用于投资的利息才能税前扣除的。建议你查查CRA网站,需要你自己确认过后,才会安心。

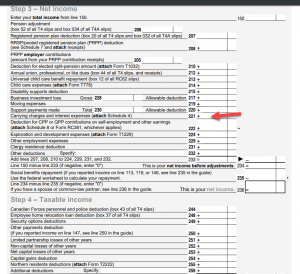

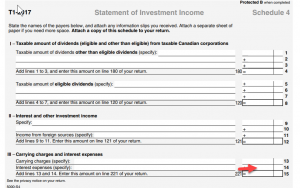

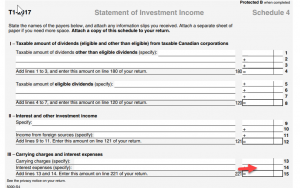

Claim certain carrying charges and interest paid to earn income from investments.

www.canada.ca

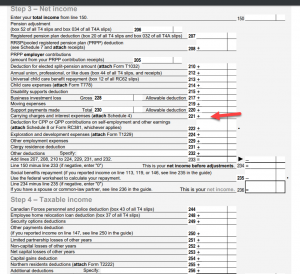

Line 221 - Carrying charges and interest expenses

Claim the following carrying charges and interest you paid to earn income from investments:

fees to manage or take care of your investments (other than any fees you paid for services in connection with your pooled registered pension plan, registered retirement income fund, registered retirement savings plan, specified pension plan, segregated funds (considered insurance product), and tax-free savings account)

fees for certain investment advice (see Interpretation Bulletin IT-238, Fees Paid to Investment Counsel) or for recording investment income

fees to have someone complete your return, but only if all of the following apply:

you have income from a business or property

accounting is a usual part of the operations of your business or property

you did not use the amounts claimed to reduce the business or property income you reported

See Interpretation Bulletin IT-99, Legal and Accounting Fees

most interest you pay on money you borrow for investment purposes, but generally only if you use it to try to earn investment income, including interest and dividends. However, if the only earnings your investment can produce are capital gains, you cannot claim the interest you paid

interest you paid during 2018 on a policy loan made to earn income. To make this claim, have your insurer complete Form T2210, Verification of Policy Loan Interest by the Insurer

legal fees you incurred relating to support payments that your current or former spouse or common-law partner, or the natural parent of your child, will have to pay to you

Legal fees you incurred to try to make child support payments non-taxable must be deducted on line 232. For more information, see Guide P102, Support Payments.