- 首页

-

菜单

- 家园币

-

比特币

Financial Markets by TradingView

您正在使用一款已经过时的浏览器!部分功能不能正常使用。

- 主题发起人 martinqz

- 发布时间 2014-05-05

更多选项

导出主题(文本)====================================================================================美联储今年要是加息,黄金不得完犊子么

加息完了,不就是否极泰来了吗!

美联储加息,每个人都认为它会大跌的,但是不是每个人都会认同跌完以后还会继续跌。

货币政策周期影响以后,是供需关系开始占上风了。农产品,矿产品等等大宗商品可能都会有好机会。

个人预期美联储加息前后,美元指数可能会升至120-125左右,美元指数和绝大部分的商品价格成反比,这就是货币政策周期的巨大影响。先避锋芒,而后择机行事!

最后编辑: 2015-04-09

A Trader Explains His Strategic "Volatility Crush" Trade

http://www.barchart.com/options/highvol

- May 3, 2011, 4:30 PM

Read more: http://www.businessinsider.com/how-to-trade-earnings-2011#ixzz3Ws025QOU - A former hedge fund analyst who trades on his own time recently explained to us how he trades earnings announcements.

“This is one of my prop trades,” he told us. “I call it ‘exploiting the volatility crush.’

Basically, his bet is simply that the month of an earnings announcement will be a more volatile month than the month after it. It's cool to hear him explain how it's done.

In the example he gave us, he made a little over $6,000 trading RIMM last fall. He put on a trade that went short September options and long October options for RIMM.

“Options are contracts that give you the option (but not the obligation) to buy or sell an asset at a certain price by a given time.” It’s kind of like insurance. The price of the insurance, the option, decreases as time goes on and uncertainty (volatility) decreases.

Or as he puts it, “Options are multi-dimensional and non-linear animals, governed by six components. Two of those components are volatility and time.”

It’s like this, he says, “People squirm watching a balloon get too much air blown into it. Will it pop now? NOW?” It’s human nature to freak out about uncertainty.

“Then they find out what happens and just like that, volatility (like uncertainty) rises before and collapses after earnings are announced.”

Usually, he says, the insurance that’s selling for September when the volatility and price is at its peak (before earnings are announced) is overpriced, and will fall later, so he’s almost guaranteed to make money shorting (selling) it. But just in case that doesn't happen, he has a hedge.

The trade he explained to us spans two days, Thursday September 16th, the date of RIMM’s earnings announcement, through Friday September 17th. The first part of it is shorting September options, because he assumes they are overpriced.

“I sold 70 [contracts] of September $42.50 [strike] options [puts] and 70 September $47.50 [strike] options [calls] before the market close on September 16th (RIMM reported earnings 10 minutes after market close, at 4:10pm EST)," he says.

“The idea is that both September and October should experience a volatility decline once the cat’s out of the bag, but September will probably be a more volatile month overall. So as a hedge, the second part of my trade is going long October options, because I want to sell an overpriced asset (the September options) and buy an underpriced one (the October options) because the former’s value decline should more than compensate for that in the latter.”

“So on the same day, I bought 70 RIMM October $50 options [calls] and 70 RIMM October $40 options [puts].”

Basically, his bet is simply that the month of September will be a more volatile month for RIMM than the month of October. Here’s how it played out.

“The trade’s sweet spot [when it’s most profitable] is if RIMM is between $42.5 and $47.5 by September 18th, when the option expires. I’d still be profitable but at a lesser rate if RIMM went either past $47.50 until $50 on the upside or past $42.50 until $40 to the downside, and I’d start losing money if it went slightly beyond $40 to $0 or slightly beyond $50 to the moon.”

The morning of Friday September 17th, RIMM’s opening price was $48.39. It traded as high as $48.74 and as low as $45.97 before closing at $46.72.

“The options I bought at average $0.21 per contract were sold at average of $1.12 per contract, and I netted approximately 533% in 2 days.”

Total profit: $6,370.00 - Read more: http://www.businessinsider.com/how-to-trade-earnings-2011#ixzz3Ws1IiKgz

http://www.barchart.com/options/highvol

最后编辑: 2015-04-17

我得意思是美元加息肯定嗷嗷涨,非美货币不就完犊子了么。兄弟您做什么品种啊,可以留个联系方式么,QQ啥的====================================================================================

加息完了,不就是否极泰来了吗!

美联储加息,每个人都认为它会大跌的,但是不是每个人都会认同跌完以后还会继续跌。

货币政策周期影响以后,是供需关系开始占上风了。农产品,矿产品等等大宗商品可能都会有好机会。

个人预期美联储加息前后,美元指数可能会升至120-125左右,美元指数和绝大部分的商品价格成反比,这就是货币政策周期的巨大影响。先避锋芒,而后择机行事!

......

预期加拿大央行维持利率不变!但如果经济数据差,二季度仍有可能降息!

借钱的要赶紧,兑成美元!

货币政策需要与财政政策,移民政策相配合,方能取得理想的效果!

财政追求平衡预算,现在是赤字,想要平衡,当然是从紧的财政政策!

移民把留学生移民从经验移民推进邀请人申请,从紧的移民政策!

加拿大统计局(Statistics Canada)周五(4月10日)公布的数据显示,加拿大3月就业人数意外增加2.87万人,远高于市场普遍预期的持平,失业率持平,因兼职人员聘用抵消了全职岗位减少的影响。

【彭博】– 富达投资的David Wolf表示,为了重振走下坡路的经济,加 拿大央行最终将加入全球央行放松货币政策的潮流,把利率降至零。

在卡尼执掌加拿大央行期间担任央行顾问的Wolf周一在多伦多表示,身为 世界第11大经济体的加拿大经济内外交困:油价疲软,消费者债务负担沉 重,汇率依然过高造成难以吸引到新的商业投资。

卡尼的继任者Stephen Poloz于1月份把基准利率下调至0.75%,以此作为 应对原油价格下挫作出的”保险”。掉期交易显示,投资者押注央行今年 将再降息一次。Wolf说,年内再降息一次恐怕不够,无法帮助加拿大像其 他大型经济体那样避免陷入全球需求疲软带来的困境。

“几乎其他所有发达经济体的利率都为零有其道理,”和他人共同管理74 亿加元(59亿美元)的Canadian Asset Allocation Fund的Wolf接受电话 采访时说道。他表示,加拿大的利率最终也将降至零。

加拿大央行下一次利率决策将于4月15日做出。

卡尼2009年4月份把基准隔夜贷款利率降至0.25%,称这个水平实际相当于 零利率,并公布了可能实施量化宽松政策的原则。不过,加拿大并没有步 美国、欧洲和日本后尘,使用这种非常规资产购买措施。

借钱的要赶紧,兑成美元!

货币政策需要与财政政策,移民政策相配合,方能取得理想的效果!

财政追求平衡预算,现在是赤字,想要平衡,当然是从紧的财政政策!

移民把留学生移民从经验移民推进邀请人申请,从紧的移民政策!

加拿大统计局(Statistics Canada)周五(4月10日)公布的数据显示,加拿大3月就业人数意外增加2.87万人,远高于市场普遍预期的持平,失业率持平,因兼职人员聘用抵消了全职岗位减少的影响。

【彭博】– 富达投资的David Wolf表示,为了重振走下坡路的经济,加 拿大央行最终将加入全球央行放松货币政策的潮流,把利率降至零。

在卡尼执掌加拿大央行期间担任央行顾问的Wolf周一在多伦多表示,身为 世界第11大经济体的加拿大经济内外交困:油价疲软,消费者债务负担沉 重,汇率依然过高造成难以吸引到新的商业投资。

卡尼的继任者Stephen Poloz于1月份把基准利率下调至0.75%,以此作为 应对原油价格下挫作出的”保险”。掉期交易显示,投资者押注央行今年 将再降息一次。Wolf说,年内再降息一次恐怕不够,无法帮助加拿大像其 他大型经济体那样避免陷入全球需求疲软带来的困境。

“几乎其他所有发达经济体的利率都为零有其道理,”和他人共同管理74 亿加元(59亿美元)的Canadian Asset Allocation Fund的Wolf接受电话 采访时说道。他表示,加拿大的利率最终也将降至零。

加拿大央行下一次利率决策将于4月15日做出。

卡尼2009年4月份把基准隔夜贷款利率降至0.25%,称这个水平实际相当于 零利率,并公布了可能实施量化宽松政策的原则。不过,加拿大并没有步 美国、欧洲和日本后尘,使用这种非常规资产购买措施。

哈哈,这比喻太逗啦

短期两三年的明星周期股,不适合长期持有!

Trade of the Day: Delta Air Lines Options

Rick Pendergraft | Apr 13, 2015 | Blue Chip Stocks, OPTIONS, Options Trading

Google +0 3 3 0

Delta Air Lines (NYSE: DAL) is scheduled to release first quarter earnings numbers on Wednesday morning before the market opens.

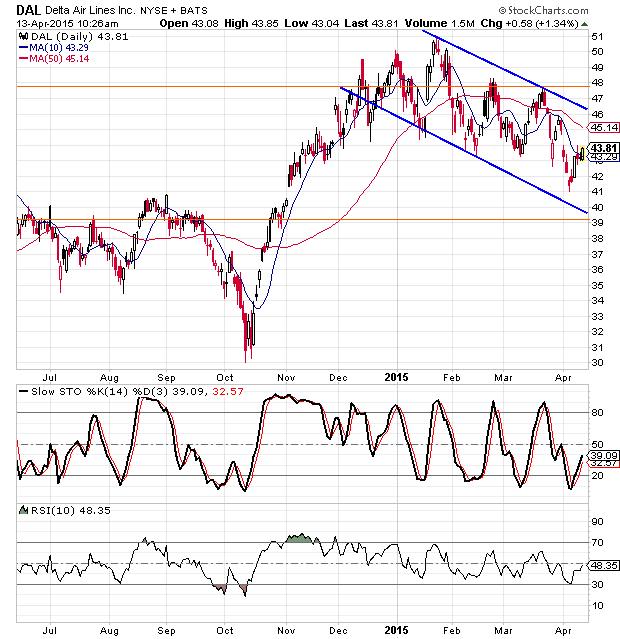

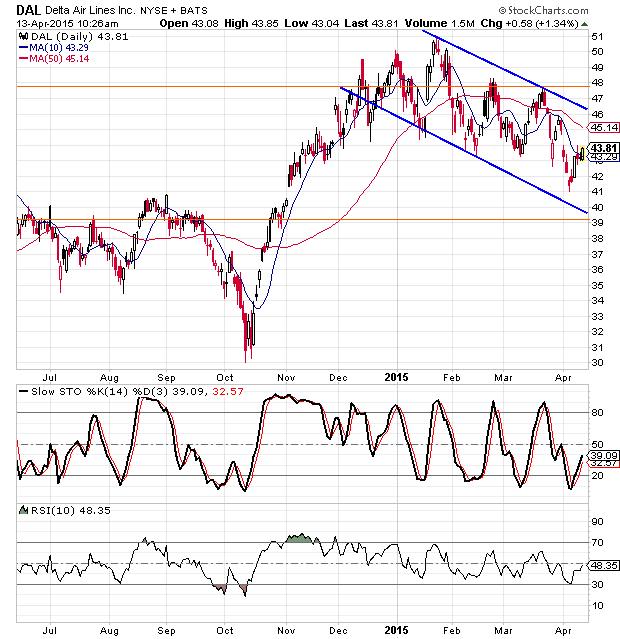

A couple of things jumped out at me as I was researching Delta and its impending earnings release. The first thing that stood out was the trend channel that has dictated trading over the last four months.

After experiencing a tremendous run over the last few years, and especially as the price of oil has fallen, the stock has been in a downward sloped trend channel for the last three or four months.

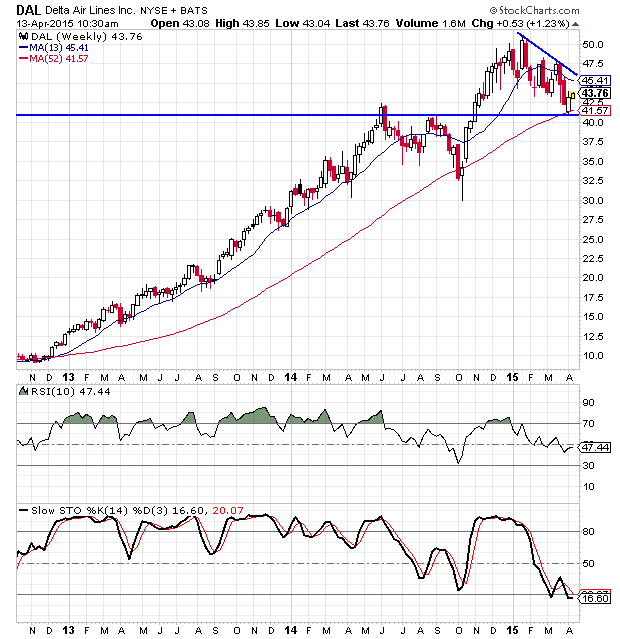

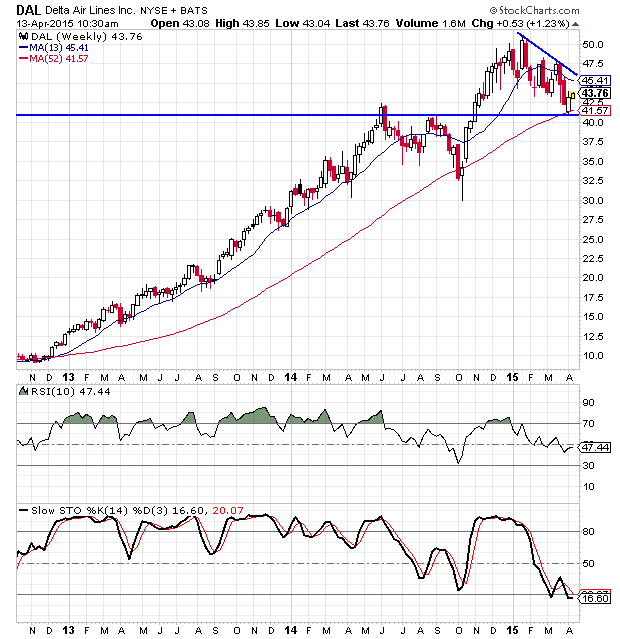

Looking at the weekly chart we see the upper rail of the trend channel, but we also see potential support around the $41 level, as well as the 52-week moving average. In addition, the stock is oversold based on the weekly slow stochastic readings.

Because of the mixed signals from the daily chart and the weekly chart, I turned to the sentiment analysis to see if there was anything that stood out. What I learned is that investors and analysts alike are very bullish toward Delta. The short interest ratio is a meager 1.5 and the put/call ratio is currently lower than 92% of the readings for the past year.

The analyst ratings show 17 “buy” ratings, one “hold” rating and not a single “sell” rating. The score on my proprietary sentiment composite reading came in at 2.36, and that is the second lowest (most bullish) reading I have seen in the two years since I developed the composite.

Because of the extreme bullish sentiment toward Delta, I am leaning toward a bearish outlook, but there are some bullish indications from the weekly chart. As a result, I think the best play ahead of earnings is with Delta Air Lines options – specifically, a strangle.

A strangle is an options trade where you buy both a put and a call with the same expiration date, but they do not have the same strike price like a straddle. In this case, I think the best bet is a May 43 strike put at $1.77 and a May 44 strike call at $2.00. This gives you a total investment of $3.77, which means the stock has to move higher than $47.77 or lower than $39.23 for this trade to be profitable come May 15.

With the earnings announcement coming up and the increase in volatility that is likely, the stock should be able to make a strong move in one direction or the other. With the trendline moving down and the 52-week moving average rising, a break above the trendline or below the moving average would likely lead to a bigger move in the prevailing direction, which would help this strangle. If you look at the daily chart, the orange lines represent the prices on the high side and the low side where this trade becomes profitable.

Trade of the Day: Delta Air Lines Options

Rick Pendergraft | Apr 13, 2015 | Blue Chip Stocks, OPTIONS, Options Trading

Google +0 3 3 0

Delta Air Lines (NYSE: DAL) is scheduled to release first quarter earnings numbers on Wednesday morning before the market opens.

A couple of things jumped out at me as I was researching Delta and its impending earnings release. The first thing that stood out was the trend channel that has dictated trading over the last four months.

After experiencing a tremendous run over the last few years, and especially as the price of oil has fallen, the stock has been in a downward sloped trend channel for the last three or four months.

Looking at the weekly chart we see the upper rail of the trend channel, but we also see potential support around the $41 level, as well as the 52-week moving average. In addition, the stock is oversold based on the weekly slow stochastic readings.

Because of the mixed signals from the daily chart and the weekly chart, I turned to the sentiment analysis to see if there was anything that stood out. What I learned is that investors and analysts alike are very bullish toward Delta. The short interest ratio is a meager 1.5 and the put/call ratio is currently lower than 92% of the readings for the past year.

The analyst ratings show 17 “buy” ratings, one “hold” rating and not a single “sell” rating. The score on my proprietary sentiment composite reading came in at 2.36, and that is the second lowest (most bullish) reading I have seen in the two years since I developed the composite.

Because of the extreme bullish sentiment toward Delta, I am leaning toward a bearish outlook, but there are some bullish indications from the weekly chart. As a result, I think the best play ahead of earnings is with Delta Air Lines options – specifically, a strangle.

A strangle is an options trade where you buy both a put and a call with the same expiration date, but they do not have the same strike price like a straddle. In this case, I think the best bet is a May 43 strike put at $1.77 and a May 44 strike call at $2.00. This gives you a total investment of $3.77, which means the stock has to move higher than $47.77 or lower than $39.23 for this trade to be profitable come May 15.

With the earnings announcement coming up and the increase in volatility that is likely, the stock should be able to make a strong move in one direction or the other. With the trendline moving down and the 52-week moving average rising, a break above the trendline or below the moving average would likely lead to a bigger move in the prevailing direction, which would help this strangle. If you look at the daily chart, the orange lines represent the prices on the high side and the low side where this trade becomes profitable.

马老师,门外汉问个问题,之前看你推荐transportation 的股票,主要是得益于oil price的大跌,可为啥delta air过去四个月随着油价的大跌而下跌?文章提到的options 几个put几个call的组合太深了,实在没那脑子。就是想按您的观点买点单纯transportation的股票。为什么是短期的明星股。

After experiencing a tremendous run over the last few years, and especially as the price of oil has fallen, the stock has been in a downward sloped trend channel for the last three or four months.

After experiencing a tremendous run over the last few years, and especially as the price of oil has fallen, the stock has been in a downward sloped trend channel for the last three or four months.

股价涨有两个层面:宏观环境+公司治理

所以油价跌是指从宏观层面看,航空,运输,化工和游轮产业上的企业会大概率受益。

从公司层面看,盈利提高是关键,所以刚开始分析师都不太同意短期公司评级改变,一般都是一个季度一次评估,和中国评级的情况不同(中国改变评级太快,一周,两周就可能改变)。

当分析师的观点改变,开始趋同时,这时候就会有共振,分析师提升评级至买入+机构投资者需求大增。国外90%都是机构投资者,中国90%是散户。

看看NYSE: DAL的股价走势就很清晰,分析师现在开始看多了+股价一直在做短期调整+股价在长期均线上的支撑位。

所以从技术层面上,中性观点看,这是可上可下的位置。从看多的观点看,机构投资者打压的很厉害。从看空的观点看,至少有一个规模不小的反弹。

从分析师的观点和公司管理层可能会释放消息的角度看,在此位置,做多的力量强于做空的力量。

如果盈利消息预期不好,呵呵,那么多的分析师都是很规规矩矩的?

The analyst ratings show 17 “buy” ratings, one “hold” rating and not a single “sell” rating.

我说的短期明星股是从2-3年的角度看,不是月度的角度看的。国外股市换手率2,3年换一次,中国3个月换次手。

所以油价跌是指从宏观层面看,航空,运输,化工和游轮产业上的企业会大概率受益。

从公司层面看,盈利提高是关键,所以刚开始分析师都不太同意短期公司评级改变,一般都是一个季度一次评估,和中国评级的情况不同(中国改变评级太快,一周,两周就可能改变)。

当分析师的观点改变,开始趋同时,这时候就会有共振,分析师提升评级至买入+机构投资者需求大增。国外90%都是机构投资者,中国90%是散户。

看看NYSE: DAL的股价走势就很清晰,分析师现在开始看多了+股价一直在做短期调整+股价在长期均线上的支撑位。

所以从技术层面上,中性观点看,这是可上可下的位置。从看多的观点看,机构投资者打压的很厉害。从看空的观点看,至少有一个规模不小的反弹。

从分析师的观点和公司管理层可能会释放消息的角度看,在此位置,做多的力量强于做空的力量。

如果盈利消息预期不好,呵呵,那么多的分析师都是很规规矩矩的?

The analyst ratings show 17 “buy” ratings, one “hold” rating and not a single “sell” rating.

我说的短期明星股是从2-3年的角度看,不是月度的角度看的。国外股市换手率2,3年换一次,中国3个月换次手。

ok,我个人感觉visa好像个人客户更多似得,在加拿大办visa很容易,相对来说办master就比较困难。==============================================================================================

美国有四大信用卡上市公司,为啥推荐的是V,MA因为我看不清谁会是将来的龙头老大,真是看不清,所以才选择两只,分享行业发展的红利。

两个背后都是银行投行业的大腕,不像运通,快递公司起家!

加拿大央行(BOC)将于4月15日公布利率决议,尽管市场普遍预期该央行将按兵不动,但少数机构对央行可能意外降息发出警告。

路透发布汇市评论称,加拿大央行将在周三召开政策会议,市场普遍预计该行届时不会调整利率;若该央行意外降息,则可能会像1月份降息那样,对加元构成沉重打击。若加拿大央行将隔夜拆款利率目标从0.75%下调,则美元/加元可能升至1.28-1.30。周三亚市早盘美元/加元报1.2480附近。摩根士丹利(Morgan Stanley)在一份报告中写道:“加拿大经济受到低油价和低油价所带来的附带影响的双重打击。本行预计加拿大央行本周的货币政策决议将提到这一点,但预计加拿大央行仍将维持货币政策不变。不过,我们仍预计加拿大央行将在今年晚些时候进一步宽松。美元/加元预计将持续区间交投,油价和技术面因素将占据主导作用。因此,本行仍长期看空加元表现。”多伦多道明银行(Toronto-Dominion Bank)首席外汇策略师Shaun Osborne说道:“从短期来看,风险偏向于美元走软,或加元相对走强,加拿大经济目前似乎保持得相对较好。”但他补充称预计加元长期而言将重拾跌势。

路透发布汇市评论称,加拿大央行将在周三召开政策会议,市场普遍预计该行届时不会调整利率;若该央行意外降息,则可能会像1月份降息那样,对加元构成沉重打击。若加拿大央行将隔夜拆款利率目标从0.75%下调,则美元/加元可能升至1.28-1.30。周三亚市早盘美元/加元报1.2480附近。摩根士丹利(Morgan Stanley)在一份报告中写道:“加拿大经济受到低油价和低油价所带来的附带影响的双重打击。本行预计加拿大央行本周的货币政策决议将提到这一点,但预计加拿大央行仍将维持货币政策不变。不过,我们仍预计加拿大央行将在今年晚些时候进一步宽松。美元/加元预计将持续区间交投,油价和技术面因素将占据主导作用。因此,本行仍长期看空加元表现。”多伦多道明银行(Toronto-Dominion Bank)首席外汇策略师Shaun Osborne说道:“从短期来看,风险偏向于美元走软,或加元相对走强,加拿大经济目前似乎保持得相对较好。”但他补充称预计加元长期而言将重拾跌势。

Similar threads

家园推荐黄页

家园币系统数据

- 家园币池子报价

- 0.0097加元

- 家园币最新成交价

- 0.0101加元

- 家园币总发行量

- 1106666家园币

- 加元现金总量

- 12155.9加元

- 家园币总成交量

- 4098206.67家园币

- 家园币总成交价值

- 384692.02加元

- 池子家园币总量

- 396336.11家园币

- 池子加元现金总量

- 3850.24加元

- 池子币总量

- 35214.19

- 1池子币现价

- 0.2187加元

- 池子家园币总手续费

- 5731.58JYB

- 池子加元总手续费

- 595.28加元

- 入池家园币年化收益率

- 0.39%

- 入池加元年化收益率

- 4.15%

- 微比特币最新报价

- 0.096967加元

- 毫以太币最新报价

- 3.47561加元

- 微比特币总量

- 0.354108BTC

- 毫以太币总量

- 0.219250ETH

- 家园币储备总净值

- 384,123.77加元

- 家园币比特币储备

- 3.4200BTC

- 家园币以太币储备

- 15.1ETH

- 比特币的加元报价

- 96,967.10加元

- 以太币的加元报价

- 3,475.61加元

- USDT的加元报价

- 1.39675加元

- 交易币种/月度交易量

- 手续费

- 家园币

- 0.1%(0.01%-1%)

- 加元交易对(比特币等)

- 1%-2%

- USDT交易对(比特币等)

- 0.1%-0.6%