请专业点,把商业地产和住宅地产分开。 讲美国地产行业的事,非你的专业,别班门弄斧,胡说八道。长篇阔论,并不代表事实!

我的两个出租房的租金都上涨,房客抢着要租。我的一个房客租了两年了,要续住,我涨了房价,他们不回价就签了。我才知道我可涨更多些。但他们是非常好的房客,我也就无所谓了。

要知道,现在银行非常愿给两个行业贷款,ASSISTED LIVING 和 RENTAL APARTMENTS.

Rents could jump double digits as vacancies drop

By CNN

Posted March 15 at 6:14 a.m.

Renters beware: Double-digit rent hikes may be coming soon amid rental vacancy rates that have dipped below the 10 percent mark, where they had been lodged for most of the past three years.

“Young people are starting to get rid of their roommates and move out of their parent’s basements,” said Peggy Alford, president of Rent.com, predicting the vacancy rate will hover at a mere 5 percent by 2012. With fewer units on the market, prices will explode.

Rent hikes have averaged less than 1 percent a year during the past decade, according to Commerce Department statistics, adjusted for inflation. Now, Alford expects rents to spike 7 percent or so in each of the next two years to a national average that will top $800 per month.

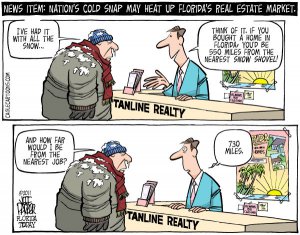

In the hottest rental markets, the increases will likely top the 10 percent mark annually for the next couple of years. In San Diego, Alford anticipates rents will rise more than 31 percent by 2015. In Seattle rents will climb 29 percent over that period; and in Boston, they may jump between 25 percent and 30 percent.

This is a sharp change from the recession, when many Americans couldn’t afford to live on their own. More than 1.2 million young adults moved back in with their parents from 2005 to 2010, said Lesley Deutch of John Burns Real Estate Consulting. Many others doubled up together.

As a result, landlords had to reduce prices and offer big incentives to snag renters.

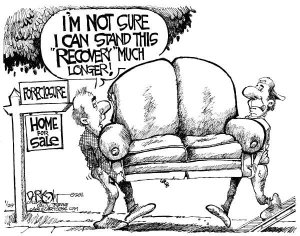

Now that the recession is easing, many of these young people are ready to find new digs, mostly as renters, not owners. Plus, the foreclosure crisis continues unabated, and the millions losing their homes are looking for new places to live.

Apartment developers many not be able to keep up with this heightened demand, which will force prices upwards, according to Chris Macke, a real estate analyst with CoStar, which tracks multi-family housing trends.

“There will be an envelope of two or three years,” said Macke, “when the rise in demand for rentals will exceed the industry’s ability to meet it.”

Plus, Alford added, “there’s been a shift in the American Dream. We’re learning from our surveys that a huge proportion of people are choosing to rent.”

They’ve experienced the downsides of homeownership or seen friends and family suffer and don’t want to take the risks or pay the higher costs of homeownership.

Where homeownership costs are particularly high, there are many more renters than owners. In Manhattan, for example, only about 20 percent own their homes; in San Francisco, about of third of the population does; in Los Angeles, less than 40 percent; and in Chicago, about 44 percent.

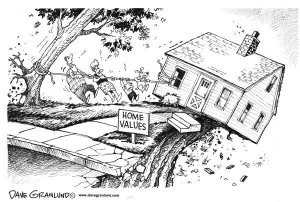

There’s one factor that could rein in rent increases: the huge number of foreclosed homes that could hit the market over the next few years.

In many markets, like Phoenix and Las Vegas, there are neighborhoods filled with recently built, single-family homes going for fire-sale prices. When the cost of owning homes falls well below the costs of renting them, more people will buy.

“That’s always been the biggest competition for rentals,” said Deutch