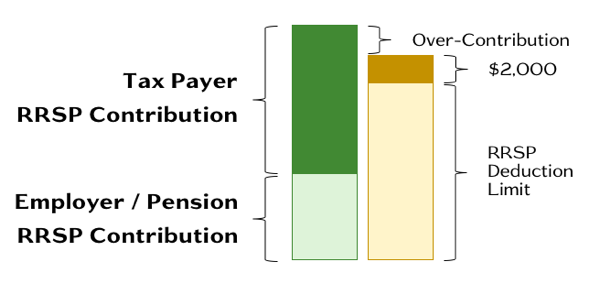

不超过2000元不用交罚款。

How to deal with RRSP over-contribution

There is no magic to resolve an RRSP over-contribution, you have to correct the situation and follow up with Canada Revenue Agency. The consequence, as mentioned above, is a 1% tax penalty on the over-contributed amount as well as a late-filing penalty if not corrected in the first 90 days of the calendar year – think the last day of March.

There are 3 steps to follow to correct your situation but if you realize that you over-contributed before the calendar year is over, what you have to do is withdraw the amount you over-contributed as soon as you can.

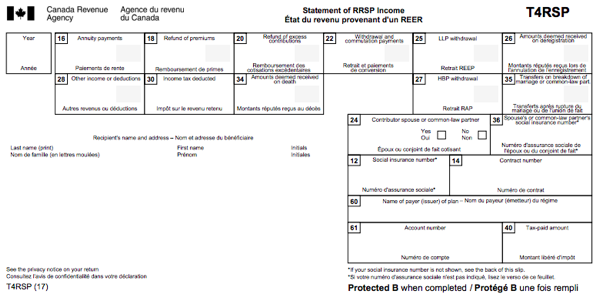

- You will have to fill out a form with your financial institutions to withdraw from your RRSP and you will be charged a withholding tax upon the withdrawal. Box 30 in the T4RSP form would have the tax paid on withdrawal when all is said and done for your tax return.

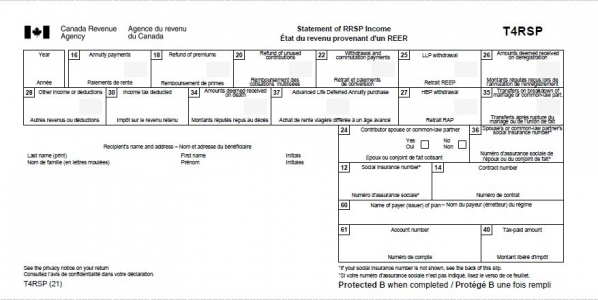

- To avoid the withholding tax, you will have to fill out the T3012A CRA form and provide details of your over-contribution situation. The financial institution will need the form to return the complete amount without any amount withheld. Box 20 in the T4RP form would have the amount to file your taxes.

Once you have step 1 & 2 completed, take a moment to call the Canada Revenue Agency to review your documents and the final steps. Check in with them to ensure all is in order. Make note of the person you are talking to and document your conversation with the CRA.

Oh! Oh! You just found out you have, or may have, over-contributed to your RRSP and you want to know what to do next.

seekingalpha.com