即使不考虑房价的上涨,如果能有正现金流,买房子好像心里更踏实

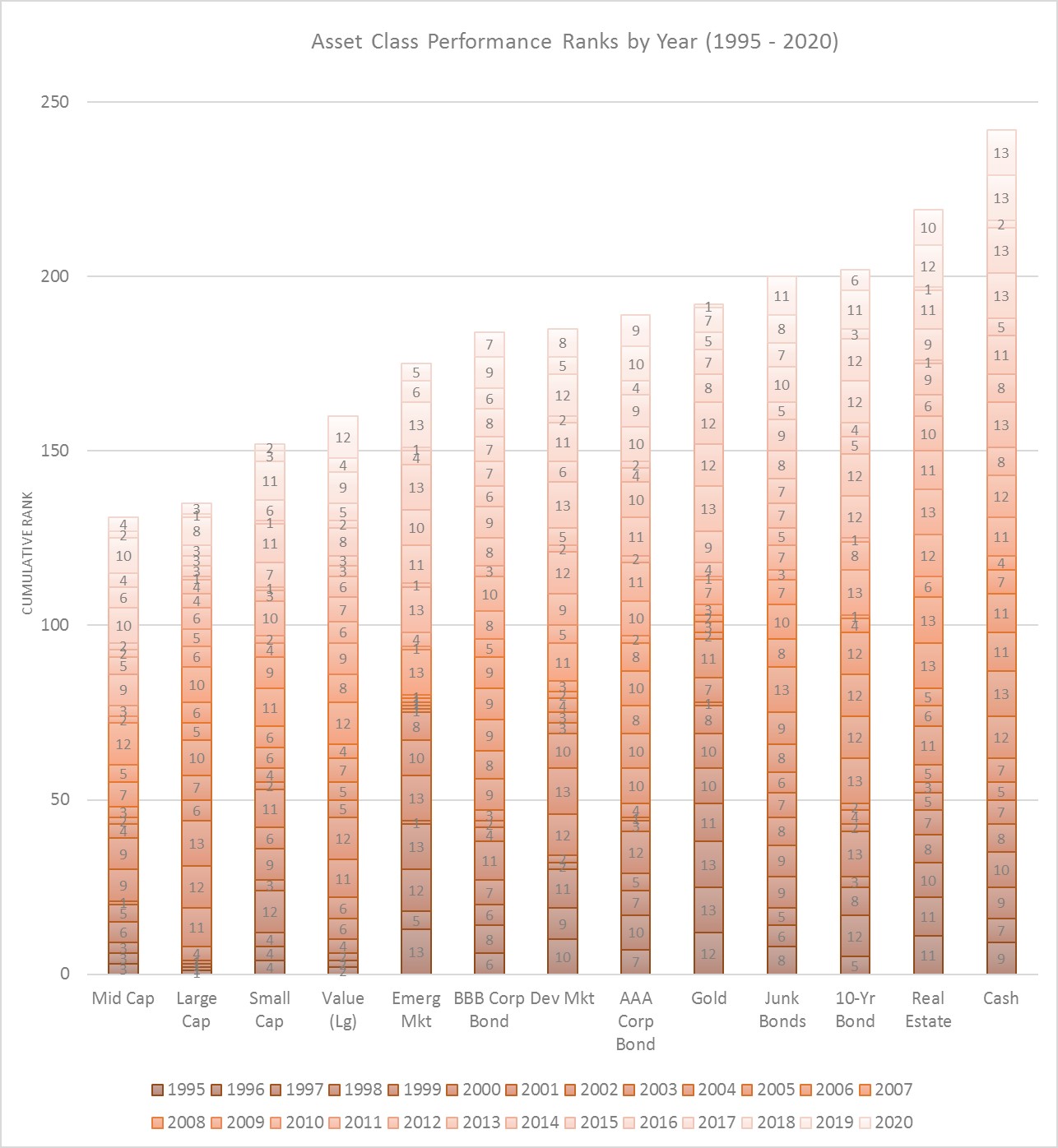

历史数据分析,长期投资最佳组合

- 主题发起人 阿吾

- 发布时间 2021-03-17

Similar threads

2021-01-31有新回复

全楼:1.77

Mr.White

- 1.40 超赞 赏

- 哈法 ,#7

- 2020-04-27

- 投资・理财・炒股・税务・福利

2021-06-01有新回复

全楼:3.75

Tianhai

- 3.03 超赞 赏

- 哈法 ,#7

- 2020-04-22

- 投资・理财・炒股・税务・福利

2020-04-26有新赞

全楼:4.57

Hexagon

- 3.07 1超赞 赏

- 多伦多上空的鸟 ,#446

- 2021-01-07

- 聊天・灌水・娱乐・新闻・时事

2021-01-09有新回复

全楼:2.07

littlewolf

精彩贴图

剑桥大学学霸们的“最美屁股大赛

- 0.03 超赞 赏

- 骆驼客

- 2020-11-30

- 聊天・灌水・娱乐・新闻・时事

2020-11-30有新回复

全楼:0.03

luf_7_6

- 超赞 赏

- David Zhu ,#263

- 2020-06-02

- 房屋买卖/房源

- 1.12 超赞 赏

- Long Vacation ,#448

- 2020-02-01

- 温哥华

2020-02-02有新赞

全楼:1.18

Long Vacation

2019-12-14有新回复

全楼:0.88

mayun_2002