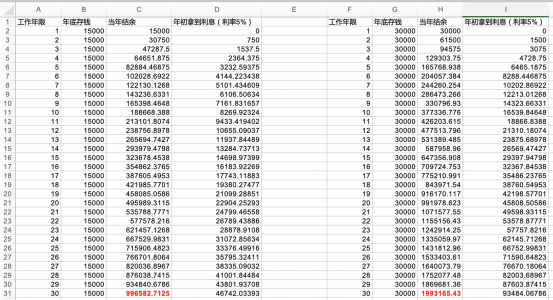

CPP历史

1966年到1986年,合并供款比例只有3.6%,其中雇员1.8%,雇主1.8%

如今已经是9.9%的合并供款比例,雇员雇主各一半

40年沧海桑田,中产阶级的曾经美好时光,彻底一去不复反了。

1966 to 1996[edit]

From 1966 to 1986, the contribution rate was 3.6 per cent. The rate was 1.8 per cent for employees (and a like amount for their employers) and 3.6 per cent in respect of self-employed earnings. By 1997, this had reached combined rates of 6 per cent of pensionable earnings.

As of 2019, the prescribed employee contribution rate was 4.95 per cent of a salaried worker's gross employment income between $3,500 and $57,400, up to a maximum contribution of $2,668. The employer matches the employee contribution, effectively doubling the contributions of the employee. Self-employed workers must pay both halves of the contribution, or 9.9 per cent of pensionable income, when filing their income tax return. These rates have been in effect since 2003.