- 首页

-

菜单

- 家园币

-

比特币

Financial Markets by TradingView

您正在使用一款已经过时的浏览器!部分功能不能正常使用。

- 主题发起人 martinqz

- 发布时间 2014-05-05

更多选项

导出主题(文本)美联储政策倾向于尽快实现利率的正常化,加息时点可能早于2015Q2。

全球资产价格,利率和汇率都可能在2014Q3-2015Q1有巨大的震荡。做壁上观!

美联储于北京时间周四02:00发布7月29~30日美联储公开市场委员会(FOMC)会议纪要,纪要显示,劳动力市场不断改善,且通胀不断接近目标值。部分与会者认为,鉴于双重使命(通胀和就业率)的实现进程快于预期,美联储应该较快结束政策宽松,否则可能导致中期超调。此外,与会者对前瞻指引提出了更“严苛”的要求,要求在货币政策正常化和首次加息前提供更早更清晰的额外信息。纪要公布后,美股和黄金价格急跌,美元指数和10年期美债收益率迅速上涨。

法国巴黎银行(BNP)表示,美联储纪要对美联储政策正常化安排抛出了有力线索。尤其是在突出劳动力市场改善方面,纪要内容更倾向于一个鹰派转折。

此前,不少分析师预计,维持宽松立场的会议纪要将成美元指数上行“拦路虎”,现在看来“事与愿违”。花旗外汇(CitiFX)策略师Richard Cochinos分析,美联储纪要反映出更强劲的立场分歧和经济持续改善,FOMC内部“鹰鸽对立”局势的加剧或是未来政策转变的征兆。

就加息预期而言,许多与会者指出,如果双重使命(通胀和就业率)的实现进程快于预期,则应该更早地结束政策宽松。一些与会者认为,依照目前进度来看,已足以撤出超级宽松的货币政策,否则可能导致中期失业率和通胀超调。

与会者对于FOMC的前瞻指引也愈发表示不满,FOMC声明中表明的首次加息时点晚于他们认为恰当的时点,且声明中联邦基金利率水平低于他们认为恰当的水平。此外,他们担心FOMC声明可能让人们误以为美联储对劳动力资源利用率不足的担心在加强。许多委员表示,对劳动力市场利用率的措辞需要更改,特别是若劳动力市场改善程度持续好于预期。

全球资产价格,利率和汇率都可能在2014Q3-2015Q1有巨大的震荡。做壁上观!

美联储于北京时间周四02:00发布7月29~30日美联储公开市场委员会(FOMC)会议纪要,纪要显示,劳动力市场不断改善,且通胀不断接近目标值。部分与会者认为,鉴于双重使命(通胀和就业率)的实现进程快于预期,美联储应该较快结束政策宽松,否则可能导致中期超调。此外,与会者对前瞻指引提出了更“严苛”的要求,要求在货币政策正常化和首次加息前提供更早更清晰的额外信息。纪要公布后,美股和黄金价格急跌,美元指数和10年期美债收益率迅速上涨。

法国巴黎银行(BNP)表示,美联储纪要对美联储政策正常化安排抛出了有力线索。尤其是在突出劳动力市场改善方面,纪要内容更倾向于一个鹰派转折。

此前,不少分析师预计,维持宽松立场的会议纪要将成美元指数上行“拦路虎”,现在看来“事与愿违”。花旗外汇(CitiFX)策略师Richard Cochinos分析,美联储纪要反映出更强劲的立场分歧和经济持续改善,FOMC内部“鹰鸽对立”局势的加剧或是未来政策转变的征兆。

就加息预期而言,许多与会者指出,如果双重使命(通胀和就业率)的实现进程快于预期,则应该更早地结束政策宽松。一些与会者认为,依照目前进度来看,已足以撤出超级宽松的货币政策,否则可能导致中期失业率和通胀超调。

与会者对于FOMC的前瞻指引也愈发表示不满,FOMC声明中表明的首次加息时点晚于他们认为恰当的时点,且声明中联邦基金利率水平低于他们认为恰当的水平。此外,他们担心FOMC声明可能让人们误以为美联储对劳动力资源利用率不足的担心在加强。许多委员表示,对劳动力市场利用率的措辞需要更改,特别是若劳动力市场改善程度持续好于预期。

美联储加息预期继续发酵 美元周一大幅高开.

在今年会议召开之前,市场普遍预期耶伦将带来明显偏向“鸽派”的讲话,但耶伦最终的讲话却偏向中立和谨慎,每段指出劳动力市场现状好于或坏于预期的话后面都紧跟着一个“但是”,让市场很难将其简单定位成“鸽派”或“鹰派”。

美国亚特兰大联储总裁洛克哈特上周六表示,美联储正在集中考虑在明年第一季和年中之间的首次升息,并最早下个月可能对政策声明做出修改。洛克哈特在杰克森霍尔接受专访时表示:“由于数据在改善,很自然开始预期指标利率政策发生改变,因此讨论到底是在2015年初或年中甚至更晚升息也非常合理。”他并称“讨论是实质性的。” 在经济增长徘徊在3%左右的情况下,洛克哈特称他依然预计2015年中升息。

有“美联储通讯社”之称的《华尔街日报》记者Jon Hilsenrath表示,耶伦和7月在美国国会的证词一样模棱两可,既承认美国劳动力市场在复苏,但却没有表示这种复苏将如何影响首次加息的时点。德意志银行全球G10外汇主管拉斯金表示,耶伦的讲话非常平衡,这让市场中认为耶伦会继续保持“鸽派”的人感到些许失望。高盛集团分析师大卫则表示,预计到2018年,美联储基准利率将从当前的近零水平升至4%,这几年股票和债券的回报将出现严重分化。

在今年会议召开之前,市场普遍预期耶伦将带来明显偏向“鸽派”的讲话,但耶伦最终的讲话却偏向中立和谨慎,每段指出劳动力市场现状好于或坏于预期的话后面都紧跟着一个“但是”,让市场很难将其简单定位成“鸽派”或“鹰派”。

美国亚特兰大联储总裁洛克哈特上周六表示,美联储正在集中考虑在明年第一季和年中之间的首次升息,并最早下个月可能对政策声明做出修改。洛克哈特在杰克森霍尔接受专访时表示:“由于数据在改善,很自然开始预期指标利率政策发生改变,因此讨论到底是在2015年初或年中甚至更晚升息也非常合理。”他并称“讨论是实质性的。” 在经济增长徘徊在3%左右的情况下,洛克哈特称他依然预计2015年中升息。

有“美联储通讯社”之称的《华尔街日报》记者Jon Hilsenrath表示,耶伦和7月在美国国会的证词一样模棱两可,既承认美国劳动力市场在复苏,但却没有表示这种复苏将如何影响首次加息的时点。德意志银行全球G10外汇主管拉斯金表示,耶伦的讲话非常平衡,这让市场中认为耶伦会继续保持“鸽派”的人感到些许失望。高盛集团分析师大卫则表示,预计到2018年,美联储基准利率将从当前的近零水平升至4%,这几年股票和债券的回报将出现严重分化。

A股就是投机市场,零和游戏,你赚的就是别人亏的,典型的贝塔市场。

我见过最狠的庄

楼层数:13 回贴量:19 浏览量:0 发帖时间:昨天 11:20

只看楼主 回复

今天天伦置业复牌了,14亿收购智慧城市概念的公司。估计复牌后至少翻番。

这个股票老汉我2013年就盯了,但是中间根本受不了庄家的洗盘,很早就出了。

今天看到他复牌,才知道这庄的狠毒之处。花点时间写下来,一方面记录一下对这票的分析,一方面可能对股友们有帮助。

喝口水,慢慢写。

先说明一下,这都是事后分析,今天复牌公告出来,老汉才恍然大悟主力的操作逻辑,才明白这一年的操作流程。

主力应该是一年前就知道了这次收购,才开始建仓吸筹,等待停牌、复牌。

这是庄家与上市公司有预谋的,狼狈为奸的一次做盘。

我是13年的7月份发现这个票的,原因是当时K线小阳密集,沿着5、10均线,缩量稳步上涨,与大盘格格不入。

这就是庄家吸筹的典型特征。而且处于一个历史级别的底部区域,老汉我就买入了,准备做中长线。

中间庄家洗的很厉害,从7.3跌到6块,我因为前面高抛低吸,成本不高,而且支撑位上都能反弹回去,所以一直守着。

没想到啊没想到,过完年以后一波杀跌到了5.5,我以为自己判断错误,赶紧就缴械投降了!

结果在0.809的黄金分割位置,他又企稳上涨了。这一波杀下来我心有余悸,也不敢再进去了。但是还一直在观察他后市,来判断和研究自己一路的分析。

结果他2014年4月17号,再次挖坑后,直接停牌了。

复牌就是四个月后的今天。直接14亿收购智慧城市概念。确保能翻番。

上一张图,分析一下此庄整个流程。

之前被洗出来,也是因为认为跌破了主力成本,也就是5.7左右,但是可能比这个还低。

我见过最狠的庄

楼层数:13 回贴量:19 浏览量:0 发帖时间:昨天 11:20

只看楼主 回复

今天天伦置业复牌了,14亿收购智慧城市概念的公司。估计复牌后至少翻番。

这个股票老汉我2013年就盯了,但是中间根本受不了庄家的洗盘,很早就出了。

今天看到他复牌,才知道这庄的狠毒之处。花点时间写下来,一方面记录一下对这票的分析,一方面可能对股友们有帮助。

喝口水,慢慢写。

先说明一下,这都是事后分析,今天复牌公告出来,老汉才恍然大悟主力的操作逻辑,才明白这一年的操作流程。

主力应该是一年前就知道了这次收购,才开始建仓吸筹,等待停牌、复牌。

这是庄家与上市公司有预谋的,狼狈为奸的一次做盘。

我是13年的7月份发现这个票的,原因是当时K线小阳密集,沿着5、10均线,缩量稳步上涨,与大盘格格不入。

这就是庄家吸筹的典型特征。而且处于一个历史级别的底部区域,老汉我就买入了,准备做中长线。

中间庄家洗的很厉害,从7.3跌到6块,我因为前面高抛低吸,成本不高,而且支撑位上都能反弹回去,所以一直守着。

没想到啊没想到,过完年以后一波杀跌到了5.5,我以为自己判断错误,赶紧就缴械投降了!

结果在0.809的黄金分割位置,他又企稳上涨了。这一波杀下来我心有余悸,也不敢再进去了。但是还一直在观察他后市,来判断和研究自己一路的分析。

结果他2014年4月17号,再次挖坑后,直接停牌了。

复牌就是四个月后的今天。直接14亿收购智慧城市概念。确保能翻番。

上一张图,分析一下此庄整个流程。

之前被洗出来,也是因为认为跌破了主力成本,也就是5.7左右,但是可能比这个还低。

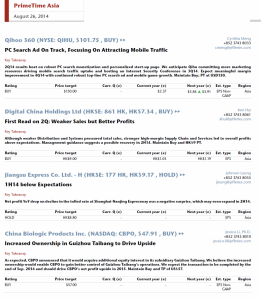

==============================================================Qihu这么牛,而且众口一词,岂不是掉馅饼一样的机会?

准备搞一点,看看占星家们的说辞准不准,hoho。

请问马老师,这个Jefferies公司是什么来头,恕我井底,怎么没听说过?

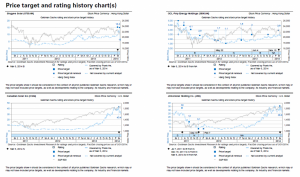

浏览附件357980

不过SINA的分析师预测一样很牛,这个我已经屯了不少了,呵呵。

浏览附件357987

Jefferies公司是小众的特色公司,特别喜欢给上市公司估值的公司,每一份比较正式的报告居然能够给几十家一起评。

比较类似的公司如BBH,特别喜欢搞外汇和政治的金融咨询公司。

附件

ECB货币政策大概率会量化宽松,美联储小概率会加快升息的步伐,即维持2015年Q2首次加息的看法,应该不会提前加息。

Goldman Slashes EURUSD Forecast To 1.20

08/29/2014 11:17 -0400

Having flip-flopped from forecasting EUR strength for the next 12 months in April (target 1.40), Goldman has rapidly ratcheted down its expectations for the flailing currency to 1.30 previously and now forecasts EURUSD at 1.20 in 12 months. As Goldman notes, "because we believe the dynamics of the Euro have fundamentally changed and because we expect cyclical outperformance of the US, a prolonged period of Euro undervaluation can be expected and this is reflected in our longer-term forecasts." Trade accordingly...

Via Goldman Sachs,

1. We are revising down our EUR/$ forecast to 1.29, 1.25 and 1.20 in 3, 6 and 12 months (from 1.35, 1.34 and 1.30 previously). We are also revising our longer-term forecasts lower, bringing the end-2015 number down to 1.15 (from 1.27), that for end-2016 to 1.05 (from 1.23) and that for end-2017 to 1.00 (from 1.20). We switched from forecasting Euro strength to weakness in April, when we revised our 12-month forecast from 1.40 to 1.30, and the decline since then has been faster than we anticipated. Our latest forecast change aims to signal that the current move lower in EUR/$ has staying power and, in our view, is the beginning of a trend.

2. This forecast change is very much a restatement of our bullish Dollar view. Indeed, because we are keeping our EUR/CHF, EUR/GBP, EUR/NOK and EUR/SEK forecasts unchanged, this change is disproportionately important for our trade-weighted Dollar forecast. When we first switched to forecasting Euro weakness in April, this implied a 6% appreciation of the trade-weighted Dollar against the G10 on a 12-month horizon. Since then the Dollar has appreciated about 3%, i.e., about half that, thanks in large part to the drop in EUR/$. Revising our 12-month EUR/$ forecast to 1.20 implies a trade-weighted appreciation of the Dollar against its G10 peers of a further 6%. We think the USD still has room to catch up with the 2-year rate differential, which is currently the most Dollar-supportive since mid-2009 (Exhibit 1). In addition, changes to the Fed’s forward guidance in coming months have the potential to move the rate differential further in support of the Dollar (Exhibit 2), especially if US data continue their cyclical outperformance versus the rest of the G10.

3. We also believe that the dynamics of the Euro have fundamentally changed. Prior to the ECB’s latest round of easing in June, the foreign exchange market was very sceptical that additional monetary stimulus could be Euro-negative, since it would attract foreign inflows that would buoy the single currency. That thinking has changed fundamentally, in our view, not because foreign portfolio flows into the Euro area have abated (Exhibit 3), but because domestics are increasingly sending portfolio flows out of the Euro area, as ongoing ECB easing encourages a hunt for yield elsewhere (Exhibit 4). Our view is that these portfolio outflows have much greater potential to grow than foreign flows into the Euro area, given that periphery risk premia are already so compressed. Key pushbacks to our view are that: (i) speculative short Euro positioning is already very stretched, with the CFTC’s CoT report for example putting positioning now on a par with 2011/12, when concerns about a potential Euro area break-up were very real; and (ii) the view that the ECB is de facto on hold, as it implements easing measures announced in June. As we have argued in a recent FX Views, the large size of foreign portfolio inflows into the Euro area over the last two years likely means that the CoT report overstates speculative Euro shorts, which we see as moderate in the scheme of things. As far as ECB policy goes, we think there is – counter to market consensus – plenty of room for President Draghi to 'talk' the currency lower, which he notably started to do in the August press conference when he said that “fundamentals for a weaker exchange rate are today much better than they were two or three months ago”. Reinforcing his comment, we estimate that the fair value for EUR/$ is around 1.19. Therefore, even with the depreciation of the Euro in recent months, it is still expensive. Because we believe the dynamics of the Euro have fundamentally changed and because we expect cyclical outperformance of the US, a prolonged period of Euro undervaluation can be expected and this is reflected in our longer-term forecasts.

4. Our 12-month EUR/$ forecast of 1.20 implies a 5% weakening of the Euro on a trade-weighted basis versus the G10. With our 12-month forecast for EUR/GBP unchanged at 0.75, this amounts to a downgrade to our GBP/$ view, with the 12-month forecast now 1.60 (from 1.73 previously). As a result, we are now expecting somewhat less appreciation of Sterling, with the trade-weighted index rising well below 5% on a one-year horizon, down from 6% earlier this year.

Goldman Slashes EURUSD Forecast To 1.20

08/29/2014 11:17 -0400

Having flip-flopped from forecasting EUR strength for the next 12 months in April (target 1.40), Goldman has rapidly ratcheted down its expectations for the flailing currency to 1.30 previously and now forecasts EURUSD at 1.20 in 12 months. As Goldman notes, "because we believe the dynamics of the Euro have fundamentally changed and because we expect cyclical outperformance of the US, a prolonged period of Euro undervaluation can be expected and this is reflected in our longer-term forecasts." Trade accordingly...

Via Goldman Sachs,

1. We are revising down our EUR/$ forecast to 1.29, 1.25 and 1.20 in 3, 6 and 12 months (from 1.35, 1.34 and 1.30 previously). We are also revising our longer-term forecasts lower, bringing the end-2015 number down to 1.15 (from 1.27), that for end-2016 to 1.05 (from 1.23) and that for end-2017 to 1.00 (from 1.20). We switched from forecasting Euro strength to weakness in April, when we revised our 12-month forecast from 1.40 to 1.30, and the decline since then has been faster than we anticipated. Our latest forecast change aims to signal that the current move lower in EUR/$ has staying power and, in our view, is the beginning of a trend.

2. This forecast change is very much a restatement of our bullish Dollar view. Indeed, because we are keeping our EUR/CHF, EUR/GBP, EUR/NOK and EUR/SEK forecasts unchanged, this change is disproportionately important for our trade-weighted Dollar forecast. When we first switched to forecasting Euro weakness in April, this implied a 6% appreciation of the trade-weighted Dollar against the G10 on a 12-month horizon. Since then the Dollar has appreciated about 3%, i.e., about half that, thanks in large part to the drop in EUR/$. Revising our 12-month EUR/$ forecast to 1.20 implies a trade-weighted appreciation of the Dollar against its G10 peers of a further 6%. We think the USD still has room to catch up with the 2-year rate differential, which is currently the most Dollar-supportive since mid-2009 (Exhibit 1). In addition, changes to the Fed’s forward guidance in coming months have the potential to move the rate differential further in support of the Dollar (Exhibit 2), especially if US data continue their cyclical outperformance versus the rest of the G10.

3. We also believe that the dynamics of the Euro have fundamentally changed. Prior to the ECB’s latest round of easing in June, the foreign exchange market was very sceptical that additional monetary stimulus could be Euro-negative, since it would attract foreign inflows that would buoy the single currency. That thinking has changed fundamentally, in our view, not because foreign portfolio flows into the Euro area have abated (Exhibit 3), but because domestics are increasingly sending portfolio flows out of the Euro area, as ongoing ECB easing encourages a hunt for yield elsewhere (Exhibit 4). Our view is that these portfolio outflows have much greater potential to grow than foreign flows into the Euro area, given that periphery risk premia are already so compressed. Key pushbacks to our view are that: (i) speculative short Euro positioning is already very stretched, with the CFTC’s CoT report for example putting positioning now on a par with 2011/12, when concerns about a potential Euro area break-up were very real; and (ii) the view that the ECB is de facto on hold, as it implements easing measures announced in June. As we have argued in a recent FX Views, the large size of foreign portfolio inflows into the Euro area over the last two years likely means that the CoT report overstates speculative Euro shorts, which we see as moderate in the scheme of things. As far as ECB policy goes, we think there is – counter to market consensus – plenty of room for President Draghi to 'talk' the currency lower, which he notably started to do in the August press conference when he said that “fundamentals for a weaker exchange rate are today much better than they were two or three months ago”. Reinforcing his comment, we estimate that the fair value for EUR/$ is around 1.19. Therefore, even with the depreciation of the Euro in recent months, it is still expensive. Because we believe the dynamics of the Euro have fundamentally changed and because we expect cyclical outperformance of the US, a prolonged period of Euro undervaluation can be expected and this is reflected in our longer-term forecasts.

4. Our 12-month EUR/$ forecast of 1.20 implies a 5% weakening of the Euro on a trade-weighted basis versus the G10. With our 12-month forecast for EUR/GBP unchanged at 0.75, this amounts to a downgrade to our GBP/$ view, with the 12-month forecast now 1.60 (from 1.73 previously). As a result, we are now expecting somewhat less appreciation of Sterling, with the trade-weighted index rising well below 5% on a one-year horizon, down from 6% earlier this year.

Similar threads

家园推荐黄页

家园币系统数据

- 家园币池子报价

- 0.0097加元

- 家园币最新成交价

- 0.0101加元

- 家园币总发行量

- 1106666家园币

- 加元现金总量

- 12155.9加元

- 家园币总成交量

- 4098206.67家园币

- 家园币总成交价值

- 384692.02加元

- 池子家园币总量

- 396336.11家园币

- 池子加元现金总量

- 3850.24加元

- 池子币总量

- 35214.19

- 1池子币现价

- 0.2187加元

- 池子家园币总手续费

- 5731.58JYB

- 池子加元总手续费

- 595.28加元

- 入池家园币年化收益率

- 0.39%

- 入池加元年化收益率

- 4.15%

- 微比特币最新报价

- 0.096767加元

- 毫以太币最新报价

- 3.46723加元

- 微比特币总量

- 0.354108BTC

- 毫以太币总量

- 0.219250ETH

- 家园币储备总净值

- 383,349.10加元

- 家园币比特币储备

- 3.4200BTC

- 家园币以太币储备

- 15.1ETH

- 比特币的加元报价

- 96,766.70加元

- 以太币的加元报价

- 3,467.23加元

- USDT的加元报价

- 1.39675加元

- 交易币种/月度交易量

- 手续费

- 家园币

- 0.1%(0.01%-1%)

- 加元交易对(比特币等)

- 1%-2%

- USDT交易对(比特币等)

- 0.1%-0.6%