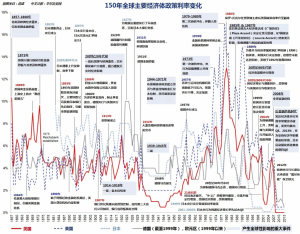

欧元自此之后,大概率成为第二个日元,大趋势是欧元兑美元下行,但不能一味看空。汇率是政府希望走弱,对冲基金疯狂借贷,抬升汇率。一有风吹草动,汇率波动加大。银行存钱在央行要收费,酷,世界首例!

ECB Cuts By 10 Bps, Sends Deposit Rate Further Into Negative Territory

While everyone was expecting Mario Draghi to announce ABS purchases, few if any had expected the ECB to

also cut rates.

Which it just did whacking its corridor rates across the board by 10 bps, in the process sending the Deposit Facility rate even further into negative territory,now down at -0.2%.

From the ECB's

monetary policy decision:

At today’s meeting the Governing Council of the ECB took the following monetary policy decisions:

- The interest rate on the main refinancing operations of the Eurosystem will be decreased by 10 basis points to 0.05%, starting from the operation to be settled on 10 September 2014.

- The interest rate on the marginal lending facility will be decreased by 10 basis points to 0.30%, with effect from 10 September 2014.

- The interest rate on the deposit facility will be decreased by 10 basis points to -0.20%, with effect from 10 September 2014.

Here are five questions from Bloomberg for Mario Draghi this morning...

Is more easing on the way?

After the ECB unveiled an unprecedented stimulus package in June, most analysts had expected officials to hold off on new measures until the end of the year. An economy that stalled in the second quarter, slowing inflation and the crisis in Ukraine changed the picture. Draghi acknowledged these developments, and their effect on inflation expectations, in a speech at Jackson Hole, Wyoming on Aug. 22, setting the stage for more stimulus, including quantitative easing.

Will there be changes to the TLTROs?

The ECB may make the terms of its targeted longer-term loans, the centerpiece of its June package, more attractive by cutting its benchmark rate or erasing the premium it plans to charge banks, analysts say. The current plan -- aimed at supporting the recovery by boosting lending -- offers funding at 0.10 percentage point above the benchmark rate. A rate cut would make what is already, according to Draghi, a “very, very attractive” offer even more appealing.

The first round of the TLTRO operation is due this month. Estimates of take-up in a Bloomberg News survey fell in August as the economic outlook for the euro area clouded. Italy’s seven biggest banks will ask to borrow as much as 30.3 billion euros ($40 billion) this month, according to a Bloomberg News report.

What’s happening with inflation?

A key thing to watch for is any change in the inflation wording of Draghi’s opening statement. In August, he said officials see “both upside and downside risks to the outlook for price developments as limited and broadly balanced over the medium term.”

The ECB will also issue new economic forecasts. It currently predicts price growth will gradually accelerate over the next 2 1/2 years, climbing from 0.7 percent this year to 1.1 percent in 2015 and 1.5 percent in the last quarter of 2016.

Inflation, which the ECB aims to keep just under 2 percent, has been below 1 percent since October and fell to 0.3 percent in August, the lowest in almost five years. In Jackson Hole, Draghi reaffirmed that most factors pushing down inflation -- from the exchange rate and geopolitical tensions to food and energy prices -- are temporary. Core inflation edged up in August to 0.9 percent.

Still, the ECB President recognized that “if this period of low inflation were to last for a prolonged period of time the risk to price stability would increase,” and said inflation expectations had “exhibited significant declines.”

Let’s cut to the chase, is quantitative easing coming?

After Draghi’s Jackson Hole speech, when he said the Governing Council “will use all the available instruments needed to ensure price stability over the medium term,” analysts from Berenberg to JPMorgan Chase & Co. said the chances of large-scale asset purchases have increased. While most analysts think QE, if it happens, will come in 2015, Citigroup Inc. economists predicted last month the central bank will unveil a QE program in December valued at 1 trillion euros.

At the same time, the technical, political and legal hurdles to asset purchases remain high, especially if they involve government bonds.

The ECB is also accelerating preparations to buy asset-backed securities. The central bank hired BlackRock Inc., the world’s biggest money manager, to advise on a program with the twin aims of reviving the shrinking European securitization market and providing another liquidity tool. ABS purchases may form part of a larger QE program.

What has Draghi been telling Europe’s leaders?

The ECB President met with France’s Francois Hollande and Italy’s Matteo Renzi in recent weeks and spoke on the phone with German Chancellor Angela Merkel. While such contacts are not news in themselves, they came as France and Italy have called for more flexibility in European Union deficit rules, something Germany opposes.

In Jackson Hole, Draghi also said governments’ “fiscal policy could play a greater role” in supporting euro area’s growth, alongside monetary policy and structural reforms.

New ECB actions were specifically intended to reap benefits through Euro currency devaluation. To achieve this aim, Draghi announced cuts in interest rates as well as administering Euro ‘printing’ through balance sheet expansion (€1,000bln or so). The ECB has had recent success as the EUR/USD dropped over 1.5% today and has fallen 5% since July.

A weaker currency is desirable during periods of recessions and subdued inflation. Doing so, however, is not always seamless or the most ideal policy. Many global central banks, for instance, needed to follow the Fed’s lead in cutting rates after the 2008 crisis or risked having an undesirable appreciation of their home currency. Tensions can periodically arise, because two countries cannot become ‘more competitive’ at the same time (‘a race to the bottom’).

Clearly, a weaker currency in one country means a stronger currency in another.

There are times, however, when currency movements are mutually beneficial. Against the USD, Draghi is maximizing his efforts to weaken the Euro by trying to utilize ideal timing; expanding the ECB balance sheet at precisely the same time that the Fed’s is flat lining. The widening of interest rate differentials also helps. The FOMC likely welcomes today’s actions. Ideally, Draghi would have also wanted a Quid Quo Pro with Italy and France regarding economic reform; this sounds good in theory, but it is not how politics work.

Despite Draghi’s vacant pleas for fiscal ‘arrows’, he had to ‘do his part’, particularly after backing himself into a corner after his Jackson Hole speech. Nonetheless, ECB actions surpassed expectations today. However, this probably means that the bazooka of sovereign QE is off the table for a while. On the other hand, since the ECB’s new forecasts for inflation and real growth are still too optimistic, Draghi might have positioned himself well to use that tool next year if absolutely necessary.

Some believe that actions today were jointly agreed to by the Fed and ECB to allow the stimulus baton to be passed from one major central bank to another. Could this be to help ease the risk-off fallout that is likely to ensue in anticipation of the first Fed hike? Maybe the price action in US equity markets today should serve as an early warning signal.

It is important to note that there are

sharp contrasts between the US and Eurozone in terms of economic reality and needed fiscal reforms. These vast contrasts require different fixes and means that central actions to date have been dissimilar and will ultimately have varying results. Put another way, the ECB did not ‘take a page out of the Fed’s playbook’. Current and past actions of the ECB make much more sense than have those of the Fed.

QE3 was always a questionable and debatable policy stance. For some, its continuation in recent months may have even veered toward irresponsibility. Economic data in the US has been steadily improving and some data is the best in almost a decade. It is not hard to argue that the Fed has been completely on the wrong track with its depression-like policy stance; a stance that has encouraged monstrous market speculation and moral hazard euphoria of epic proportions.

It has likely resulted in a mammoth surge in obscured financial instability; the risks of which are not tempered in any way by the smoke-screen known as ‘monitoring’ and ‘macro-prudential’ policy.

Moreover, the six years of Zero Interest Rate Policy (ZIRP), has ballooned debt levels; a good portion of which are buried on the Fed’s balance sheet.

Shuffling debt chairs doesn’t fix underlying problems, but merely delays the inevitable. As Martin Wolf wrote in the FT, “beyond some point, the growth in debt adds to the fragility of the economy more than it adds to either personal welfare or aggregate demand. Amir Sufi argues this persuasively in his book House of Debt.”

There is still failure in understanding the causes of past crises.

Unlike at the Fed, today’s ECB actions must be worrying to the Swiss National Bank (SNB). The SNB’s 1.2000 floor for EUR/CHF stands diametrically opposed to the devaluation desires of the ECB. With little growth or inflation, the SNB would like to see the CHF weaken. However, there are factors putting upside pressure on the CHF (a safe-haven), including: an attractive interest rate differential to the EU; a 10% current account surplus; and heightened geo-political risks (particularly in Eastern Europe).

How will the SNB manage its peg? It can no longer sell CHF for EUR and invest it in the negative yielding front end of Germany. This is a losing proposition. Will it have to drop the peg? Will it buy USD/CHF and invest the proceeds in Treasuries?