加国退休金(Canada Pension Plan,CPP)60岁至70岁领取

老年保障金(Old Age Security,OAS)俗称老人金,65岁领取

入息补助金(Guaranteed Income Supplement,GIS)与老人金同领

2024年1月 65-74岁 (OAS+GIS) + BC Senior’s Supplement

0收入单人$1778.81+$99.30=$1,878.11 (居住未满40年,皆由Extra GIS补足$1778.81)

0收入双人$2709.38+220.50=$2,929.88 (居住未满40年,皆由Extra GIS补足$2,709.38)

2024年1月 75岁以上 (OAS+GIS) + BC Senior’s Supplement

0收入单人$1850.14+$99.30=$1,949.44 (居住未满40年,皆由Extra GIS补足$1850.14)

0收入双人$2852.04+220.50=$3,072.54 (居住未满40年,皆由Extra GIS补足$2,852.04)

https://www2.gov.bc.ca/gov/content/...ce-rate-tables/senior-s-supplement-rate-table

OAS与GIS计算神器

操作简易,非常实用

全年收入不包括OAS和GIS

Yearly Income (excluding OAS Pension and GIS)

Combined Yearly Income of couple (excluding OAS Pension and GIS)

Table 1 : 单身OAS领取GIS金额

Amounts for single, surviving spouse/common-law partner or divorced pensioners receiving a full Old Age Security pension

Yearly Income (excluding OAS Pension and GIS) 不包含OAS与GIS,年收入零的情况下

单身全额OAS $714.34 + GIS $1065.47 = $1778.81 (请按此计算表键接)

不包含OAS与GIS,年收入超过$21,624,则不符合资格领取GIS

Table 2 : 配偶双方OAS领取GIS金额

Amounts for married or common-law partners, both receiving a full Old Age Security pension

Yearly Income (excluding OAS Pension and GIS) 不包含OAS与GIS,合併年收入零的情况下

毎人全额OAS + GIS : $1354.69 X 2 = $2709.38 (请按此计算表键接)

不包含OAS与GIS,合併年收入超过$28,560,则不符合资格领取GIS

Table 3 : 配偶单方OAS领取GIS金额

Amounts for individuals receiving a full Old Age Security pension whose spouse or common-law partner does not receive an OAS pension

Yearly Income (excluding OAS Pension and GIS) 不包含OAS与GIS,合併年收入为零的情况下:

全额OAS $714.34 + GIS $1065.47 = $1778.81 (请按此计算表键接)

不包含OAS与GIS,合併年收入超过$51,840,则不符合资格领取GIS

Table 4 :60岁至64岁配偶津贴

Amounts for individuals receiving a full Old Age Security pension and their spouse or common-law partner aged 60 to 64

配偶一方领OAS,另一方配偶60岁至64岁,可申请津贴

Yearly Income (excluding OAS Pension and GIS) 不包含OAS与GIS,合併年收入为零的情况下:

全额OAS $713.34 + GIS 641.35 + Allowance 1354.69 = $2709.38 (请按此计算表键接)

不包含OAS与GIS,合併年收入超过$39,984,则不符合资格领取GIS 配偶津贴

Table 5 :60岁至64岁未再婚鳏寡津贴

Amounts for surviving spouses or common-law partners aged 60 to 64 who have not re married or entered into a common-law partnership

Yearly Income (excluding OAS Pension and GIS) 不包含OAS与GIS,年收入为零的情况下

60岁至64岁未再婚鳏寡津贴$1614.89 (请按此计算表键接)

不包含OAS与GIS,年收入超过$29,112,则不符合资格领取鳏寡配偶津贴

少量收入如何拿到部分额外的 Extra GIS?

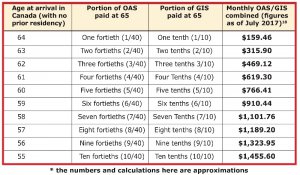

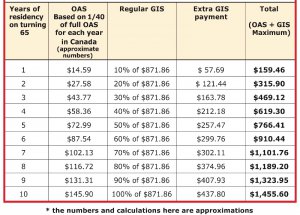

HOW RECEIVING A PARTIAL OAS PENSION AFFECTS GIS AMOUNTS

针对低收入+OAS不足人士,Extra GIS 隐含在下表 Combined Monthly OAS Pension and GIS

以达到最低保障金额

https://www.canada.ca/en/services/benefits/publicpensions/cpp/old-age-security/payments/tab1-1.html

为什么低收入要在60岁领CPP?

Why should a low-income person take early CPP Retirement?

1/ 您可能会在65岁时获得补助金(GIS),对於除了老人金(OAS)以外,没有或仅有少许收入的老年人,会很有帮助。

2/ 届时每10元CPP收入,会减少5元补助金(GIS)。而60岁开始领的CPP金额少,日后的GIS扣除也少。

为什么低收入要在63岁前清空RRSP?

Why would an RRSP hurt me later?

因为64岁那年的收入,会影响65岁的GIS补助

以后,更加不用服食’我怎么会知道’牌子的后悔药了!

担保移民在担保10年或20年期间不能申请GIS补助金

担保入或死亡或破产或入狱或虐待你罪名成立等等情况下例外

The Old Age Security program toolkit

The Guaranteed Income Supplement and Social Security Agreements

Note: If you entered Canada as a sponsored immigrant, you cannot receive the supplement while you are still being sponsored. Exceptions may be made under specific circumstances (such as if your sponsor dies, is imprisoned for a period of more than six months, is convicted of a criminal offence, or declares personal bankruptcy).

2018起始 65岁即自动享GIS补助 长者无需申请

在新制度下,住满40年以上长者自动列入老人保障金(Old Age Security Benefits 简称OAS)申请名单,

也会自动列入保证入息补助金名单内(Guaranteed Income Supplement 简称GIS)申请名单。

政府查看他们的报税资料,评估有没有资格领取入息补助金。

未住满40年,则64岁生日后第一个月获通知填表申请老人金

中国退休金如何报税

退休金在中国不用交税,所以只能填 Line115 , 不能填 Line256 扣税额

应该报养老金收入在Line 115,同时可以享受最多$2000*15%的Tax Credit 在Line 314

领取GIS人士每年必须住在加拿大不少过六个月

If you leave Canada for more than 6 months

You cannot collect the Guaranteed Income Supplement if you are outside of Canada for more than 6 months.

Application for the Guaranteed Income Supplement

HOW RECEIVING A PARTIAL OAS PENSION AFFECTS GIS AMOUNTS

加拿大政府出狠招!华人移民被迫放弃每年¥10万的老人金

领中国退休金要报税 汇率以收款当日计算

加拿大政府狙击“中式移民” 严查老人金补助金违规

你打算在加拿大、中国两地都拿养老金吗?

GIS 与银行存款有关吗?

GIS 和房产存款有关吗?

取出RRSP $2000 砸了GIS $1000

取出RRSP 如何免税

关于OAS老人金

关于CPP退休金

卑诗长者指南

老人院(Senior Living/Retirement Home)

低收入退休规划 Doug Runchey 前资深福利官员

RETIRING ON A LOW INCOME

71岁那年必须把RRSP转成 RRIF

关于 BC Senior's Supplement

如何处理原雇主退休金?

加拿大的退休金够不够生存 讨论帖

关于RRIF 与 Line 31400 Pension Income Tax Credit $2000

2023年 老人低保

收到Service Canada 让我开CPP账户的通知 Dave

也来谈谈RRSP的好处 & 养老计划 阿吾

老年保障金(Old Age Security,OAS)俗称老人金,65岁领取

入息补助金(Guaranteed Income Supplement,GIS)与老人金同领

2024年1月 65-74岁 (OAS+GIS) + BC Senior’s Supplement

0收入单人$1778.81+$99.30=$1,878.11 (居住未满40年,皆由Extra GIS补足$1778.81)

0收入双人$2709.38+220.50=$2,929.88 (居住未满40年,皆由Extra GIS补足$2,709.38)

2024年1月 75岁以上 (OAS+GIS) + BC Senior’s Supplement

0收入单人$1850.14+$99.30=$1,949.44 (居住未满40年,皆由Extra GIS补足$1850.14)

0收入双人$2852.04+220.50=$3,072.54 (居住未满40年,皆由Extra GIS补足$2,852.04)

https://www2.gov.bc.ca/gov/content/...ce-rate-tables/senior-s-supplement-rate-table

OAS与GIS计算神器

操作简易,非常实用入息补助金(Guaranteed Income Supplement,GIS)

关于老人金OAS与补助金GIS的计算全年收入不包括OAS和GIS

Yearly Income (excluding OAS Pension and GIS)

Combined Yearly Income of couple (excluding OAS Pension and GIS)

Table 1 : 单身OAS领取GIS金额

Amounts for single, surviving spouse/common-law partner or divorced pensioners receiving a full Old Age Security pension

Yearly Income (excluding OAS Pension and GIS) 不包含OAS与GIS,年收入零的情况下

单身全额OAS $714.34 + GIS $1065.47 = $1778.81 (请按此计算表键接)

不包含OAS与GIS,年收入超过$21,624,则不符合资格领取GIS

65岁或以上,若仅居满10年,OAS金额为$179,GIS 则额外增加$534.34,补足全额OAS至$714.34

Table 2 : 配偶双方OAS领取GIS金额

Amounts for married or common-law partners, both receiving a full Old Age Security pension

Yearly Income (excluding OAS Pension and GIS) 不包含OAS与GIS,合併年收入零的情况下

毎人全额OAS + GIS : $1354.69 X 2 = $2709.38 (请按此计算表键接)

不包含OAS与GIS,合併年收入超过$28,560,则不符合资格领取GIS

65岁或以上,若仅居满10年,OAS金额为$179,GIS 则额外增加$534.34,补足全额OAS至$714.34

Table 3 : 配偶单方OAS领取GIS金额

Amounts for individuals receiving a full Old Age Security pension whose spouse or common-law partner does not receive an OAS pension

Yearly Income (excluding OAS Pension and GIS) 不包含OAS与GIS,合併年收入为零的情况下:

全额OAS $714.34 + GIS $1065.47 = $1778.81 (请按此计算表键接)

不包含OAS与GIS,合併年收入超过$51,840,则不符合资格领取GIS

65岁或以上,若仅居满10年,OAS金额为$179,GIS 则额外增加$534.34,补足全额OAS至$714.34

Table 4 :60岁至64岁配偶津贴

Amounts for individuals receiving a full Old Age Security pension and their spouse or common-law partner aged 60 to 64

配偶一方领OAS,另一方配偶60岁至64岁,可申请津贴

Yearly Income (excluding OAS Pension and GIS) 不包含OAS与GIS,合併年收入为零的情况下:

全额OAS $713.34 + GIS 641.35 + Allowance 1354.69 = $2709.38 (请按此计算表键接)

不包含OAS与GIS,合併年收入超过$39,984,则不符合资格领取GIS 配偶津贴

65岁或以上,若仅居满10年,OAS金额为$179,GIS 则额外增加$534.34,补足全额OAS至$714.34

Table 5 :60岁至64岁未再婚鳏寡津贴

Amounts for surviving spouses or common-law partners aged 60 to 64 who have not re married or entered into a common-law partnership

Yearly Income (excluding OAS Pension and GIS) 不包含OAS与GIS,年收入为零的情况下

60岁至64岁未再婚鳏寡津贴$1614.89 (请按此计算表键接)

不包含OAS与GIS,年收入超过$29,112,则不符合资格领取鳏寡配偶津贴

少量收入如何拿到部分额外的 Extra GIS?

HOW RECEIVING A PARTIAL OAS PENSION AFFECTS GIS AMOUNTS

针对低收入+OAS不足人士,Extra GIS 隐含在下表 Combined Monthly OAS Pension and GIS

以达到最低保障金额

https://www.canada.ca/en/services/benefits/publicpensions/cpp/old-age-security/payments/tab1-1.html

为什么低收入要在60岁领CPP?

Why should a low-income person take early CPP Retirement?

1/ 您可能会在65岁时获得补助金(GIS),对於除了老人金(OAS)以外,没有或仅有少许收入的老年人,会很有帮助。

2/ 届时每10元CPP收入,会减少5元补助金(GIS)。而60岁开始领的CPP金额少,日后的GIS扣除也少。

为什么低收入要在63岁前清空RRSP?

Why would an RRSP hurt me later?

因为64岁那年的收入,会影响65岁的GIS补助

以后,更加不用服食’我怎么会知道’牌子的后悔药了!

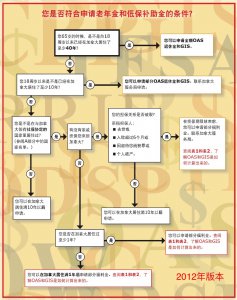

担保移民在担保10年或20年期间不能申请GIS补助金

担保入或死亡或破产或入狱或虐待你罪名成立等等情况下例外

The Old Age Security program toolkit

The Guaranteed Income Supplement and Social Security Agreements

Note: If you entered Canada as a sponsored immigrant, you cannot receive the supplement while you are still being sponsored. Exceptions may be made under specific circumstances (such as if your sponsor dies, is imprisoned for a period of more than six months, is convicted of a criminal offence, or declares personal bankruptcy).

2018起始 65岁即自动享GIS补助 长者无需申请

在新制度下,住满40年以上长者自动列入老人保障金(Old Age Security Benefits 简称OAS)申请名单,

也会自动列入保证入息补助金名单内(Guaranteed Income Supplement 简称GIS)申请名单。

政府查看他们的报税资料,评估有没有资格领取入息补助金。

未住满40年,则64岁生日后第一个月获通知填表申请老人金

中国退休金如何报税

退休金在中国不用交税,所以只能填 Line115 , 不能填 Line256 扣税额

应该报养老金收入在Line 115,同时可以享受最多$2000*15%的Tax Credit 在Line 314

领取GIS人士每年必须住在加拿大不少过六个月

If you leave Canada for more than 6 months

You cannot collect the Guaranteed Income Supplement if you are outside of Canada for more than 6 months.

Application for the Guaranteed Income Supplement

HOW RECEIVING A PARTIAL OAS PENSION AFFECTS GIS AMOUNTS

加拿大政府出狠招!华人移民被迫放弃每年¥10万的老人金

领中国退休金要报税 汇率以收款当日计算

加拿大政府狙击“中式移民” 严查老人金补助金违规

你打算在加拿大、中国两地都拿养老金吗?

GIS 与银行存款有关吗?

GIS 和房产存款有关吗?

取出RRSP $2000 砸了GIS $1000

取出RRSP 如何免税

关于OAS老人金

关于CPP退休金

卑诗长者指南

老人院(Senior Living/Retirement Home)

低收入退休规划 Doug Runchey 前资深福利官员

RETIRING ON A LOW INCOME

71岁那年必须把RRSP转成 RRIF

关于 BC Senior's Supplement

如何处理原雇主退休金?

加拿大的退休金够不够生存 讨论帖

关于RRIF 与 Line 31400 Pension Income Tax Credit $2000

2023年 老人低保

收到Service Canada 让我开CPP账户的通知 Dave

也来谈谈RRSP的好处 & 养老计划 阿吾

什么时候申请CPP是最合适时间?

有关清空RRSP(RRIF) 和领取社保金(GIS)的探讨

Canada income tax calculator

最后编辑: 2024-01-03

:

: