T友人移加多年,选举从不投票,从不填报人口普查表

俺开玩笑说:联邦档案里全无加拿大生活点滴记录,恐怕不利申请老人金哦

T友人决定明天去投票了!

俺开玩笑说:联邦档案里全无加拿大生活点滴记录,恐怕不利申请老人金哦

T友人决定明天去投票了!

最后编辑: 2019-10-20

“Parliament quietly passed a bill last month to give Statistics Canada more independence in how it conducts its research, and also changed the punishment for refusing to fill out the census or for providing false information. Canadians will no longer be threatened with up to three months of jail time, but they could still receive fines of up to $500.”T友人移加多年,选举从不投票,从不填报人口普查表

俺开玩笑说:联邦档案里全无加拿大生活点滴记录,恐怕不利申请老人金哦

T友人决定明天去投票了!

T友人去投票了!也决定不再抗拒人口普查了!“Parliament quietly passed a bill last month to give Statistics Canada more independence in how it conducts its research, and also changed the punishment for refusing to fill out the census or for providing false information. Canadians will no longer be threatened with up to three months of jail time, but they could still receive fines of up to $500.”

New law ends threat of jailing census resisters

Canadians who refuse to fill out the mandatory survey can still be fined up to $500www.theglobeandmail.com

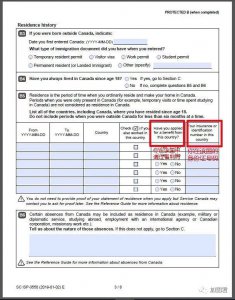

CPP 应该可以申请,只要你曾contribution to CPP。但OAS 必须符合以下三个条件。如果放弃PR身份,不敢确定行不行。一直想知道,如果满足住够20年条件,人离开加拿大回国放弃pr的话, 还怎么申领CPP和OAS

俺理解:放弃PR,曾经住满20年也可以申请OAS放弃PR,等于放弃OAS。

Legal status

If you live outside Canada, you must have been a Canadian citizen or a permanent resident or have held Indian Status or a temporary resident permit on the day before you left Canada.

Application for a Canada Pension Plan Retirement Pension一直想知道,如果满足住够20年条件,人离开加拿大回国放弃pr的话, 还怎么申领CPP和OAS

我看了OAS申请表,应该是可以。但以前有报道说有人曾被拒绝,忘了是什么原因了。俺理解:放弃PR,曾经住满20年也可以申请OAS

If you are living outside Canada, you must:

1. be 65 years old or older;

2. have been a Canadian citizen or a legal resident of Canada on the day before you left Canada; and

3. have resided in Canada for at least 20 years since the age of 18.

谢谢森林之歌!Application for a Canada Pension Plan Retirement Pension

Mail your forms to:

The nearest Service Canada office listed below.

From outside of Canada: The Service Canada office in the province where you last resided.

Need help completing the forms?

Canada or the United States: 1-800-277-9914

All other countries: 613-957-1954 (we accept collect calls)

TTY: 1-800-255-4786

Important: Please have your social insurance number ready when you call.

Application for the Old Age Security Pension

Mail your forms to:

Service Canada Offices Old Age Security

The nearest Service Canada office listed below.

From outside of Canada: The Service Canada office in the province where you last resided.

Need help completing the forms?

Canada or the United States: 1-800-277-9914

All other countries: 613-957-1954 (we accept collect calls)

TTY: 1-800-255-4786

Important: Please have your social insurance number ready when you call.

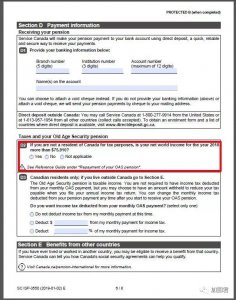

在这里了~在别国申领加拿大的CPP和OAS好像要被扣除一个比率的税款,好像在哪里看过是25%,有的国家和加拿大有税务协定,可以申请减免,中国好像和几年都没有这方面税务协定,所以曾经的华人移民回国后无法申请税务减免?

那么中国移民回国后申请税务减免有可能获得批准吗?在这里了~

Taxes on Pensions and Benefits for those outside Canada

Non-resident tax

Your monthly Old Age Security (OAS) and Canada Pension Plan (CPP) or Quebec Pension Plan (QPP) pensions and benefits may be subject to a Canadian income tax called the "non-resident tax". The tax rate is 25% unless reduced or exempted by a tax treaty between Canada and your country of residence. The non-resident tax will be deducted from your benefit payments.

Requesting a reduction in the amount of non-resident tax withheld (form NR5)

If you live in a country with a tax treaty with Canada, you don't need to ask for taxes on your payments to be reduced or exempted. It will be done automatically when you file your income tax.

If you live in a country without a tax treaty or if you want less tax to be withheld from your monthly payments, you may ask for your taxes to be reduced or eliminated from your benefit payment by completing the Application by a Non-Resident of Canada for a Reduction in the Amount of Non-Resident Tax Required to be Withheld (NR5) . The NR5 should be received by October 31 if you want less tax to be withheld in the following year starting in January. If late, your application cannot be accepted. Once approved, the NR5 is valid for five years unless your income changes. Note, however, that you must still file an income tax return each taxation year. Also, if you already have an NR5 for one pension and you start to receive a second pension, you must complete a new NR5.

汗!这俺就不知道了!那么中国移民回国后申请税务减免有可能获得批准吗?

境内住满10年,境外须曾住满20年OAS不是注满20年才有资格申请吗,怎么是住满10年了

首先,登入My Service Canada Account这个帖子太好了,谢谢楼主分享。

也想60 岁开始领CPP. CPP跟工作年头有关系吗?

用楼主提供的计算器,只要输入本人年龄和退休年龄,

算出的比政府估计的要高好多,不知道怎么回事?