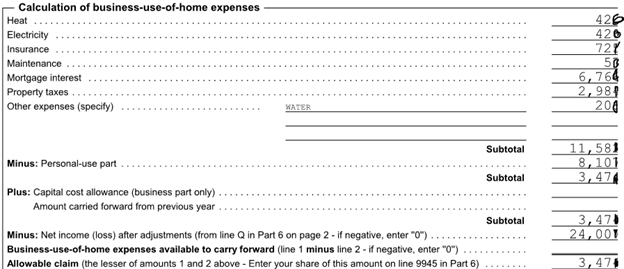

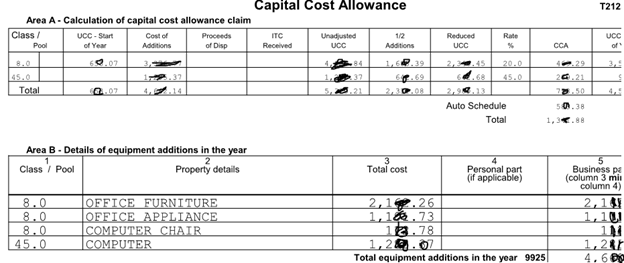

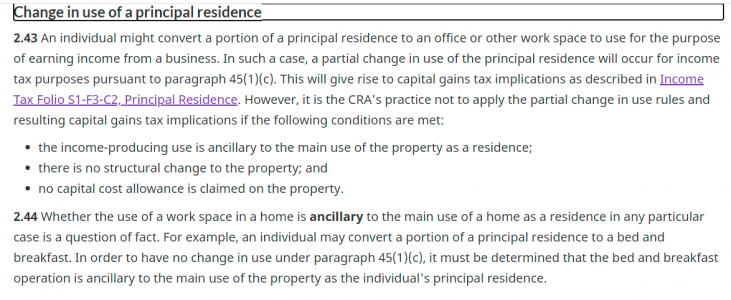

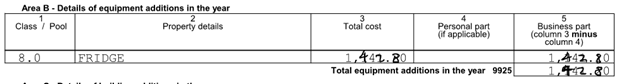

我是自雇在家办公。想问T2125表中Business use of home expense 报税的话,自用与办公是多少比例,以后卖房收益是可以亨受免税的呢?以前报税是按30%用于办公的,后来才了解以后卖房受影响,哪位可以帮忙解答一下?谢谢。

Business use of home自雇

- 主题发起人 applesandy

- 发布时间 2021-04-07

Similar threads

2024-04-21有新赞

全楼:0.00

flashlight

2024-06-23有新回复

全楼:0.01

soleil_lee-太阳李

2024-10-05有新回复

全楼:0.04

john_smith7777

2023-11-18有新回复

全楼:0.00

Sarasgift

2024-07-05有新回复

全楼:0.02

Saint.Saens