- 首页

-

菜单

- 家园币

-

比特币

Financial Markets by TradingView

您正在使用一款已经过时的浏览器!部分功能不能正常使用。

更多选项

导出主题(文本)不过感觉google wallet不如apple pay安全。之前用过一次用google wallet订房,但惊奇地发现商家发来的发票上赫然有我信用卡的后4位。后来网上一搜果然是,google wallet会把你的真实信用卡号码发送给商家。Apple pay会自动生成一张虚拟卡号,商家不会知道你的真实信用卡号。

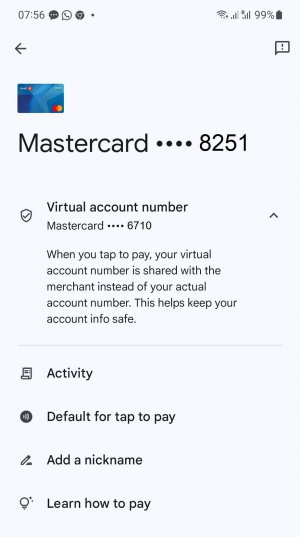

我安装了 Google Wallet,发现它也是使用虚拟卡号,商家得到的是虚拟卡号。Apple Wallet 里的卡资料里除了有虚拟信用卡的最后4位数的号码外(指明是用于Apple Pay).,还有实体卡的最后4位数的号码。当用Apple Pay 付款后,所收到的收据里所显示的是虚拟信用卡的最后4位数的号码,而不是实体卡的最后4位数的号码。

从付款的交易上看,Apple pay 比 Google pay 更安全。这篇文章说,用Google pay 付款时先通过Google 的服务器 (云端)然后再到卖方。也就是说在这个交易过程中,Google Pay 是做为中介的。

When the seller charged the virtual card, Google, in turn, charged your stored debit or credit card and is the only entity that ever sees your real card through this transaction.

Apple Pay vs. Google Wallet: How They Work

Google Security

With both systems, you provide your card details only once, during the initial setup. Google adopts an intermediary role and saves your card details on its servers. Google would then issue a virtual card to your device, the Google Pay virtual card.When the seller charged the virtual card, Google, in turn, charged your stored debit or credit card and is the only entity that ever sees your real card through this transaction.

Apple Security

Apple employs a different system known as tokenization. Here, when your card details are provided to the device, it contacts the issuing bank directly and, upon confirmation, receives a device- and card-specific token called the Device Account Number (DAN), which is stored on a secure chip on the device. The DAN structurally resembles a credit card number and is passed on to the merchant when any payment is made before getting authorized by the bank.Apple Pay vs. Google Wallet: How They Work

Google pay里可以看到虚拟卡号,但google选择把我的真实卡号给了商家。不是扫QR code国外不流行这套,是用手机进入订房的网页(或者是app?记不清了),最后选择付款方式时选了google pay。我上面那张截图是在Google Wallet里显示的,你可以查查你的信用卡有没有虚拟号。

你订房的网站支持Google pay吗?怎么操作的,是不是网页生成一个QR code,让你拿手机去扫?

随便在网上搜一下,可以看到很多这样的投诉:

https://www.reddit.com/r/googlepay/comments/14zzb0e https://www.reddit.com/r/googlepay/comments/1dmqm9n

只有极少几个连锁酒店和订房网站支持Google pay。主要原因是酒店方面的系统不支持。Google pay里可以看到虚拟卡号,但google选择把我的真实卡号给了商家。不是扫QR code国外不流行这套,是用手机进入订房的网页(或者是app?记不清了),最后选择付款方式时选了google pay。

随便在网上搜一下,可以看到很多这样的投诉:

https://www.reddit.com/r/googlepay/comments/14zzb0e https://www.reddit.com/r/googlepay/comments/1dmqm9n

通常的订房只是一个付款预授权,入住时酒店按照信用卡号取得预授权,结账的时候再用这个卡号收款。这种情况,银行卡都不方便,Google pay 的虚拟号码更不好使了。

在手机和网上订房时,我只是用了Google Wallet 里储存的信用卡信息,避免了输入卡号和相关信息,但CVC 需要输入。酒店收到的是信用卡信息。

Apple pay没有用过。

看来要用手机操作,电脑网页可能不行。Google pay里可以看到虚拟卡号,但google选择把我的真实卡号给了商家。不是扫QR code国外不流行这套,是用手机进入订房的网页(或者是app?记不清了),最后选择付款方式时选了google pay。

随便在网上搜一下,可以看到很多这样的投诉:

https://www.reddit.com/r/googlepay/comments/14zzb0e https://www.reddit.com/r/googlepay/comments/1dmqm9n

这样的话,网上订房或网购,能用手机支付的不多,像亚马逊这样的大网站也不支持,因为它自己就有Amazon pay,当然要把竞争对手挡在外面。只有极少几个连锁酒店和订房网站支持Google pay。主要原因是酒店方面的系统不支持。

通常的订房只是一个付款预授权,入住时酒店按照信用卡号取得预授权,结账的时候再用这个卡号收款。这种情况,银行卡都不方便,Google pay 的虚拟号码更不好使了。

在手机和网上订房时,我只是用了Google Wallet 里储存的信用卡信息,避免了输入卡号和相关信息,但CVC 需要输入。酒店收到的是信用卡信息。

Apple pay没有用过。

Similar threads

家园推荐黄页

家园币系统数据

- 家园币池子报价

- 0.0097加元

- 家园币最新成交价

- 0.0101加元

- 家园币总发行量

- 1106666家园币

- 加元现金总量

- 12155.9加元

- 家园币总成交量

- 4098206.67家园币

- 家园币总成交价值

- 384692.02加元

- 池子家园币总量

- 396336.11家园币

- 池子加元现金总量

- 3850.24加元

- 池子币总量

- 35214.19

- 1池子币现价

- 0.2187加元

- 池子家园币总手续费

- 5731.58JYB

- 池子加元总手续费

- 595.28加元

- 入池家园币年化收益率

- 0.39%

- 入池加元年化收益率

- 4.16%

- 微比特币最新报价

- 0.072303加元

- 毫以太币最新报价

- 3.66449加元

- 微比特币总量

- 0.354108BTC

- 毫以太币总量

- 0.219250ETH

- 家园币储备总净值

- 302,562.48加元

- 家园币比特币储备

- 3.4200BTC

- 家园币以太币储备

- 15.1ETH

- 比特币的加元报价

- 72,303.20加元

- 以太币的加元报价

- 3,664.49加元

- USDT的加元报价

- 1.39183加元

- 交易币种/月度交易量

- 手续费

- 家园币

- 0.1%(0.01%-1%)

- 加元交易对(比特币等)

- 1%-2%

- USDT交易对(比特币等)

- 0.1%-0.6%