Tue 21 Apr 2020 23:43:39 GMT Author: Adam Button

What a mess

Retail traders are piling into the USO ETF thinking there bottom-fishing in crude oil. The fund is an absolute mess right now. They stopped issuing new units because they were becoming too large a part of the open interest in futures.

Trading was halted at least four times today and the final time included an announcement that the ETF would shift funds from 80/20 front/second month to whatever mix of oil future it wanted, along with the option to buy gasoline, natural gas and "other petroleum-based fuels".

For some reason this set off another misguided rush into the ETF.

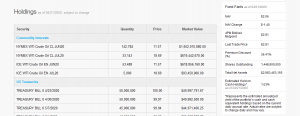

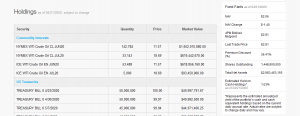

Now the fund has published its daily holdings and says it holds assets worth $2.06 per share. It's last trade was at $2.81.

That's a comically large premium to NAV and means that nearly $1 billion of the $3 billion ETF is a fantasy.

As for its holdings -- which are now opaque intraday -- the shift so far is small. Nearly $2.2 billion of the ETF is still in June oil futures but there are pending trades to sell about 40% of that with the vast majority going into the July contract.

I don't see how this thing survives and I can't understand why brokers would allow clients to trade something at 36% above NAV and guaranteed to lose money. The only sliver of good news here is that by spreading out its holdings among several contracts, it's less likely to spontaneously implode and drag down oil with it.

Either that or the things it holds all rally 40% on Wednesday. But if that's the case, I suspect even more retail money will flow in and the premium to NAV will be even greater in the day ahead.

source of article https://www.forexlive.com/news/!/uso-etf-reveals-it-closed-at-a-364-premium-to-nav-20200421

@lovemapleleaf

What a mess

Retail traders are piling into the USO ETF thinking there bottom-fishing in crude oil. The fund is an absolute mess right now. They stopped issuing new units because they were becoming too large a part of the open interest in futures.

Trading was halted at least four times today and the final time included an announcement that the ETF would shift funds from 80/20 front/second month to whatever mix of oil future it wanted, along with the option to buy gasoline, natural gas and "other petroleum-based fuels".

For some reason this set off another misguided rush into the ETF.

Now the fund has published its daily holdings and says it holds assets worth $2.06 per share. It's last trade was at $2.81.

That's a comically large premium to NAV and means that nearly $1 billion of the $3 billion ETF is a fantasy.

As for its holdings -- which are now opaque intraday -- the shift so far is small. Nearly $2.2 billion of the ETF is still in June oil futures but there are pending trades to sell about 40% of that with the vast majority going into the July contract.

I don't see how this thing survives and I can't understand why brokers would allow clients to trade something at 36% above NAV and guaranteed to lose money. The only sliver of good news here is that by spreading out its holdings among several contracts, it's less likely to spontaneously implode and drag down oil with it.

Either that or the things it holds all rally 40% on Wednesday. But if that's the case, I suspect even more retail money will flow in and the premium to NAV will be even greater in the day ahead.

source of article https://www.forexlive.com/news/!/uso-etf-reveals-it-closed-at-a-364-premium-to-nav-20200421

@lovemapleleaf

最后编辑: 2020-04-21