- 最大赞力

- 0.00

- 当前赞力

- 100.00%

Canada Emergency Response Benefit (CERB) - Canada.ca

Learn who was eligible for the Canada Emergency Response Benefit (CERB), if you need to repay, and about CERB debt reduction for students.

The CERB supports Canadians by providing urgently needed financial support to employed and self-employed Canadians who have been directly affected by COVID-19. It provides a payment of $2,000 for a 4 week period (equivalent to $500 a week) for up to 16 weeks.

On this page

Unsure about whether you should apply for CERB with Service Canada or CRA?

Who can apply

The CERB will be available to workers:

- residing in Canada, who are at least 15 years old;

- who have stopped working because of COVID-19 or are eligible for Employment Insurance regular or sickness benefits;

- who had income of at least $5,000 in 2019 or in the 12 months prior to the date of their application; and

- who are or expect to be without employment or self-employment income for at least 14 consecutive days in the initial four-week period.

The income of at least $5,000 may be from any or a combination of the following sources: employment; self-employment; maternity and parental benefits under the Employment Insurance program and/or similar benefits paid in Quebec under the Quebec Parental Insurance Plan.

The Benefit is only available to individuals who stopped work and are not earning employment or self-employment income as a result of reasons related to COVID-19. If you have not stopped working because of COVID-19, you are not eligible for the Benefit.

Once you apply, you can expect to get your payment in 3 business days if you have signed up for direct deposit, and approximately 10 business days if you haven’t signed up for direct deposit.

If your situation continues, you can re-apply for a payment for multiple 4-week periods, to a maximum of 16 weeks (4 periods).

How to apply

Applications for the CERB will begin the week of Monday, April 6, 2020.

There are two ways to apply:

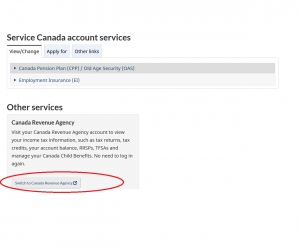

- Online with CRA My Account

- Over the phone with an automated phone service

Although you can't apply yet, you can get ready now to ensure your application will be as easy and quick as possible.

If you are applying online:

1 – You will need a CRA My Account to apply

Do you have a CRA My Account?

- Yes - I have a CRA My Account

- Yes - but I forget my CRA user ID or password

- Yes - but I'm locked out

- No - but I have a My Service Canada Account

- No - I don't have either

If you are applying online or on phone:

1 – Your payment will be delivered by direct deposit or by cheque

Is your direct deposit and mailing information up to date with the CRA?

- Yes – My direct deposit and mailing information is up to date with the CRA

- No - I need to update direct deposit and mailing information

2 - Determine the best day of the week to apply once the system is available

Whether you apply online or by phone, we want to provide the best service possible to everyone. To help manage this, we have set up specific days for you to apply. Please use the following guidelines:

Day to apply for the Canada Emergency Response Benefit

| If you were born in the month of | Apply for CERB on | Your best day to apply |

|---|---|---|

| January, February or March | Mondays | April 6 |

| April, May, or June | Tuesdays | April 7 |

| July, August, or September | Wednesdays | April 8 |

| October, November, or December | Thursdays | April 9 |

| Any month | Fridays, Saturdays and Sundays | Not applicable |

Apply Online:

Follow instructions below before you

Instructions once you're in your CRA My Account Apply By phone: Call the automated toll-free line

Both of these services are available 21 hours a day, 7 days a week. Both services are closed from 3:00 a.m. to 6:00 a.m. (Eastern time) for maintenance.

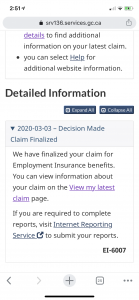

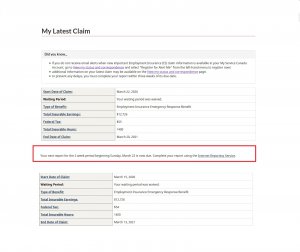

After you apply

If you are eligible for the CERB, you can expect $2,000 ($500 per week) for a 4-week period.

It is a single payment for a 4-week period.

If your situation continues, you can re-apply for a payment for multiple 4-week periods, to a maximum of 16 weeks (4 periods)

Note: These benefits are taxable and you will need to report any payments received on next year's tax filing. An information slip will be made available for the 2020 tax year in My Account under Tax Information Slips (T4 and more).

Understand the payment periods

Each payment of the Canada Emergency Response Benefit (CERB) covers a 4-week period, beginning March 15, 2020. When you apply, it is for a single payment for the 4-week period. If your situation continues, you can apply for an additional 4-week period, up to a maximum of 16 weeks (4 periods in total).

What are the payment methods

The CERB is paid by direct deposit or by cheque if your direct deposit information is not on file.

When to expect payment

- If you are getting your payment by direct deposit, expect your payment within 3 business days from the day you submitted your application

- If you are getting your payment by cheque, expect to get the cheque within 10 business days from the day you submitted your application.

You will need to apply and confirm your eligibility for the Canada Emergency Response Benefit every 4 weeks (to a maximum of 16 weeks) if your situation continues.

最后编辑: 2020-04-01