- 首页

-

菜单

- 家园币

-

比特币

Financial Markets by TradingView

您正在使用一款已经过时的浏览器!部分功能不能正常使用。

- 主题发起人 martinqz

- 发布时间 2014-05-05

更多选项

导出主题(文本)===========================================================================================美国股市大跌,有望逐步调整10%

真是有空,投资低买高卖就赢利了,哪需要等美国股市大跌?

美股不是最高峰,也是出于高位。QE刺激的结果。

投资需要择机而动,目前低位需要买进的是(1)中国一线城市的,人口净流入的房产,住房需求逐步增加,增值保值需求基本没有(2010年开始限购)。供应成本增加,土地2008年3000一平楼板价(中外环),现在1.5万都不一定拿的下来。

(2)大宗商品中的部分品种。没有看明白的是CRB指数已经到低位了,为啥看见的石油,贵金属,农产品都还没有到低位。正在抽空研究中。

(3)Visa(V),Master(MA)每季度定金额买点屯着。

马老师吉祥,我上次买了V,今天买入MA,建个仓,86.9买入。准备以后每季度定屯,中午吃饭时候和我闺女开玩笑,说今天买入的这些美元产品,等她结婚时取出送她,看看到时候是多少钱了。===========================================================================================

真是有空,投资低买高卖就赢利了,哪需要等美国股市大跌?

美股不是最高峰,也是出于高位。QE刺激的结果。

投资需要择机而动,目前低位需要买进的是(1)中国一线城市的,人口净流入的房产,住房需求逐步增加,增值保值需求基本没有(2010年开始限购)。供应成本增加,土地2008年3000一平楼板价(中外环),现在1.5万都不一定拿的下来。

(2)大宗商品中的部分品种。没有看明白的是CRB指数已经到低位了,为啥看见的石油,贵金属,农产品都还没有到低位。正在抽空研究中。

(3)Visa(V),Master(MA)每季度定金额买点屯着。

马老师是北京来的吗,北京的房价,五环内,找不到3.5万RMB一平米的板楼啦。

最后编辑: 2015-05-15

=====================================================================================马老师吉祥,我上次买了V,今天买入MA,建个仓,86.69买入。准备以后每季度定屯,中午吃饭时候和我闺女开玩笑,说今天买入的这些美元产品,等她结婚时取出送她,看看到时候是多少钱了。

马老师是北京来的吗,北京的房价,五环内,找不到3.5万RMB一平米的板楼啦。

三十年一千倍!呵呵!老婆给我的研究课题,如果有点小余钱,如何让她长期投资赚钱?女人一般买点房产,黄金和珠宝保值。

上海的,2000-2002年有段时间上海房价超过北京,之后就一直是老二了。目前上海中外环均价2.5万。北京上海涨到5-10万真的一点不稀奇。

最近有点忙了,估计还需要一段时间研究CRB指数的问题!

玩也要玩的精彩,不玩No1.的VIRT还玩啥!

===============================================================

高频交易公司Virtu闪亮登场 首日开盘较发行价上涨21%

文 / 吴晓喻 2015年04月17日 05:16:15 1

4月16日,世界最大高频交易公司之一的Virtu Financial在纳斯达克成功挂牌交易,股票代码“VIRT”,开盘价每股23美元,较发行价上涨21%。上市首日收盘价22.18美元,盘中最高23.67美元。

据《华尔街日报》报道,Virtu此次IPO共计发行1650万股,每股定价19美元,为发行价区间17-19美元的高端。该公司募得资金3.135亿美元,市值达到26亿美元。募集资金少部分将用于业务投资,其余大部分用于收购其现有投资者,包括管理层及美国私募巨头银湖(Silver Lake Partners)的股权。

去年3月,Virtu Financial曾向美国证券交易委员会(SEC)递交了IPO招股文件。但由于Michael Lewis有关介绍高频交易的书籍《Flash Boys: A Wall Street Revolt》面世,引发市场对于高频交易极大的负面关注,该公司不得不推迟了原本的上市时间表。

Virtu Financial是一家利用高速计算机在200多个市场买卖股票、债券、货币和其他资产的金融公司。华尔街见闻曾报道,在2009年至2013年的1238个交易日里,Virtu Financial仅有一天出现亏损。更加吸引眼球的是,根据彭博社数据,在2014年的252个交易日里,Virtu Financial又一次创下“零亏损日”的纪录。

Virtu Financial在IPO招股书中称,2014年,该公司的全球所有资产类别平均每日交易530万次,盈利达到累计持仓的49%。

负责此次IPO的承销商包括高盛、摩根大通(JP Morgan)和奥尼尔投资银行(Sandler O’Neill)等多家投资银行机构。

===============================================================

高频交易公司Virtu闪亮登场 首日开盘较发行价上涨21%

文 / 吴晓喻 2015年04月17日 05:16:15 1

4月16日,世界最大高频交易公司之一的Virtu Financial在纳斯达克成功挂牌交易,股票代码“VIRT”,开盘价每股23美元,较发行价上涨21%。上市首日收盘价22.18美元,盘中最高23.67美元。

据《华尔街日报》报道,Virtu此次IPO共计发行1650万股,每股定价19美元,为发行价区间17-19美元的高端。该公司募得资金3.135亿美元,市值达到26亿美元。募集资金少部分将用于业务投资,其余大部分用于收购其现有投资者,包括管理层及美国私募巨头银湖(Silver Lake Partners)的股权。

去年3月,Virtu Financial曾向美国证券交易委员会(SEC)递交了IPO招股文件。但由于Michael Lewis有关介绍高频交易的书籍《Flash Boys: A Wall Street Revolt》面世,引发市场对于高频交易极大的负面关注,该公司不得不推迟了原本的上市时间表。

Virtu Financial是一家利用高速计算机在200多个市场买卖股票、债券、货币和其他资产的金融公司。华尔街见闻曾报道,在2009年至2013年的1238个交易日里,Virtu Financial仅有一天出现亏损。更加吸引眼球的是,根据彭博社数据,在2014年的252个交易日里,Virtu Financial又一次创下“零亏损日”的纪录。

Virtu Financial在IPO招股书中称,2014年,该公司的全球所有资产类别平均每日交易530万次,盈利达到累计持仓的49%。

负责此次IPO的承销商包括高盛、摩根大通(JP Morgan)和奥尼尔投资银行(Sandler O’Neill)等多家投资银行机构。

最后编辑: 2015-04-17

美能源信息署预判油价见底 沙特石油王冠摇摇欲坠

2015年04月17日 23:12 华夏时报 微博 我有话说(1人参与) 收藏本文

本报记者 王晓薇 北京报道

虽然面对已经被“腰斩”的国际石油价格,沙特一直不愿意低头,但是其石油王国的“王冠”却已经摇摇欲坠。

4月14日,美国能源信息署(EIA)发布了其最新的《2015年能源前景预期报告》。虽然在报告中,EIA表示面对沙特发起的“价格战”,美国2015年下半年日均原油(56.14, -0.57, -1.01%)产量有可能萎缩10万桶,但是这并不会妨碍美国2015年全年平均原油日产量突破1000万桶关口。EIA预测2015年美国日均原油产量为1252万桶,这一产量将超过1970年所创下的历史最高纪录。而除了创下新的历史纪录外,原油日产量突破1000万桶也将意味着美国在石油日产量上将有可能超越沙特,和俄罗斯位列全球第一。

更让沙特忧心的是,作为自己原油出口的最大目的地——EIA预测,在2028年之前,美国将终结能源净进口时代。

在这场价格战中,沙特有可能赢得了开局却输掉了全局。

2015年04月17日 23:12 华夏时报 微博 我有话说(1人参与) 收藏本文

本报记者 王晓薇 北京报道

虽然面对已经被“腰斩”的国际石油价格,沙特一直不愿意低头,但是其石油王国的“王冠”却已经摇摇欲坠。

4月14日,美国能源信息署(EIA)发布了其最新的《2015年能源前景预期报告》。虽然在报告中,EIA表示面对沙特发起的“价格战”,美国2015年下半年日均原油(56.14, -0.57, -1.01%)产量有可能萎缩10万桶,但是这并不会妨碍美国2015年全年平均原油日产量突破1000万桶关口。EIA预测2015年美国日均原油产量为1252万桶,这一产量将超过1970年所创下的历史最高纪录。而除了创下新的历史纪录外,原油日产量突破1000万桶也将意味着美国在石油日产量上将有可能超越沙特,和俄罗斯位列全球第一。

更让沙特忧心的是,作为自己原油出口的最大目的地——EIA预测,在2028年之前,美国将终结能源净进口时代。

在这场价格战中,沙特有可能赢得了开局却输掉了全局。

分红大气,估值合理。

http://seekingalpha.com/article/3073596-ipo-preview-virtu-financial

Dividends

Subject to the sole discretion of its board of directors, VIRT intends to pay dividends that will annually equal, in the aggregate, between 70% and 100% of its net income.

VIRT expects that its first dividend will be paid in the third quarter of 2015 (in respect of the second quarter of 2015) and will be $0.24 per share of its Class A common stock.

Conclusion

Positive based on March qtr estimates

A leading technology-enabled market maker and liquidity provider to the global financial markets.

IPO is for class A stock, expects to pay on class A stock 5.3% annual yield

P/E based on 2014: 15.5, Compare with KCG, see 'valuation' below

P/E based on annualizing March qtr estimates: 7.3

March '15 qtr expectations vs March '14

Rev +21-30%; Net inc +44-55%; ebitda +40-48%

'14 rev +9%, Low income tax rate of 2.5%

Price-to-book of 7.8; per share dilution of -$20.93 vs IPO mid-range of $18

http://seekingalpha.com/article/3073596-ipo-preview-virtu-financial

Dividends

Subject to the sole discretion of its board of directors, VIRT intends to pay dividends that will annually equal, in the aggregate, between 70% and 100% of its net income.

VIRT expects that its first dividend will be paid in the third quarter of 2015 (in respect of the second quarter of 2015) and will be $0.24 per share of its Class A common stock.

Conclusion

Positive based on March qtr estimates

A leading technology-enabled market maker and liquidity provider to the global financial markets.

IPO is for class A stock, expects to pay on class A stock 5.3% annual yield

P/E based on 2014: 15.5, Compare with KCG, see 'valuation' below

P/E based on annualizing March qtr estimates: 7.3

March '15 qtr expectations vs March '14

Rev +21-30%; Net inc +44-55%; ebitda +40-48%

'14 rev +9%, Low income tax rate of 2.5%

Price-to-book of 7.8; per share dilution of -$20.93 vs IPO mid-range of $18

科技创新是摧毁性的打击!以前还在想出了俄罗斯,还会有谁会duang倒下!

海面是多么的风平浪静,听到海啸到来前的声音了吗?duang,钱又少了哈!

美国原油库存屡创新高 油价反弹或昙花一现

2015年04月17日 04:07 FX168 我有话说(8人参与) 收藏本文

FX168讯 尽管美原油(56.14, -0.57, -1.01%)期货周三(4月15日)曾暴涨近6%,且刷新年内高位,但这样的跃升可能只是短期的,因为美国库欣地区原油库存升至85年以来高位,为产量下降做了保障。本周,美原油(WTI)在美国能源信息署(EIA)预测由页岩热潮导致的美国创纪录的库存快接近尾声之后跃升7%。EIA数据周三(4月15日) 显示,美国的石油库存已经连续第14周上升至自1930年期的最高位。油价在钻探机创纪录的减少之后本月上涨17%,钻探机减少也使市场对产量将减少和炼油厂在季节性维护之后增加石油消耗的预测升温。美国的页岩产量有望下降,而OPEC在4年内石油供应增加得最多。石油历史学家和经济学家Daniel Yergin称,这些混合信号可能在增加的波动性中打压价格。“我很想象我们到了价格转折点。”圣路易斯Confluence Investment Management的首席市场战略顾问Bill O’Grady称,“目前仍然有超过4.8亿桶原油。我并不认为库存能很快减少。”EIA数据成,4月10日当周美国原油库存增加了129万桶,至4.837亿桶,为1930年以来的最高点。EIA周一称,从多产紧岩层,如北达科他州的巴肯页岩产量在5月将每天下降57000桶。这是自2013年开始发布每月钻探产量报告以来的第一次预测产量下降。此外,作为WTI石油交付点的俄克拉荷马州库欣的库存上周增加129万桶,至6150万桶。EIA称,中转站的最大处理量为7080万桶。休斯顿麦格理资本公司分析师Vikas Dwivedi称,可以预见,当库欣的的库存到顶之时,一个潜在的大回调可能会将美原油价格打压到较低的40美元/桶的水平。据EIA周一的预估报告称,上周的原油生产一天减少2万桶到938万桶。今年石油供应还是增加到平均每天923万桶,自1972年来的最高点,机构预计,2016年的数字是每天931万桶。驻法国的国际能源署(IEA)周三称,OPEC的石油产量在3月每天增加89万桶到3102万桶/天,是自2011年6月以来的最大增长。OPEC开采全球40%的石油的12个成员国预计6月5日在维也纳召开会议。“看涨的市场是臭名昭著的无视利空消息的。”花旗(Citi)能源分析师Tim Evans称,“上周市场关注美国石油产量减少2万桶,却无视EIA提供的OPEC产量每天增加89万桶。市场可能会无法接受下一波的抛售。” 北京时间04:03,WTI美原油报56.49美元/桶。

海面是多么的风平浪静,听到海啸到来前的声音了吗?duang,钱又少了哈!

美国原油库存屡创新高 油价反弹或昙花一现

2015年04月17日 04:07 FX168 我有话说(8人参与) 收藏本文

FX168讯 尽管美原油(56.14, -0.57, -1.01%)期货周三(4月15日)曾暴涨近6%,且刷新年内高位,但这样的跃升可能只是短期的,因为美国库欣地区原油库存升至85年以来高位,为产量下降做了保障。本周,美原油(WTI)在美国能源信息署(EIA)预测由页岩热潮导致的美国创纪录的库存快接近尾声之后跃升7%。EIA数据周三(4月15日) 显示,美国的石油库存已经连续第14周上升至自1930年期的最高位。油价在钻探机创纪录的减少之后本月上涨17%,钻探机减少也使市场对产量将减少和炼油厂在季节性维护之后增加石油消耗的预测升温。美国的页岩产量有望下降,而OPEC在4年内石油供应增加得最多。石油历史学家和经济学家Daniel Yergin称,这些混合信号可能在增加的波动性中打压价格。“我很想象我们到了价格转折点。”圣路易斯Confluence Investment Management的首席市场战略顾问Bill O’Grady称,“目前仍然有超过4.8亿桶原油。我并不认为库存能很快减少。”EIA数据成,4月10日当周美国原油库存增加了129万桶,至4.837亿桶,为1930年以来的最高点。EIA周一称,从多产紧岩层,如北达科他州的巴肯页岩产量在5月将每天下降57000桶。这是自2013年开始发布每月钻探产量报告以来的第一次预测产量下降。此外,作为WTI石油交付点的俄克拉荷马州库欣的库存上周增加129万桶,至6150万桶。EIA称,中转站的最大处理量为7080万桶。休斯顿麦格理资本公司分析师Vikas Dwivedi称,可以预见,当库欣的的库存到顶之时,一个潜在的大回调可能会将美原油价格打压到较低的40美元/桶的水平。据EIA周一的预估报告称,上周的原油生产一天减少2万桶到938万桶。今年石油供应还是增加到平均每天923万桶,自1972年来的最高点,机构预计,2016年的数字是每天931万桶。驻法国的国际能源署(IEA)周三称,OPEC的石油产量在3月每天增加89万桶到3102万桶/天,是自2011年6月以来的最大增长。OPEC开采全球40%的石油的12个成员国预计6月5日在维也纳召开会议。“看涨的市场是臭名昭著的无视利空消息的。”花旗(Citi)能源分析师Tim Evans称,“上周市场关注美国石油产量减少2万桶,却无视EIA提供的OPEC产量每天增加89万桶。市场可能会无法接受下一波的抛售。” 北京时间04:03,WTI美原油报56.49美元/桶。

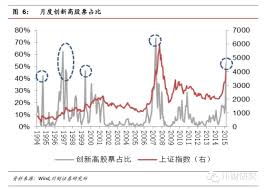

我的A股账户在过去的一个月,盈利50%是肯定有的以前很喜欢做的量化分析图!

2015年4月有54%的股票创历史新高,上一次超过40%以上是在2007年3月到5月。值得启发的信号是每次超过40%的股票创新高以后的回调都是剧烈的,但是绝大多数都不是一轮牛市的顶部。

浏览附件381956

发现移民加拿大真是太对了!

央妈放水,高通胀在后面埋着,那管百姓死活!

杨红旭[微博]:政府拿出了08年底猛劲救经济

易居研究院副院长杨红旭指出,此次央行降准1个百分点,另额外加大对小微企业、“三农”以及重大水利工程建设等的支持力度。这是今年以来第2次降准(上次是2月5日)本轮降准周期的第5次。以往一般每次调整0.5个百分点。而这次居然是1个百分点,上次如此大力度是2008年11月∩见,政府正拿出了08年底猛劲,救经济!杨红旭称,经济由高增长转为中增长是历史宿命,当年日本与亚洲四小龙都如此。但需平稳过渡。一季度GDP跌至7%,创09年二季度来新低!仅略好于08年四季度和09年一季度。今天降准1个百分点,大放水,必须滴!过去30年我国存准率中枢值14%,当前降后仍高达18.5%。年内还得降2次左右、1.5个百分点!

央妈放水,高通胀在后面埋着,那管百姓死活!

杨红旭[微博]:政府拿出了08年底猛劲救经济

易居研究院副院长杨红旭指出,此次央行降准1个百分点,另额外加大对小微企业、“三农”以及重大水利工程建设等的支持力度。这是今年以来第2次降准(上次是2月5日)本轮降准周期的第5次。以往一般每次调整0.5个百分点。而这次居然是1个百分点,上次如此大力度是2008年11月∩见,政府正拿出了08年底猛劲,救经济!杨红旭称,经济由高增长转为中增长是历史宿命,当年日本与亚洲四小龙都如此。但需平稳过渡。一季度GDP跌至7%,创09年二季度来新低!仅略好于08年四季度和09年一季度。今天降准1个百分点,大放水,必须滴!过去30年我国存准率中枢值14%,当前降后仍高达18.5%。年内还得降2次左右、1.5个百分点!

Similar threads

家园推荐黄页

家园币系统数据

- 家园币池子报价

- 0.0097加元

- 家园币最新成交价

- 0.0101加元

- 家园币总发行量

- 1106666家园币

- 加元现金总量

- 12155.9加元

- 家园币总成交量

- 4098206.67家园币

- 家园币总成交价值

- 384692.02加元

- 池子家园币总量

- 396336.11家园币

- 池子加元现金总量

- 3850.24加元

- 池子币总量

- 35214.19

- 1池子币现价

- 0.2187加元

- 池子家园币总手续费

- 5731.58JYB

- 池子加元总手续费

- 595.28加元

- 入池家园币年化收益率

- 0.39%

- 入池加元年化收益率

- 4.15%

- 微比特币最新报价

- 0.096823加元

- 毫以太币最新报价

- 3.46698加元

- 微比特币总量

- 0.354108BTC

- 毫以太币总量

- 0.219250ETH

- 家园币储备总净值

- 383,459.77加元

- 家园币比特币储备

- 3.4200BTC

- 家园币以太币储备

- 15.1ETH

- 比特币的加元报价

- 96,823.30加元

- 以太币的加元报价

- 3,466.98加元

- USDT的加元报价

- 1.39675加元

- 交易币种/月度交易量

- 手续费

- 家园币

- 0.1%(0.01%-1%)

- 加元交易对(比特币等)

- 1%-2%

- USDT交易对(比特币等)

- 0.1%-0.6%