Departmental policy ................ 5 部门政策

5.1. Responsibility for processing by the visa office .......... 5

5.2. Responsibility for processing in Canada............. 5

5.3. Issuance or renewal of work permits in Canada......6发行或续期工作签证在加拿大

5.4. Mandatory employment contract................................

5.5. Validation of a job offer ................................... 6

5.6. Eligibility for permanent residence ........................ 6

5.7. Admissibility requirements ......................... 7

5.8. Quebec applicants .............................. 7

5.9. Parallel processing of family members ............... 7家庭成员同时进行

5.10. Responding to representations ......................回应申述

6. Definitions ..................................................................

6.1. Bridge extension ........................ 7

6.2. Employment contract .............. 8

6.3. Family member ...............................

6.4. Live-in caregiver...........................................

7. Processing an employment contract....................

8. Procedures for issuance/renewal of work permits, study permit... 9

8.1. Applications for work permits ....................

8.2. Requirements for issuance of work permits.......................

8.3. If all requirements are met ........................

8.4. If requirements are not met: Live-in caregiver has left work .... 10

8.5. If requirements are not met: Live-in caregiver is between..... 10

8.6. Refusal of an application for a work permit..................... 拒签

8.7. Issuance of study permits .........................

9. Processing applications for permanent residence..............

9.1. General guidelines .................... 一般准则

9.2. Applications..................... 11

9.3. Fees ............................

9.4. Assessing eligibility to become a member of the live-in caregiver cla.....12

9.5. Acceptable evidence of two years’ employment..........2年雇用记录

9.6. Checking for pending criminal charges......... 13

9.7. Granting approval-in-principle (applicants determined to be members of

live-in caregiver class)............................

9.8. Refusing applicants determined not to be members of live-in caregiver class

(ineligible applicants)................. 13

9.9. Applications in Quebec ............... 13

9.10. Assessing admissibility requirements ............ 14

9.11. Criminal and security checks ................... 14

9.12. Medical examinations................ 14

9.13. Processing of family members.................. 14

9.14. Family members not subject to examination........ 15

9.15. Ineligible family members..................................

9.16. Finalizing approved cases................................. 最后批准

9.17. Finalizing refused cases...................... 最后拒绝

10. Tracking the application...................

Appendix A Sample letters........................

Appendix B Fact sheet on employment standards legislation ... 24

http://www.cic.gc.ca/english/resources/manuals/ip/ip04e.pdf

最后编辑: 2009-01-21

回复: 想去加国做住家保姆

IP 04 Processing Live-in Caregivers in Canada

2008-04-24 2

Appendix C Provincial and territorial employment standards .................................................... 30

Appendix D Counselling fact sheet...................................33

Appendix E Live-in caregiver/domestic worker 附录e 住家保姆/佣人工作者协会associations................................................34

Appendix F Live-in caregivers, working conditions by region........................................................ 36

IP 04 Processing Live-in Caregivers in Canada

2008-04-24 3

Updates to chapter

Listing by date:

Date: 2008-04-24

Section 6.3 was amended to provide an accurate link to the definition of a “Family Member.”修订定义“家庭成员”的 精确链接

Date: 2007-11-30

Section 9.5 was updated to clarify清楚 that acceptable evidence 证明of two year’s employment MUST

include ALL documents listed. As well, a new document requirement was added: a letter from

the current employer showing the start date and confirming the applicant’s status as currently

being employed.

当前雇主出示 开始工作的日期和申请人的身份目前被雇用的信件

The “Updates to chaper” section was created

IP 04 Processing Live-in Caregivers in Canada

2008-04-24 4

1. What this chapter is about文章说的是

This chapter describes the processing in Canada of applications for renewal of work permits这章描述的是 在加拿大申请者更新工作签证的进程(老雇主)

(same employer), applications for new work permits (new employer), applications for study申请新的工作签证(新雇主) ,申请学生签证 和申请移民

permits and applications for permanent residence, under the Live-in Caregiver Program (LCP).

Note: See OP 14 for the processing of live-in caregiver applications at visa offices abroad.

2. Program objectives项目目的

Citizenship and Immigration Canada established 设立this program to meet a labour market shortage of

live-in caregivers in Canada鉴于劳工市场缺少住家保姆, giving qualified foreign caregivers the opportunity机会 to work and

eventually最终 apply for permanent residence within Canada.

3. The Act and Regulations

The Immigration and Refugee Protection Act (IRPA)移民和难民保护法, which was passed on November 1, 2001,

and its accompanying Regulations took effect June 28, 2002. They replace the Immigration Act of

1976 and the Regulations条例 established on April 1, 1997.

References in the Regulations to the Live-in Caregiver Program

For more information about Refer to

Authorization授权 for application for permanent residence in Canada R72

Definition定义 of live-in caregiver R2

Live-in caregiver class R113

Requirements for work permit R111, R112

Application for permanent residence in Canada R113在加拿大申请移民

Requirements for family members R114家庭成员要求

Applicable times R115

Study without a work permit: short-term courses R188

Application in Canada for work permit R207

Application in Canada for study permit R215

Forms Required

Form Title Form Number

In-Canada Application for Permanent Resident Status在加拿大申请移民身份 IMM 5002E

Document Checklist Live-in Caregiver 住家保姆文件清单IMM 5282E

Application to Change Conditions or to Extend my Stay in Canada IMM 1249E

4. Instruments and Delegations

4.1. Instruments and delegations

Subsection第 A6(1) of the Act authorizes the Minister to designate指定 officers to carry out specific

powers, and to delegate authorities. It also states those ministerial authorities that may

IP 04 Processing Live-in Caregivers in Canada

2008-04-24 5

Pursuant根据 to subsection A6(2) of the Immigration and Refugee Protection Act, the Minister of

Citizenship and Immigration has delegated代表 powers and designated those officials authorized to

carry out any purpose of any provisions legislative规定立法 or regulatory in instrument IL 3 Designation

of Officers and Delegation of Authority.

4.2. Delegated powers

Chapter IL 3 organizes delegated powers by modules. Each module模块 is divided into columns,

including column列 1: provides an item number for the described powers; column 2: provides a

reference to the sections or subsections of the Act and Regulations covered by the described

powers; and column 3: provides a description of the delegated powers. The duties and powers

specific to this chapter are found in the modules listed below:

Module 1 Permanent residence and the sponsorship of foreign nationals

Module 7 Temporary Residents Remaining in Canada

Module 9 Inadmissibility取缔 loss of status removal清除

4.3. Delegates/Designated officers

The delegates or designated officers, specified in column 4 of Annexes附录 A to H, are authorized to

carry out the powers described in column 3 of each module. Annexes are organized by region and

by module. Officers should verify the list below for the annex specific to their region.

Annex A Atlantic Region

Annex B Quebec Region

Annex C Ontario Region区域

Annex D Prairies/NWT Region

Annex E BC Region

Annex F International Region

Annex G Departmental Delivery Network

Annex H NHQ

5. Departmental policy

5.1. Responsibility for processing by the visa office

Visa offices are responsible for the initial 初次selection process and issuance of work permits to live-in

caregivers. See OP 14, section 8.3 for assessment 评估of eligibility criteria标准. They are also responsible

for processing overseas family members of live-in caregivers who have applied for permanent

residence.

5.2. Responsibility for processing in Canada

The Case Processing Centre in Vegreville (CPC-V) is responsible for processing applications in

Canada for:

work permits and renewals;

study permits;

permanent residence in Canada.

IP 04 Processing Live-in Caregivers in Canada

2008-04-24 6

Note: CPC-V refers cases to an inland immigration office (CIC) if an interview is warranted 值得or if there is

suspected misrepresentation涉嫌虚假陈述, serious criminality or security concerns, as described in A34, A35,

A36(1) or A37.

CPC-V issues all refusal letters.

5.3. Issuance发行 or renewal of work permits in Canada

Work permits are issued for one year at a time. Live-in caregivers must apply to CPC-V for a

renewal of their work permit before it expires.在签证过期前更新

They may change employers but must apply for a new work permit, with a validated job offer and可以换雇主但一定要申请新的工作签证,和有效工作offter和新雇用合同

a new employment contract. If the caregiver continues to work for the same employer, there is no如果保姆继续为同一雇主工作,不需要验证。

need for a new validation. A letter from the employer stating that the live-in caregiver will continue

to be employed full time for another year is sufficient. The employer and caregiver must also

extend their employment contract for another year.

Live-in caregivers must continue to meet the requirements of the LCP.

Note: Applicants who take live-out employment are automatically disqualified from the program, as are

those who work for more than one employer at a time.

The total duration of all work permits (added together) should not exceed three years.总共工作签证时间不能超过3年 Participants

must complete two years of full-time employment to qualify for permanent residence. The threeyear

period gives them flexibility灵活性 to compensate补偿 for periods of unemployment, illness, vacation or

maternity产假 leave.

5.4. Mandatory强制性 employment contract

An employment contract between employer and live-in caregiver, outlining概述 the terms and

conditions of employment, is a legal requirement of the Live-in Caregiver Program and must be

provided to CPC-V before a work permit can be renewed. The contract must be signed by both

employer and employee. Terms and conditions must, by law, be consistent一致 with provincial

employment standards.

5.5. Validation of a job offer

See OP 14, section 5.11.

Validation by Human Resources Development Canada (HRDC) is required for a new work permit

(change of employer).

HRDC’s local Human Resources Centres of Canada (HRCCs) ask employers interested in hiring

a live-in caregiver to complete an EMP 5093, Application for Foreign Live-in Caregiver.

For more information about application and validation, please see section 7, Processing an

employment contract.

5.6. Eligibility for permanent residence

Live-in caregivers may apply for permanent residence after they have worked for two years in the

LCP within three years of their arrival in Canada. They must meet the requirements of the class as

specified in R113. The live-in requirement is an important element of the program, as there is no

shortage of Canadians willing to work on a live-out basis.

All family members of LCP applicants for permanent residence must undergo 接受and pass medical,

criminal and security checks. Separated or former spouses/common-law partners and children in

the custody保管 of another person, including the separated or former spouse/common-law partner, are

not eligible family members. Live-in caregivers cannot become permanent residents if any of their

eligible family members are inadmissible.

p7

IP 04 Processing Live-in Caregivers in Canada

2008-04-24 2

Appendix C Provincial and territorial employment standards .................................................... 30

Appendix D Counselling fact sheet...................................33

Appendix E Live-in caregiver/domestic worker 附录e 住家保姆/佣人工作者协会associations................................................34

Appendix F Live-in caregivers, working conditions by region........................................................ 36

IP 04 Processing Live-in Caregivers in Canada

2008-04-24 3

Updates to chapter

Listing by date:

Date: 2008-04-24

Section 6.3 was amended to provide an accurate link to the definition of a “Family Member.”修订定义“家庭成员”的 精确链接

Date: 2007-11-30

Section 9.5 was updated to clarify清楚 that acceptable evidence 证明of two year’s employment MUST

include ALL documents listed. As well, a new document requirement was added: a letter from

the current employer showing the start date and confirming the applicant’s status as currently

being employed.

当前雇主出示 开始工作的日期和申请人的身份目前被雇用的信件

The “Updates to chaper” section was created

IP 04 Processing Live-in Caregivers in Canada

2008-04-24 4

1. What this chapter is about文章说的是

This chapter describes the processing in Canada of applications for renewal of work permits这章描述的是 在加拿大申请者更新工作签证的进程(老雇主)

(same employer), applications for new work permits (new employer), applications for study申请新的工作签证(新雇主) ,申请学生签证 和申请移民

permits and applications for permanent residence, under the Live-in Caregiver Program (LCP).

Note: See OP 14 for the processing of live-in caregiver applications at visa offices abroad.

2. Program objectives项目目的

Citizenship and Immigration Canada established 设立this program to meet a labour market shortage of

live-in caregivers in Canada鉴于劳工市场缺少住家保姆, giving qualified foreign caregivers the opportunity机会 to work and

eventually最终 apply for permanent residence within Canada.

3. The Act and Regulations

The Immigration and Refugee Protection Act (IRPA)移民和难民保护法, which was passed on November 1, 2001,

and its accompanying Regulations took effect June 28, 2002. They replace the Immigration Act of

1976 and the Regulations条例 established on April 1, 1997.

References in the Regulations to the Live-in Caregiver Program

For more information about Refer to

Authorization授权 for application for permanent residence in Canada R72

Definition定义 of live-in caregiver R2

Live-in caregiver class R113

Requirements for work permit R111, R112

Application for permanent residence in Canada R113在加拿大申请移民

Requirements for family members R114家庭成员要求

Applicable times R115

Study without a work permit: short-term courses R188

Application in Canada for work permit R207

Application in Canada for study permit R215

Forms Required

Form Title Form Number

In-Canada Application for Permanent Resident Status在加拿大申请移民身份 IMM 5002E

Document Checklist Live-in Caregiver 住家保姆文件清单IMM 5282E

Application to Change Conditions or to Extend my Stay in Canada IMM 1249E

4. Instruments and Delegations

4.1. Instruments and delegations

Subsection第 A6(1) of the Act authorizes the Minister to designate指定 officers to carry out specific

powers, and to delegate authorities. It also states those ministerial authorities that may

IP 04 Processing Live-in Caregivers in Canada

2008-04-24 5

Pursuant根据 to subsection A6(2) of the Immigration and Refugee Protection Act, the Minister of

Citizenship and Immigration has delegated代表 powers and designated those officials authorized to

carry out any purpose of any provisions legislative规定立法 or regulatory in instrument IL 3 Designation

of Officers and Delegation of Authority.

4.2. Delegated powers

Chapter IL 3 organizes delegated powers by modules. Each module模块 is divided into columns,

including column列 1: provides an item number for the described powers; column 2: provides a

reference to the sections or subsections of the Act and Regulations covered by the described

powers; and column 3: provides a description of the delegated powers. The duties and powers

specific to this chapter are found in the modules listed below:

Module 1 Permanent residence and the sponsorship of foreign nationals

Module 7 Temporary Residents Remaining in Canada

Module 9 Inadmissibility取缔 loss of status removal清除

4.3. Delegates/Designated officers

The delegates or designated officers, specified in column 4 of Annexes附录 A to H, are authorized to

carry out the powers described in column 3 of each module. Annexes are organized by region and

by module. Officers should verify the list below for the annex specific to their region.

Annex A Atlantic Region

Annex B Quebec Region

Annex C Ontario Region区域

Annex D Prairies/NWT Region

Annex E BC Region

Annex F International Region

Annex G Departmental Delivery Network

Annex H NHQ

5. Departmental policy

5.1. Responsibility for processing by the visa office

Visa offices are responsible for the initial 初次selection process and issuance of work permits to live-in

caregivers. See OP 14, section 8.3 for assessment 评估of eligibility criteria标准. They are also responsible

for processing overseas family members of live-in caregivers who have applied for permanent

residence.

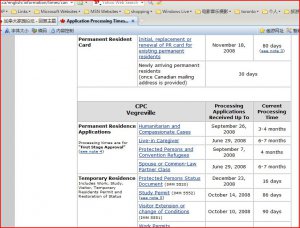

5.2. Responsibility for processing in Canada

The Case Processing Centre in Vegreville (CPC-V) is responsible for processing applications in

Canada for:

work permits and renewals;

study permits;

permanent residence in Canada.

IP 04 Processing Live-in Caregivers in Canada

2008-04-24 6

Note: CPC-V refers cases to an inland immigration office (CIC) if an interview is warranted 值得or if there is

suspected misrepresentation涉嫌虚假陈述, serious criminality or security concerns, as described in A34, A35,

A36(1) or A37.

CPC-V issues all refusal letters.

5.3. Issuance发行 or renewal of work permits in Canada

Work permits are issued for one year at a time. Live-in caregivers must apply to CPC-V for a

renewal of their work permit before it expires.在签证过期前更新

They may change employers but must apply for a new work permit, with a validated job offer and可以换雇主但一定要申请新的工作签证,和有效工作offter和新雇用合同

a new employment contract. If the caregiver continues to work for the same employer, there is no如果保姆继续为同一雇主工作,不需要验证。

need for a new validation. A letter from the employer stating that the live-in caregiver will continue

to be employed full time for another year is sufficient. The employer and caregiver must also

extend their employment contract for another year.

Live-in caregivers must continue to meet the requirements of the LCP.

Note: Applicants who take live-out employment are automatically disqualified from the program, as are

those who work for more than one employer at a time.

The total duration of all work permits (added together) should not exceed three years.总共工作签证时间不能超过3年 Participants

must complete two years of full-time employment to qualify for permanent residence. The threeyear

period gives them flexibility灵活性 to compensate补偿 for periods of unemployment, illness, vacation or

maternity产假 leave.

5.4. Mandatory强制性 employment contract

An employment contract between employer and live-in caregiver, outlining概述 the terms and

conditions of employment, is a legal requirement of the Live-in Caregiver Program and must be

provided to CPC-V before a work permit can be renewed. The contract must be signed by both

employer and employee. Terms and conditions must, by law, be consistent一致 with provincial

employment standards.

5.5. Validation of a job offer

See OP 14, section 5.11.

Validation by Human Resources Development Canada (HRDC) is required for a new work permit

(change of employer).

HRDC’s local Human Resources Centres of Canada (HRCCs) ask employers interested in hiring

a live-in caregiver to complete an EMP 5093, Application for Foreign Live-in Caregiver.

For more information about application and validation, please see section 7, Processing an

employment contract.

5.6. Eligibility for permanent residence

Live-in caregivers may apply for permanent residence after they have worked for two years in the

LCP within three years of their arrival in Canada. They must meet the requirements of the class as

specified in R113. The live-in requirement is an important element of the program, as there is no

shortage of Canadians willing to work on a live-out basis.

All family members of LCP applicants for permanent residence must undergo 接受and pass medical,

criminal and security checks. Separated or former spouses/common-law partners and children in

the custody保管 of another person, including the separated or former spouse/common-law partner, are

not eligible family members. Live-in caregivers cannot become permanent residents if any of their

eligible family members are inadmissible.

p7

最后编辑: 2009-02-02

回复: 想去加国做住家保姆

插一条

http://www.cic.gc.ca/english/department/media/releases/2008/2008-11-28.asp

News Release

Minister Kenney announces immigration levels for 2009; Issues instructions on processing federal skilled workers

Ottawa, November 28, 2008 ― Canada will stay the course on immigration in 2009, welcoming between 240,000 and 265,000 new permanent residents, Jason Kenney, Minister of Citizenship, Immigration and Multiculturalism, announced today.

“While countries such as the United Kingdom and Australia are talking about taking fewer immigrants, our planned numbers for 2009 are on par with last year and are among the highest for this country over the past 15 years,” Minister Kenney said. “The numbers reflect a continued commitment to an immigration program that balances Canada’s economic, humanitarian and family reunification goals.”

The 2009 plan includes up to 156,600 immigrants in the economic category; 71,000 in the family category; and 37,400 in the humanitarian category.

Minister Kenney also announced another step in measures to improve the immigration program’s responsiveness to Canada’s labour market. Retroactive to February 27, 2008, the date specified by the Federal Budget, the Action Plan for Faster Immigration includes issuing instructions to visa officers reviewing new federal skilled worker applications to process those from candidates who:

“The eligibility criteria apply only to new federal skilled worker applicants and will not affect Canada’s family reunification or refugee protection goals,” said Minister Kenney. “Applicants who aren’t eligible for the federal skilled worker category may qualify under another category, such as the Provincial Nominee Program, or as temporary foreign workers, which could then put them on a path to permanent residency through the new Canadian Experience Class. There are many ways to immigrate to Canada.”

The Department has expanded its website in an effort to make it easier for people to navigate the range of immigration options open to them. The site now includes a specific section for employers (www.cic.gc.ca/employers) and a new interactive tool (www.cic.gc.ca/cometocanada) that matches information provided by potential applicants with immigration programs that best suit their circumstances.

“We expect new federal skilled worker applicants, including those with arranged employment, to receive a decision within six to 12 months compared with up to six years under the old system,” said Minister Kenney. “All other economic class applications―including applicants chosen by Quebec, provincial nominees, the Canadian Experience Class, and live-in caregivers―will continue to be given priority.”

These improvements, coupled with a number of recent initiatives that include the introduction of the Canadian Experience Class, bring Canada in line with two of its main competitors for highly skilled labour: Australia and New Zealand. Both of these countries have eliminated their backlogs and have systems that deliver final decisions for economic applicants within a year.

“The recent steps this Government has taken to improve our immigration system will help ensure that Canada remains competitive internationally and responsive to labour market needs domestically,” said Minister Kenney.

For further information (media only), please contact:

Alykhan Velshi

Minister’s Office

Citizenship and Immigration Canada

613-954-1064

Media Relations Unit

Communications Branch

Citizenship and Immigration Canada

613-952-1650

插一条

http://www.cic.gc.ca/english/department/media/releases/2008/2008-11-28.asp

News Release

Minister Kenney announces immigration levels for 2009; Issues instructions on processing federal skilled workers

Ottawa, November 28, 2008 ― Canada will stay the course on immigration in 2009, welcoming between 240,000 and 265,000 new permanent residents, Jason Kenney, Minister of Citizenship, Immigration and Multiculturalism, announced today.

“While countries such as the United Kingdom and Australia are talking about taking fewer immigrants, our planned numbers for 2009 are on par with last year and are among the highest for this country over the past 15 years,” Minister Kenney said. “The numbers reflect a continued commitment to an immigration program that balances Canada’s economic, humanitarian and family reunification goals.”

The 2009 plan includes up to 156,600 immigrants in the economic category; 71,000 in the family category; and 37,400 in the humanitarian category.

Minister Kenney also announced another step in measures to improve the immigration program’s responsiveness to Canada’s labour market. Retroactive to February 27, 2008, the date specified by the Federal Budget, the Action Plan for Faster Immigration includes issuing instructions to visa officers reviewing new federal skilled worker applications to process those from candidates who:

- are in 38 high-demand occupations such as health, skilled trades, finance and resource extraction; or

- have an offer of arranged employment or have already been living legally in Canada for one year as a temporary foreign worker or international student.

“The eligibility criteria apply only to new federal skilled worker applicants and will not affect Canada’s family reunification or refugee protection goals,” said Minister Kenney. “Applicants who aren’t eligible for the federal skilled worker category may qualify under another category, such as the Provincial Nominee Program, or as temporary foreign workers, which could then put them on a path to permanent residency through the new Canadian Experience Class. There are many ways to immigrate to Canada.”

The Department has expanded its website in an effort to make it easier for people to navigate the range of immigration options open to them. The site now includes a specific section for employers (www.cic.gc.ca/employers) and a new interactive tool (www.cic.gc.ca/cometocanada) that matches information provided by potential applicants with immigration programs that best suit their circumstances.

“We expect new federal skilled worker applicants, including those with arranged employment, to receive a decision within six to 12 months compared with up to six years under the old system,” said Minister Kenney. “All other economic class applications―including applicants chosen by Quebec, provincial nominees, the Canadian Experience Class, and live-in caregivers―will continue to be given priority.”

These improvements, coupled with a number of recent initiatives that include the introduction of the Canadian Experience Class, bring Canada in line with two of its main competitors for highly skilled labour: Australia and New Zealand. Both of these countries have eliminated their backlogs and have systems that deliver final decisions for economic applicants within a year.

“The recent steps this Government has taken to improve our immigration system will help ensure that Canada remains competitive internationally and responsive to labour market needs domestically,” said Minister Kenney.

For further information (media only), please contact:

Alykhan Velshi

Minister’s Office

Citizenship and Immigration Canada

613-954-1064

Media Relations Unit

Communications Branch

Citizenship and Immigration Canada

613-952-1650

回复: 想去加国做住家保姆

再插一条

排期,星期2更新的次数多

排期,我统计的最近

http://www.cic.gc.ca/english/information/times/canada/process-in.asp

08年11月6日 MAY 1.2008

11月12日 MAY 11.

11月18日 MAY 23.

11月26日 JUNE 1

12月3日 JUNE 15.

09年1月4日 JUNE 16

1月13日 JUNE 29.

1月20日 july 10

2月5日 JULY 29

2月11日 AUG 3

2月18日 AUG 5

2月2 6日 AUG 11.

3月3日 AUG 17

因为过年 圣诞节 或者案例多,最近比较慢

再插一条

排期,星期2更新的次数多

排期,我统计的最近

http://www.cic.gc.ca/english/information/times/canada/process-in.asp

08年11月6日 MAY 1.2008

11月12日 MAY 11.

11月18日 MAY 23.

11月26日 JUNE 1

12月3日 JUNE 15.

09年1月4日 JUNE 16

1月13日 JUNE 29.

1月20日 july 10

2月5日 JULY 29

2月11日 AUG 3

2月18日 AUG 5

2月2 6日 AUG 11.

3月3日 AUG 17

因为过年 圣诞节 或者案例多,最近比较慢

附件

最后编辑: 2009-03-04

回复: 想去加国做住家保姆

IP 04 Processing Live-in Caregivers in Canada

2008-04-24 7

Live-in caregivers may request parallel同时 processing for some or all of their family members living in

or outside Canada. Family members processed concurrently at a visa office may be issued

permanent resident visas. Once the live-in caregiver is a permanent resident, family members

who are not processed concurrently同时 may be sponsored as members of the family class, provided

they were examined.

Note: A separated spouse, former common-law partner or child in the custody of another person, who

was not examined, cannot later be sponsored as a member of the family class [R117(9)(d)].

5.7. Admissibility受理 requirements

Applicants and all family members, both in Canada and outside Canada, must pass medical,

criminal and security checks. They cannot be granted permanent residence if they or any of their

family members are inadmissible拒签. See A33 to A42.

5.8. Quebec applicants

The Canada-Quebec Accord gives Quebec legal authority to select independent immigrants such

as live-in caregivers. Applicants need Quebec’s approval after completing two years of full-time

work in the program in order to be granted permanent residence in that province.

If Quebec refuses the application, the applicant should be given the opportunity to apply for

permanent residence in another province. It would be unfair and legally unfounded to remove

these applicants from Canada if they meet federal LCP requirements for permanent residence as

specified in R113.

Note: For more information, the provincial government booklet, Guide for Live-in Caregivers

http://www.immigration-quebec.gouv....le/temporary-workers/obtainingauthorizations/

certificat-permit/live-in-caregiver/index.html is available from the ministère des

Relations avec les citoyens et de l’Immigration (MRCI).

5.9. Parallel processing of family members家庭成员同时受理

Live-in caregiver applicants for permanent residence may have their family members living abroad

processed concurrently for permanent residence. If all admissibility requirements are met, the visa

office issues permanent resident visas to eligible family members of live-in caregivers granted

permanent residence in Canada.

5.10. Responding to representations

The Privacy Act requires that information concerning clients must be released only to the client or

a designated representative who is a Canadian citizen or permanent resident. Before responding

to a representation made in person or in writing, the identity of clients or their representative must

be confirmed.

The decisions on a live-in caregiver’s application for permanent residence are objective and

straightforward. The Regulations do not allow for discretion. Officers should reply to

representations by reiterating the grounds of ineligibility or inadmissibility.

6. Definitions

6.1. Bridge extension

A bridge extension is an interim 临时work permit given to live-in caregivers who are between jobs

IP 04 Processing Live-in Caregivers in Canada

2008-04-24 8

6.2. Employment contract

Live-in caregivers and their employers must sign an employment contract which states the terms

and conditions of employment before a work permit can be issued. This ensures that both parties

understand what is expected of them and reinforces加强 the employers’ legal responsibilities to the

caregivers.

6.3. Family member

Definitions in R1(3): Any of the following relationships qualify an individual as a family member:

spouse or common-law partner;

dependent child;

dependent child of dependent child.

6.4. Live-in caregiver

A live-in caregiver is a person who provides child care, senior home support care or care of the

disabled without supervision in a private household in Canada in which the person resides [R2].

7. Processing an employment contract

HRCCs inform employers of the legal requirement to have an employment contract with their livein

caregiver.

Employers are required to:

provide a signed employment contract to their prospective live-in caregiver;

have the live-in caregiver sign the employment contract and return it to the employer;

give the contract to the HRCC along with the application form.

Note: Employers are told that their live-in caregiver must submit a copy of the signed contract to the

CPC-V as part of the documentation required for the work permit application process.

The HRCC provides information on:

acceptable wage standards;

taxation;税

health insurance;

workers’ compensation and other employment issues.

Once the application and employment contract are submitted by the employer, the HRCC:

reviews the application/employment contract;

confirms that the job offer exists;

confirms the need for live-in care;

IP 04 Processing Live-in Caregivers in Canada在加拿大受理住家保姆

2008-04-24 9

records details of job validation in the HRDC National Employment Service System (NESS);

provides letter to employer confirming validation;

instructs employer to send copy of validation letter to live-in caregiver;

issues refusal letter to employer if offer of employment rejected.

Note: The validation information is available to CPC-V through the FOSS-NESS link.

8. Procedures for issuance/renewal of work permits, study permits

8.1. Applications for work permits

Applicants must apply for:

a permit renewal before the expiry of the current permit;

a new permit if they change employers.

Applicants mail completed Application to Change Conditions or to Extend my Stay in Canada

IMM 1249E to CPC-V. (Applications are available through the Call Centres or by downloading

from the CIC Internet site.)

Note: Proof of fee payment at a financial institution is submitted with the application, as is a copy of the

new or extended employment contract (signed by both employer and caregiver). (See IR5 for

details on fees.)

8.2. Requirements for issuance of work permits

Requirements Applicant must provide: CPC-V must:

Live-in, full-time caregiver:

If same employer

1. Letter from the employer

stating that the live-in caregiver

will continue to be employed full

time for another year.

2. Copy of a new or extended,

signed employment contract.

No need for new validation.

1. Assess whether applicant

continues to meet the definition

of a live-in caregiver, (i.e., fulltime,

live-in employment as

caregiver).

If change of employer 1. Copy of HRC validation of

new offer of employment.

2. A new employment contract

signed by the applicant and the

new employer.

1. Check FOSS-NESS link for

record of validation by HRC.

2. Verify that contract contains

required information (see OP

14, section 7 for details).

8.3. If all requirements are met

CPC-V issues a new permit for one year and

writes LCP in special programs box;

includes in Remarks: “May study without study permit if course or program of studies is six months or

less” [R188].

IP 04 Processing Live-in Caregivers in Canada

2008-04-24 10

8.4. If requirements are not met: Live-in caregiver has left work

If it is clear that an applicant has left live-in caregiver work, CPC-V will refuse the application.

Note: If an investigation is required, the case should be referred to an inland Canada Immigration

Centre (CIC).

8.5. If requirements are not met: Live-in caregiver is between jobs

If an applicant is between jobs and has not found a new employer, CPC issues an interim work

permit to bridge the gap. Cost recovery applies.

The bridge extension should:

have a duration of two months;

show the last employer;

include “bridge extension” in Remarks.

Note: If the bridge extension expires before the applicant finds a new job, CPC should carefully assess

the reasons for continued unemployment, and may need to refer the applicant to an inland CIC.

8.6. Refusal of an application for a work permit

Reasons for refusing an application must be well documented and provided to the applicant.

Refusal of a work permit means that the person is disqualified from applying for permanent

residence in Canada under the LCP.

Should the refused applicant request an extension of their temporary resident status, the officer

should assess carefully their bona fides as a temporary resident.

If it appears that the person may not leave Canada, or has no means of support, or in some other

way no longer qualifies for temporary resident status (e.g., worked without authorization), the

request for an extension should be refused. (See IP 6 Temporary Resident Extensions.)

8.7. Issuance of study permits

Live-in caregivers who wish to take a course or program of studies more than six months in

duration require a study permit.

CPC-V may issue study permits to live-in caregivers because they hold work permits [R215].

Officers should enter the LCP code in the special program box.

9. Processing applications for permanent residence

9.1. General guidelines

CPC-V sends a letter with the final work permit extension, advising live-in caregivers when they will be

eligible to apply for permanent residence, how to obtain an application for permanent residence kit

and what requirements must be met.

The officer determines if the applicant meets the requirements to become a member of the live- in

caregiver class.

Once a member of the live-in caregiver class, the applicant is given approval批准 in principle and can

apply for an open work permit.

IP 04 Processing Live-in Caregivers in Canada

2008-04-24 11

Applicant and family members in Canada and abroad are referred for examination to determine

admissibility.

Once statutory requirements are met, permanent residence is granted to the live-in caregiver and any

family members in Canada, and permanent resident visas are issued to accompanying family

members abroad.

If necessary, refusal letters are issued.

Note: Live-in caregivers must provide enough information in their applications so that officers can make

the required decisions [R113(1)(a)].

9.2. Applications

Applicants complete the In-Canada Application for Permanent Resident Status for Live-in

Caregivers (forms IMM 5002E and IMM 5282E). The kit can be requested through the Call

Centre, or downloaded from the CIC Internet site.

Applicants must list all family members in Canada and abroad, and indicate which ones they wish

to have processed concurrently for permanent residence.

Note: Family members may not be added to an application once processing has begun.

Applicants submit the completed forms with fee receipts and all required supporting documents to

CPC-V.

CPC-V staff screen the application for completeness and verify:

that all required forms are completed and signed as per Immigration Guide IMM 5290E;

that evidence of payment of applicable processing fees at designated financial institution exists;

that two passport-sized photographs of applicant and of family members in Canada are included;

that all required documents are included as per Document Checklist IMM 5282E, including proof of

two years of employment.

The application is considered made on the date the completed application, correct fees and

supporting documentation are received by CPC-V.

Applications returned to the applicant are not considered to be applications.

If the application is not complete, CPC enters the date of the incomplete application in the Field

Operational Support System (FOSS) and returns the package to the applicant, with a letter

explaining the reason.

9.3. Fees

Principal applicants in Canada pay processing and right of permanent residence fees (RPRF) for

all family members included in the application for parallel同时进行 processing for permanent residence,

whether in Canada or abroad. No RPRF is required for the principal applicant’s dependent

children [R303(2)(a)]. No processing or right of permanent residence fees are charged for family

members not included for parallel processing (see IR 5). The CPC will indicate that fees have

been paid in Canada when forwarding the forms to the responsible visa office.

The kit includes instructions on how to pay fees at a financial institution and to submit the receipt

with the application. If an application does not include the correct cost recovery fee, CPC must

return the kit to the applicant with a letter requesting payment.

12

IP 04 Processing Live-in Caregivers in Canada

2008-04-24 7

Live-in caregivers may request parallel同时 processing for some or all of their family members living in

or outside Canada. Family members processed concurrently at a visa office may be issued

permanent resident visas. Once the live-in caregiver is a permanent resident, family members

who are not processed concurrently同时 may be sponsored as members of the family class, provided

they were examined.

Note: A separated spouse, former common-law partner or child in the custody of another person, who

was not examined, cannot later be sponsored as a member of the family class [R117(9)(d)].

5.7. Admissibility受理 requirements

Applicants and all family members, both in Canada and outside Canada, must pass medical,

criminal and security checks. They cannot be granted permanent residence if they or any of their

family members are inadmissible拒签. See A33 to A42.

5.8. Quebec applicants

The Canada-Quebec Accord gives Quebec legal authority to select independent immigrants such

as live-in caregivers. Applicants need Quebec’s approval after completing two years of full-time

work in the program in order to be granted permanent residence in that province.

If Quebec refuses the application, the applicant should be given the opportunity to apply for

permanent residence in another province. It would be unfair and legally unfounded to remove

these applicants from Canada if they meet federal LCP requirements for permanent residence as

specified in R113.

Note: For more information, the provincial government booklet, Guide for Live-in Caregivers

http://www.immigration-quebec.gouv....le/temporary-workers/obtainingauthorizations/

certificat-permit/live-in-caregiver/index.html is available from the ministère des

Relations avec les citoyens et de l’Immigration (MRCI).

5.9. Parallel processing of family members家庭成员同时受理

Live-in caregiver applicants for permanent residence may have their family members living abroad

processed concurrently for permanent residence. If all admissibility requirements are met, the visa

office issues permanent resident visas to eligible family members of live-in caregivers granted

permanent residence in Canada.

5.10. Responding to representations

The Privacy Act requires that information concerning clients must be released only to the client or

a designated representative who is a Canadian citizen or permanent resident. Before responding

to a representation made in person or in writing, the identity of clients or their representative must

be confirmed.

The decisions on a live-in caregiver’s application for permanent residence are objective and

straightforward. The Regulations do not allow for discretion. Officers should reply to

representations by reiterating the grounds of ineligibility or inadmissibility.

6. Definitions

6.1. Bridge extension

A bridge extension is an interim 临时work permit given to live-in caregivers who are between jobs

IP 04 Processing Live-in Caregivers in Canada

2008-04-24 8

6.2. Employment contract

Live-in caregivers and their employers must sign an employment contract which states the terms

and conditions of employment before a work permit can be issued. This ensures that both parties

understand what is expected of them and reinforces加强 the employers’ legal responsibilities to the

caregivers.

6.3. Family member

Definitions in R1(3): Any of the following relationships qualify an individual as a family member:

spouse or common-law partner;

dependent child;

dependent child of dependent child.

6.4. Live-in caregiver

A live-in caregiver is a person who provides child care, senior home support care or care of the

disabled without supervision in a private household in Canada in which the person resides [R2].

7. Processing an employment contract

HRCCs inform employers of the legal requirement to have an employment contract with their livein

caregiver.

Employers are required to:

provide a signed employment contract to their prospective live-in caregiver;

have the live-in caregiver sign the employment contract and return it to the employer;

give the contract to the HRCC along with the application form.

Note: Employers are told that their live-in caregiver must submit a copy of the signed contract to the

CPC-V as part of the documentation required for the work permit application process.

The HRCC provides information on:

acceptable wage standards;

taxation;税

health insurance;

workers’ compensation and other employment issues.

Once the application and employment contract are submitted by the employer, the HRCC:

reviews the application/employment contract;

confirms that the job offer exists;

confirms the need for live-in care;

IP 04 Processing Live-in Caregivers in Canada在加拿大受理住家保姆

2008-04-24 9

records details of job validation in the HRDC National Employment Service System (NESS);

provides letter to employer confirming validation;

instructs employer to send copy of validation letter to live-in caregiver;

issues refusal letter to employer if offer of employment rejected.

Note: The validation information is available to CPC-V through the FOSS-NESS link.

8. Procedures for issuance/renewal of work permits, study permits

8.1. Applications for work permits

Applicants must apply for:

a permit renewal before the expiry of the current permit;

a new permit if they change employers.

Applicants mail completed Application to Change Conditions or to Extend my Stay in Canada

IMM 1249E to CPC-V. (Applications are available through the Call Centres or by downloading

from the CIC Internet site.)

Note: Proof of fee payment at a financial institution is submitted with the application, as is a copy of the

new or extended employment contract (signed by both employer and caregiver). (See IR5 for

details on fees.)

8.2. Requirements for issuance of work permits

Requirements Applicant must provide: CPC-V must:

Live-in, full-time caregiver:

If same employer

1. Letter from the employer

stating that the live-in caregiver

will continue to be employed full

time for another year.

2. Copy of a new or extended,

signed employment contract.

No need for new validation.

1. Assess whether applicant

continues to meet the definition

of a live-in caregiver, (i.e., fulltime,

live-in employment as

caregiver).

If change of employer 1. Copy of HRC validation of

new offer of employment.

2. A new employment contract

signed by the applicant and the

new employer.

1. Check FOSS-NESS link for

record of validation by HRC.

2. Verify that contract contains

required information (see OP

14, section 7 for details).

8.3. If all requirements are met

CPC-V issues a new permit for one year and

writes LCP in special programs box;

includes in Remarks: “May study without study permit if course or program of studies is six months or

less” [R188].

IP 04 Processing Live-in Caregivers in Canada

2008-04-24 10

8.4. If requirements are not met: Live-in caregiver has left work

If it is clear that an applicant has left live-in caregiver work, CPC-V will refuse the application.

Note: If an investigation is required, the case should be referred to an inland Canada Immigration

Centre (CIC).

8.5. If requirements are not met: Live-in caregiver is between jobs

If an applicant is between jobs and has not found a new employer, CPC issues an interim work

permit to bridge the gap. Cost recovery applies.

The bridge extension should:

have a duration of two months;

show the last employer;

include “bridge extension” in Remarks.

Note: If the bridge extension expires before the applicant finds a new job, CPC should carefully assess

the reasons for continued unemployment, and may need to refer the applicant to an inland CIC.

8.6. Refusal of an application for a work permit

Reasons for refusing an application must be well documented and provided to the applicant.

Refusal of a work permit means that the person is disqualified from applying for permanent

residence in Canada under the LCP.

Should the refused applicant request an extension of their temporary resident status, the officer

should assess carefully their bona fides as a temporary resident.

If it appears that the person may not leave Canada, or has no means of support, or in some other

way no longer qualifies for temporary resident status (e.g., worked without authorization), the

request for an extension should be refused. (See IP 6 Temporary Resident Extensions.)

8.7. Issuance of study permits

Live-in caregivers who wish to take a course or program of studies more than six months in

duration require a study permit.

CPC-V may issue study permits to live-in caregivers because they hold work permits [R215].

Officers should enter the LCP code in the special program box.

9. Processing applications for permanent residence

9.1. General guidelines

CPC-V sends a letter with the final work permit extension, advising live-in caregivers when they will be

eligible to apply for permanent residence, how to obtain an application for permanent residence kit

and what requirements must be met.

The officer determines if the applicant meets the requirements to become a member of the live- in

caregiver class.

Once a member of the live-in caregiver class, the applicant is given approval批准 in principle and can

apply for an open work permit.

IP 04 Processing Live-in Caregivers in Canada

2008-04-24 11

Applicant and family members in Canada and abroad are referred for examination to determine

admissibility.

Once statutory requirements are met, permanent residence is granted to the live-in caregiver and any

family members in Canada, and permanent resident visas are issued to accompanying family

members abroad.

If necessary, refusal letters are issued.

Note: Live-in caregivers must provide enough information in their applications so that officers can make

the required decisions [R113(1)(a)].

9.2. Applications

Applicants complete the In-Canada Application for Permanent Resident Status for Live-in

Caregivers (forms IMM 5002E and IMM 5282E). The kit can be requested through the Call

Centre, or downloaded from the CIC Internet site.

Applicants must list all family members in Canada and abroad, and indicate which ones they wish

to have processed concurrently for permanent residence.

Note: Family members may not be added to an application once processing has begun.

Applicants submit the completed forms with fee receipts and all required supporting documents to

CPC-V.

CPC-V staff screen the application for completeness and verify:

that all required forms are completed and signed as per Immigration Guide IMM 5290E;

that evidence of payment of applicable processing fees at designated financial institution exists;

that two passport-sized photographs of applicant and of family members in Canada are included;

that all required documents are included as per Document Checklist IMM 5282E, including proof of

two years of employment.

The application is considered made on the date the completed application, correct fees and

supporting documentation are received by CPC-V.

Applications returned to the applicant are not considered to be applications.

If the application is not complete, CPC enters the date of the incomplete application in the Field

Operational Support System (FOSS) and returns the package to the applicant, with a letter

explaining the reason.

9.3. Fees

Principal applicants in Canada pay processing and right of permanent residence fees (RPRF) for

all family members included in the application for parallel同时进行 processing for permanent residence,

whether in Canada or abroad. No RPRF is required for the principal applicant’s dependent

children [R303(2)(a)]. No processing or right of permanent residence fees are charged for family

members not included for parallel processing (see IR 5). The CPC will indicate that fees have

been paid in Canada when forwarding the forms to the responsible visa office.

The kit includes instructions on how to pay fees at a financial institution and to submit the receipt

with the application. If an application does not include the correct cost recovery fee, CPC must

return the kit to the applicant with a letter requesting payment.

12

最后编辑: 2009-02-27

回复: 想去加国做住家保姆

希望在明天!

希望在明天!

回复: 想去加国做住家保姆

IP 04 Processing Live-in Caregivers in Canada

2008-04-24 12

9.4. Assessing eligibility to become a member of the live-in caregiver class

CPC-V must determine whether applicants meet the following requirements to become members

of the live-in caregiver class, as listed in R113:

• application for permanent residence has been submitted;

• they are temporary residents;

• they possess a valid work permit to work as a live-in caregiver;

• they provide proof of having worked full time as a live-in caregiver for a total of two years during the

three years since being admitted to Canada as a live-in caregiver (see below);

• they have lived in the employer’s home while working as a live-in caregiver;

• they have provided, without supervision, child care, senior home support care, or care of the disabled

in that home;

• they are not the subject of, and they do not have family members who are the subject of, an

inadmissibility hearing (A44(1) report), an appeal or judicial review resulting from an inadmissiblity

hearing, or a removal order.

Officers should check:

• the statutory questions on the IMM 5002E;

• the FOSS for any record of A44(1) report, referral to a hearing or removal order;

Note: A live-in caregiver is not eligible for permanent residence if their spouse or common-law partner is

a refugee claimant, or has appealed or sought judicial review.

• that the applicant did not misrepresent education, training or experience when applying to come to

Canada as a live-in caregiver.

Note: This could include misrepresentation by another person as well as by the applicant. See OP 14,

section 7.1 for requirements for initial work permit issued by the visa office. Information may have

since come to light indicating misrepresentation in order to meet these requirements.

9.5. Acceptable evidence of two years’ employment

Evidence must include:

• a letter from the current employer showing the start date and confirming the applicant’s status as

being currently employed;

• record of earnings (ROE): under the Employment Insurance Regulations, an employer must complete

an ROE after every interruption of earnings due to termination of contract, illness or injury. Applicants

should have ROEs for each previous job, but will not have one for their current job. The local HRCC

may assist if employees have trouble obtaining ROEs;

• a statement of earnings showing hours worked and deductions made by employer;

• a record of wages and deductions sent to the Canada Customs and Revenue Agency;

IP 04

IP 04 Processing Live-in Caregivers in Canada

2008-04-24 13

• if they are still employed with the same employer and any of the above documents are not available,

they may provide a statutory declaration stating terms and conditions of their most recent

employment.

Note: The two-year period does not include any absence from Canada, periods of unemployment, parttime

work, sickness or maternity leave. However, allowable vacation leave, as outlined in the

provincial and territorial employment standards legislation, will be counted as part of the two

years.

Live-in caregivers have the right to be covered under workers’ compensation, but this period of

unemployment is not included in the required two-year work record.

Note: For additional information on vacation leave, see the fact sheet on employment standards

legislation (Appendix B).

9.6. Checking for pending criminal charges

If an officer has reason to believe the applicant or a dependant of the applicant may have

committed an offence in Canada that would make them inadmissible, processing may be delayed

for a year, pending police investigation, or, if charges are laid, until the courts have disposed of

the matter. If the police do not lay charges or the person is found not guilty, processing may

continue. If the person is convicted, the person would be reported under A44(1) and not be

eligible for permanent residence.

If an officer has reason to believe the applicant or dependant may have committed or been

convicted of a crime outside Canada, the application may be refused. Reliable and releasable

information is necessary. Unsupported suspicion is not sufficient grounds for refusal.

Example: Newspaper clippings, anonymous letters or oral comments may generate suspicion that will

require more reliable substantiation, likely from a jurisdiction that has authority to conduct an investigation

for the purpose of laying criminal charges. An official confirmation by the authorities that an individual is

under investigation or a copy of the charges will provide “reasonable grounds.”

9.7. Granting approval-in-principle (applicants determined to be members of live-in caregiver

class)

CPC sends a letter to applicants informing them that they have been granted “approval-inprinciple”

and requesting any further information needed.

Approved applicants and any family members in Canada at the time of approval-in-principle may

apply for an open work permit and are exempt from validation R207. They must obtain the guide,

Applying to Change Conditions or Extend your Stay in Canada, by visiting the CIC Web site or

phoning the Call Centre.

9.8. Refusing applicants determined not to be members of live-in caregiver class (ineligible

applicants)

CPC sends a letter to ineligible applicants informing them that they have been refused. (See

Appendix A.)

If an interview is necessary in order to explain the reasons for refusal and to counsel the client

with respect to their status in Canada, CPC may refer the case to an inland CIC.

9.9. Applications in Quebec

CPC-V sends a copy of the application for permanent residence and a covering letter to the

MRCI. If Quebec accepts the application, the MRCI issues a Certificat de sélection du Québec

(CSQ).

IP 04 Processing Live-in Caregivers in Canada

2008-04-24 14

If Quebec refuses the application, CPC informs the applicant that they may apply for permanent

residence in another province, and will continue processing if the applicant selects another

province.

For further information, please see section 5.8.

9.10. Assessing admissibility requirements

Once CPC has determined that the applicant is a member of the live-in caregiver class, they and

their family members in Canada and outside Canada will undergo medical, criminal and security

checks to determine admissibility. Applicants cannot be granted permanent residence if they or

any of their family members are inadmissible.

Note: See OP 14, section 9 for processing family members outside Canada.

9.11. Criminal and security checks

Applicants and dependent children 18 years of age or over must provide police certificates for

every country they have lived in for six months or more.

CPC-V should:

• check notes in the Computer-Assisted Immigration Processing System (CAIPS) for visa office

comments;

• check FOSS and the Canadian Police Information Centre (CPIC) for any report on inadmissibility or

criminal activity;

• refer cases involving suspected misrepresentation or serious criminality or security, as described in

A34, A35, A36(1) and A37, to an inland CIC.

Note: Applications will be refused if the applicant or any dependent child is inadmissible.

For more information about Refer to

Criminal and security checks OP 2, section 5.21

Security and criminal screening of

permanent residents

IC 1

Evaluating inadmissibility ENF 2

9.12. Medical examinations

For information on procedures, see OP 15, Medical Procedures.

9.13. Processing of family members

Live-in caregivers must name all their family members, whether in Canada or abroad, on their

application so that they can be assessed against requirements for permanent residence. Live-in

caregivers may choose concurrent processing for some or all of their family members, or they

may choose to sponsor some or all at a later date, provided they have been examined. Family

members sponsored later must meet all the requirements at that time.

Applicants must indicate which family members will be processed concurrently for purposes of

obtaining their permanent resident visas and which family members are listed only for the purpose

of examination.

IP 04 Processing Live-in Caregivers in Canada

2008-04-24 15

For family members living abroad, CPC-V will inform the responsible visa office by

forwarding:

• a copy of the IMM 5002E (In-Canada Application for Permanent Resident Status), which lists all family

members and shows which ones are to be processed concurrently;

• confirmation that fees have been paid for family members to be processed concurrently.

CPC should ensure that the visa office has up-to-date contact information for family members,

and advise the visa office of any change in the live-in caregiver’s address and telephone number.

Note: For visa office processing, see OP 14.

9.14. Family members not subject to examination

Separated spouses, former common-law partners and children in the custody of a separated

spouse or former spouse or common-law partner do not need to be examined.

Applicants must provide written evidence of the breakdown of their relationship:

• formal separation agreement;

• letter from a lawyer indicating that divorce proceedings are underway;

• court order in respect of children identifying the fact of the relationship breakdown;

• documents removing the spouse or common-law partner from insurance policies or will;

• statutory declaration in the case of countries where legal separation and divorce are not possible, e.g.,

the Philippines. To be satisfied that the relationship has truly broken down, the officer may consider

supporting evidence such as:

♦ evidence that the separated spouse is living with or has children with another partner;

♦ income tax returns showing status as separated.

CPC should review CAIPS notes from the initial work permit application at the visa office to see if

the visa officer confirmed the applicant’s marital status. CPC may ask the visa office to confirm or

discredit the statutory declaration or other information provided by the applicant concerning their

marital status.

Note: It is important to distinguish between “separated” spouses or former common-law partners and

“uncooperative” spouses or common-law partners. The former need not undergo examination; the

latter must undergo examination, without which the live-in caregiver’s application for permanent

residence in Canada may have to be refused.

Children are exempt from examination only if the applicant provides written evidence that the child

is in the legal custody or guardianship of another individual (including the other parent). If written

legal evidence is not available, a child must undergo a medical examination.

9.15. Ineligible family members

If a visa office informs CPC-V that family members do not meet the definition of “family member”

(e.g., over 22 and not full-time students) or are not subject to examination, CPC-V should:

• inform the applicant that the ineligible family members cannot be part of the application;

IP 04

\\\\

IP 04 Processing Live-in Caregivers in Canada

2008-04-24 16