- 首页

-

菜单

- 家园币

-

比特币

Financial Markets by TradingView

您正在使用一款已经过时的浏览器!部分功能不能正常使用。

- 主题发起人 martinqz

- 发布时间 2014-05-05

更多选项

导出主题(文本)这是要赌财报呀小雯好,sorry,未能及时回信,我买了。呵呵,马老师推荐的V,MA早前也买入,建了个薄仓底,准备以后定期季屯的。BABA挂了五单,每单200股,可惜的是80元以上的成交了,80元以下的三单未买成,还继续挂着呢。

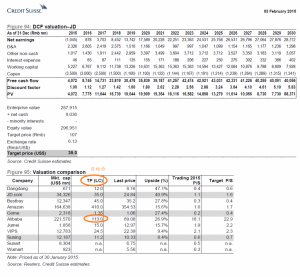

浏览附件383413

================================================请教一个基础问题如果做short put, 比如strike 80 on baba, 假设premium是$5,那如果短期跌到75以下了,contract exercise之前writer怎么做保护?

(buy put) or (write put=naked put)

如果是卖put, write put, stike 80 on baba,就是你收钱premium=$5,然后跌倒75以下,就是对方赚钱了。

baba的期权premium的价格太高,主要是股票的波动性很高。

散户没有保护,交割股票或买回put(先卖就后买),专业的有其他方式可以做。

听起来short options风险挺大阿, contract可以允许在expire之前任何时间exercise,如果不交割又下跌,writer做不了任何事情那真着急。================================================

(buy put) or (write put=naked put)

如果是卖put, write put, stike 80 on baba,就是你收钱premium=$5,然后跌倒75以下,就是对方赚钱了。

baba的期权premium的价格太高,主要是股票的波动性很高。

散户没有保护,交割股票或买回put(先卖就后买),专业的有其他方式可以做。

读懂这玩意貌似很难,好像还和投资行为关联度不大。

但是在市场里能够长久生存下来的,是各方面都强的人,从央行的货币政策走向,宏观经济解读,公司的估值分析和技术面分析。

投资股票需要寻找公司内在价值和市场技术面分析共振的状态,这样才能在市场中长久生存。

货币政策走向太重要了,辛辛苦苦折腾来折腾去,还不如躺在床上数钱就行。以前不太信中国会有伯南克看跌期权,现在是相信央妈会了。

伯南克眼中的泰勒法则和美联储利率

2015年04月30日 13:42 华尔街见闻

前美联储主席伯南克近日在其金融博客上就泰勒法则和美联储利率决策之间的关系做了详尽的分析。在文中,伯南克不仅利用改良版的泰勒法则反驳了市场针对美联储零利率政策的诟病,并且强调,在可以预见的未来,FOMC的存在无法被替代。

以下是伯南克博客全文:

斯坦福大学经济学家约翰泰勒(John Taylor)对货币经济学贡献良多,其中最为著名的自然是泰勒法则。泰勒法则本质上是一个简单的等式,可以比较准确地预测联邦基金名义利率的变动趋势。因此,这一法则不仅受到学术界和美联储的重视,也为广大投资者所瞩目。

泰勒本人认为该法则应该作为货币政策的基准,因此从这个角度出发,泰勒一直对美联储过去十多年的货币政策持质疑态度。在近期的IMF[微博]会议上,泰勒再次重复表示美联储未能严格遵照法则操作才导致了货币政策的无效。在本文中,我将解释为什么我不认同泰勒的说法。

何为泰勒法则?

首先来简单了解一下泰勒法则。长久以来,FOMC就一直是联邦基准利率、隔夜贷款利率的决策者,而泰勒法则在1993年才面世。泰勒法则描述了短期利率如何针对通胀率和产出变化调整的准则。

公式可以描述为:r = p + 0.5y + 0.5(p – 2) + 2 (the “Taylor rule”)

其中

r=联邦利率

p=通胀率

y=实际GDP和目标GDP的绝对偏差

2=美联储目标通胀率

名义上,美联储的目标真实GDP是指在劳动力和资本完全使用的假设下,经济体的总产出。在这一假设之下,变量y在泰勒法则中可以被视为产出缺口。

简而言之,(原先的)泰勒法则认为美联储应该以0.5%作为基准来收紧货币政策(加息)。每加息1%相对应通胀率走高2%,亦或者实际GDP之于潜在GDP1%的增幅。

泰勒法则还认为,当产出缺口为零的情况下,美联储应该将利率维持在历史平均水平2%。在1993的论文中,泰勒指出,此前6年(1993年之前)FOMC的决策和他的公式描述完全一致。

泰勒对美联储货币政策的诟病

看起来泰勒法则很好的展示了过去美联储货币政策的路径,但是这对于未来美联储的决策有实际意义么?

最初泰勒本人也不认为泰勒法则可以作为实际政策的指导。在他1993的论文中,泰勒承认,一个定式的规则无法将货币政策决策人所遇到的种种因素考虑在内。作为美联储主席,我相信泰勒最初的判断是完全正确的。在我的决策中,我会参考很多公式和法则,包括各种泰勒法则的变化公式。但是我可以完全确定的说,在变化莫测的实际经济面前,任何单一的法则都不可能解决所有难题。

但是随着时间的变化,泰勒却开始变得固执。他坚称美联储任何时候都应该遵照泰勒法则来制定货币政策,任何细微的变化都会带来巨大的错误。

泰勒认为,美联储在2003-2005年保持了过低的利率(和泰勒法则的理论利率相比),由此引发了地产泡沫和金融危机的出现。此外,泰勒还指责美联储在金融危机之后未能及时加息,因此导致了美国复苏乏力。

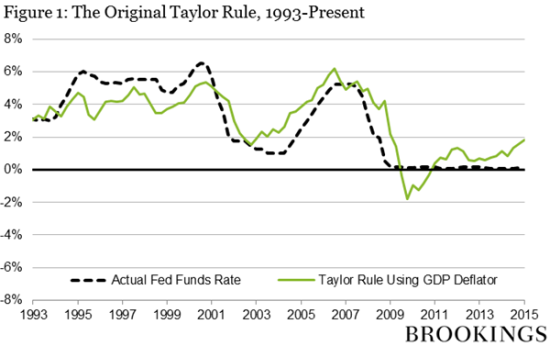

泰勒做出上述指责的理由可以如下图1所示。我按照泰勒1993论文中的理论公式和GDP平减指数下的泰勒法则结果做出了图1。在计算产出缺口上,2009年之前我使用的是FOMC官员当时的预估数据,2010年之后我使用的则是国会预算委员会的预估数据。这样做的理由在于,在当时的情况下,实际数据要反复修正,因此第一时间并无法得确切的结果。对于货币政策决策者而言,预估和实际数据的意义显然是完全不同的。

显而易见, 2003-2005年和2011年之后,美联储实际利率的确“过于宽松”——低于泰勒法则的理论利率水平。

我曾在2010年就泰勒所认为的低利率引发地产泡沫做出回应。简单来说,我认为2003-2005年的利率水平情况并无法和地产泡沫的规模和引发时间有明确的联系。这里我不想就这段时间的利率做更多的展开,让我们来重点看一下金融危机后时代的利率水平是否过低。

改良版的泰勒法则

为了检验泰勒法则的有效性,我对泰勒法则做出了一定的改良,并对其指导意义做了一些统计。

首先,我对泰勒法则中通胀率的计算方式做了调整。原公式中,泰勒将GDP平减指数作为通胀指标,但是在实际决策中,包括FOMC在内通常将消费者价格作为通胀参考。GDP平减指数不仅覆盖了国内生活消费品和服务价格,而且还涉及了政府开支和资本商品的价格。此外,它还排除了进口物价这一因素。

实际操作中,FOMC一直更倾向于将消费者价格的变化作为通胀指标,其中PCE指标重要性最为明显。美联储为PCE设立目标水平,并将核心PCE视为中期通胀趋势的参考。简而言之,我用PCE替代了传统泰勒法则的通胀指标。

第二个变化则出现在通胀和产出缺口的对应上。在原版泰勒法则中,0.5%的利率调整直接对应1%的通胀和产出缺口。而在实际中,货币政策决策者更倾向于接受更大的通胀变量,以换取更为稳定的产出状况。泰勒在其随后的研究中也有类似的变化。从我的经验来看,FOMC更乐于接受相对更高的利率/产出比。现任联储主席耶伦也暗示1.0%的利率调整对应1%的产出缺口可以更好的反映通胀和就业情况。

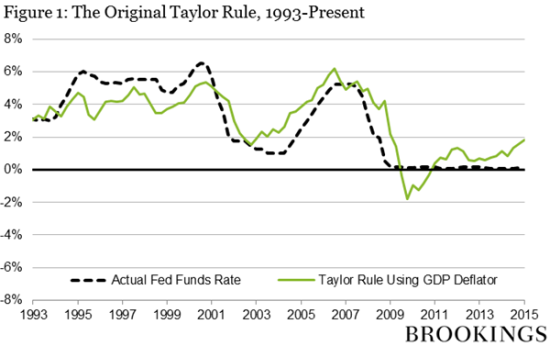

图2所体现的结果就是修正版泰勒法则的表现。在修正法则下,绿色的理论利率和黑色的实际利率在过去20年都保持了十分高的契合度。在2003-2005年间也没有出现所谓的利率过低情况。

图二

图二

而对于金融危机之后的利率表现,图表也说明了一切。所谓的“标准利率”长期以来在实际利率下方,直到近期才“归位”。显而易见,泰勒法则所推荐的明显负利率并不符合实际情况,因此FOMC维持利率水平在零附近并利用其他更多宽松措施的决策完全正确。

针对泰勒诟病的美国复苏不够强劲,我想说的是,2007-2009年的金融危机是大衰退时代以来最严峻的一次考验。美国在复苏中也面临了其他不利因素,包括2010年的财政危机和随后的欧洲债务危机。和其他发达国家相比,我必须说,美国的复苏已然显著。

言而总之,泰勒所认为的美联储问题缺乏根据。20世纪90年来以来,美联储的货币政策十分合理并且具有延续性。

当然,你可以说就是因为对泰勒法则变量做出了调整才得出了我的结论。不过在我看来,用核心PCE替代GDP平减指数完全合理,而调整后的利率/产出缺口比也可以更好的呈现FOMC的实际情况。

值得一提的是,在使用原公式利率/产出缺口比的情况下,无论使用何种通胀参考,泰勒公式都会将1990年代的货币政策定义为“过紧”;将2003-2005年的货币政策定义为“过松”。如果货币政策过松是造成泡沫的主因的话,那么如何解释90年代股市的大涨行情呢?

真实的货币政策:系统性,而非自动化

在上文中,我已经证明,90年代以来的美国国币政策在改良版泰勒法则下十分合理。那是否意味着美联储就可以依照这一改良公式而去实际操作呢?FOMC能否仅凭借一个公式来做利率调整的决策?

答案显然是否定的。货币政策需要的是系统性,而非自动化。简单的泰勒法则并无法描绘出FOMC委员实际抉择中的复杂性。举几个例子:

泰勒法则假定(认为)货币政策注定者了解产出缺口的规模。然而在实际情况中,很难计算产出缺口,因此FOMC委员们根本不可能就产出缺口达成一致。

泰勒法则还假定(认为)联邦利率存在均衡性并且(通胀处于目标水平且产出缺口为零的情况下)是固定的2%。而上文已经指出,FOMC委员和市场均已经意识到实际均衡性要低于泰勒法则的设定。当然,FOMC也不可能就均衡性利率达成一致看法。

泰勒法则并未指出,在预测利率为负数的情况下,货币政策者应该如何操作。

泰勒法则未能给出通胀和产出缺口的重要性/偏好性。事实上,政策决策者的偏重点不同,经济结果的不同以及货币政策效果传递的差异化也很难标准化。

最后,我想说的是,在可以预见的时间内,FOMC的存在无法被替代。当然,我也不希望见到机器人(63.880, 3.68, 6.11%)代替人类做决策的那一天到来。

但是在市场里能够长久生存下来的,是各方面都强的人,从央行的货币政策走向,宏观经济解读,公司的估值分析和技术面分析。

投资股票需要寻找公司内在价值和市场技术面分析共振的状态,这样才能在市场中长久生存。

货币政策走向太重要了,辛辛苦苦折腾来折腾去,还不如躺在床上数钱就行。以前不太信中国会有伯南克看跌期权,现在是相信央妈会了。

伯南克眼中的泰勒法则和美联储利率

2015年04月30日 13:42 华尔街见闻

前美联储主席伯南克近日在其金融博客上就泰勒法则和美联储利率决策之间的关系做了详尽的分析。在文中,伯南克不仅利用改良版的泰勒法则反驳了市场针对美联储零利率政策的诟病,并且强调,在可以预见的未来,FOMC的存在无法被替代。

以下是伯南克博客全文:

斯坦福大学经济学家约翰泰勒(John Taylor)对货币经济学贡献良多,其中最为著名的自然是泰勒法则。泰勒法则本质上是一个简单的等式,可以比较准确地预测联邦基金名义利率的变动趋势。因此,这一法则不仅受到学术界和美联储的重视,也为广大投资者所瞩目。

泰勒本人认为该法则应该作为货币政策的基准,因此从这个角度出发,泰勒一直对美联储过去十多年的货币政策持质疑态度。在近期的IMF[微博]会议上,泰勒再次重复表示美联储未能严格遵照法则操作才导致了货币政策的无效。在本文中,我将解释为什么我不认同泰勒的说法。

何为泰勒法则?

首先来简单了解一下泰勒法则。长久以来,FOMC就一直是联邦基准利率、隔夜贷款利率的决策者,而泰勒法则在1993年才面世。泰勒法则描述了短期利率如何针对通胀率和产出变化调整的准则。

公式可以描述为:r = p + 0.5y + 0.5(p – 2) + 2 (the “Taylor rule”)

其中

r=联邦利率

p=通胀率

y=实际GDP和目标GDP的绝对偏差

2=美联储目标通胀率

名义上,美联储的目标真实GDP是指在劳动力和资本完全使用的假设下,经济体的总产出。在这一假设之下,变量y在泰勒法则中可以被视为产出缺口。

简而言之,(原先的)泰勒法则认为美联储应该以0.5%作为基准来收紧货币政策(加息)。每加息1%相对应通胀率走高2%,亦或者实际GDP之于潜在GDP1%的增幅。

泰勒法则还认为,当产出缺口为零的情况下,美联储应该将利率维持在历史平均水平2%。在1993的论文中,泰勒指出,此前6年(1993年之前)FOMC的决策和他的公式描述完全一致。

泰勒对美联储货币政策的诟病

看起来泰勒法则很好的展示了过去美联储货币政策的路径,但是这对于未来美联储的决策有实际意义么?

最初泰勒本人也不认为泰勒法则可以作为实际政策的指导。在他1993的论文中,泰勒承认,一个定式的规则无法将货币政策决策人所遇到的种种因素考虑在内。作为美联储主席,我相信泰勒最初的判断是完全正确的。在我的决策中,我会参考很多公式和法则,包括各种泰勒法则的变化公式。但是我可以完全确定的说,在变化莫测的实际经济面前,任何单一的法则都不可能解决所有难题。

但是随着时间的变化,泰勒却开始变得固执。他坚称美联储任何时候都应该遵照泰勒法则来制定货币政策,任何细微的变化都会带来巨大的错误。

泰勒认为,美联储在2003-2005年保持了过低的利率(和泰勒法则的理论利率相比),由此引发了地产泡沫和金融危机的出现。此外,泰勒还指责美联储在金融危机之后未能及时加息,因此导致了美国复苏乏力。

泰勒做出上述指责的理由可以如下图1所示。我按照泰勒1993论文中的理论公式和GDP平减指数下的泰勒法则结果做出了图1。在计算产出缺口上,2009年之前我使用的是FOMC官员当时的预估数据,2010年之后我使用的则是国会预算委员会的预估数据。这样做的理由在于,在当时的情况下,实际数据要反复修正,因此第一时间并无法得确切的结果。对于货币政策决策者而言,预估和实际数据的意义显然是完全不同的。

显而易见, 2003-2005年和2011年之后,美联储实际利率的确“过于宽松”——低于泰勒法则的理论利率水平。

我曾在2010年就泰勒所认为的低利率引发地产泡沫做出回应。简单来说,我认为2003-2005年的利率水平情况并无法和地产泡沫的规模和引发时间有明确的联系。这里我不想就这段时间的利率做更多的展开,让我们来重点看一下金融危机后时代的利率水平是否过低。

改良版的泰勒法则

为了检验泰勒法则的有效性,我对泰勒法则做出了一定的改良,并对其指导意义做了一些统计。

首先,我对泰勒法则中通胀率的计算方式做了调整。原公式中,泰勒将GDP平减指数作为通胀指标,但是在实际决策中,包括FOMC在内通常将消费者价格作为通胀参考。GDP平减指数不仅覆盖了国内生活消费品和服务价格,而且还涉及了政府开支和资本商品的价格。此外,它还排除了进口物价这一因素。

实际操作中,FOMC一直更倾向于将消费者价格的变化作为通胀指标,其中PCE指标重要性最为明显。美联储为PCE设立目标水平,并将核心PCE视为中期通胀趋势的参考。简而言之,我用PCE替代了传统泰勒法则的通胀指标。

第二个变化则出现在通胀和产出缺口的对应上。在原版泰勒法则中,0.5%的利率调整直接对应1%的通胀和产出缺口。而在实际中,货币政策决策者更倾向于接受更大的通胀变量,以换取更为稳定的产出状况。泰勒在其随后的研究中也有类似的变化。从我的经验来看,FOMC更乐于接受相对更高的利率/产出比。现任联储主席耶伦也暗示1.0%的利率调整对应1%的产出缺口可以更好的反映通胀和就业情况。

图2所体现的结果就是修正版泰勒法则的表现。在修正法则下,绿色的理论利率和黑色的实际利率在过去20年都保持了十分高的契合度。在2003-2005年间也没有出现所谓的利率过低情况。

而对于金融危机之后的利率表现,图表也说明了一切。所谓的“标准利率”长期以来在实际利率下方,直到近期才“归位”。显而易见,泰勒法则所推荐的明显负利率并不符合实际情况,因此FOMC维持利率水平在零附近并利用其他更多宽松措施的决策完全正确。

针对泰勒诟病的美国复苏不够强劲,我想说的是,2007-2009年的金融危机是大衰退时代以来最严峻的一次考验。美国在复苏中也面临了其他不利因素,包括2010年的财政危机和随后的欧洲债务危机。和其他发达国家相比,我必须说,美国的复苏已然显著。

言而总之,泰勒所认为的美联储问题缺乏根据。20世纪90年来以来,美联储的货币政策十分合理并且具有延续性。

当然,你可以说就是因为对泰勒法则变量做出了调整才得出了我的结论。不过在我看来,用核心PCE替代GDP平减指数完全合理,而调整后的利率/产出缺口比也可以更好的呈现FOMC的实际情况。

值得一提的是,在使用原公式利率/产出缺口比的情况下,无论使用何种通胀参考,泰勒公式都会将1990年代的货币政策定义为“过紧”;将2003-2005年的货币政策定义为“过松”。如果货币政策过松是造成泡沫的主因的话,那么如何解释90年代股市的大涨行情呢?

真实的货币政策:系统性,而非自动化

在上文中,我已经证明,90年代以来的美国国币政策在改良版泰勒法则下十分合理。那是否意味着美联储就可以依照这一改良公式而去实际操作呢?FOMC能否仅凭借一个公式来做利率调整的决策?

答案显然是否定的。货币政策需要的是系统性,而非自动化。简单的泰勒法则并无法描绘出FOMC委员实际抉择中的复杂性。举几个例子:

泰勒法则假定(认为)货币政策注定者了解产出缺口的规模。然而在实际情况中,很难计算产出缺口,因此FOMC委员们根本不可能就产出缺口达成一致。

泰勒法则还假定(认为)联邦利率存在均衡性并且(通胀处于目标水平且产出缺口为零的情况下)是固定的2%。而上文已经指出,FOMC委员和市场均已经意识到实际均衡性要低于泰勒法则的设定。当然,FOMC也不可能就均衡性利率达成一致看法。

泰勒法则并未指出,在预测利率为负数的情况下,货币政策者应该如何操作。

泰勒法则未能给出通胀和产出缺口的重要性/偏好性。事实上,政策决策者的偏重点不同,经济结果的不同以及货币政策效果传递的差异化也很难标准化。

最后,我想说的是,在可以预见的时间内,FOMC的存在无法被替代。当然,我也不希望见到机器人(63.880, 3.68, 6.11%)代替人类做决策的那一天到来。

油价拖累出口 加拿大贸易赤字创纪录高位

文 / 冷静420 2015-05-05 21:10:55

由于油价下跌造成能源商品出口价值大幅缩水,同时消费品进口增长,加拿大3月贸易帐赤字规模飙升,创下纪录高位。由于美国贸易帐赤字规模创下六年高位,加拿大赤字规模创纪录高位,美元/加元在数据公布之后飙升后再度暴跌,刷新日内低位1.2045。加拿大统计局(Statistics Canada)周二(5月5日)公布的数据显示,加拿大4月贸易帐赤字规模达到30.2亿加元,预期赤字8.5亿加元,前值修正为22.2亿加元。

美国贸易赤字扩至514亿美元 创2008年来最大

2015-05-05 20:51:00 来源: 汇通网(上海)

周二(5月5日)纽约盘初,美国3月贸易逆差扩大至514亿美元,创自2008年以来最大,因进口飙升,美指短线小幅下挫,刷新日低至95.34,非美货币走高。加拿大3月份贸易帐逆差达成创纪录的30亿加元,美元兑加元短线大幅动荡。数据显示,美国3月贸易逆差扩大至514亿美元,创自2008年以来最大,市场预期贸易逆差为413亿美元,前值逆差354亿美元。

文 / 冷静420 2015-05-05 21:10:55

由于油价下跌造成能源商品出口价值大幅缩水,同时消费品进口增长,加拿大3月贸易帐赤字规模飙升,创下纪录高位。由于美国贸易帐赤字规模创下六年高位,加拿大赤字规模创纪录高位,美元/加元在数据公布之后飙升后再度暴跌,刷新日内低位1.2045。加拿大统计局(Statistics Canada)周二(5月5日)公布的数据显示,加拿大4月贸易帐赤字规模达到30.2亿加元,预期赤字8.5亿加元,前值修正为22.2亿加元。

美国贸易赤字扩至514亿美元 创2008年来最大

2015-05-05 20:51:00 来源: 汇通网(上海)

周二(5月5日)纽约盘初,美国3月贸易逆差扩大至514亿美元,创自2008年以来最大,因进口飙升,美指短线小幅下挫,刷新日低至95.34,非美货币走高。加拿大3月份贸易帐逆差达成创纪录的30亿加元,美元兑加元短线大幅动荡。数据显示,美国3月贸易逆差扩大至514亿美元,创自2008年以来最大,市场预期贸易逆差为413亿美元,前值逆差354亿美元。

全球投资界最有影响力的大会。巴菲特的时代已经远去。

http://www.cnbc.com/id/102645305

Sohn Conference: Stock picks from 5 top hedge fund manager

May 4, 2015, 6:26 PM EDT

AbbVie, Microsoft and Yum! Brands were among the stocks in the spotlight as the managers explained their favorite recent long bets.

On stage at Lincoln Center in Manhattan for the 20th annual Sohn Investment Conference, a slate of renowned hedge fund managers from David Einhorn to Bill Ackman had 15 minutes apiece to pitch their best investment ideas.

Following Einhorn’s presentation on why he is shorting Pioneer Natural Resources and other oil frackers, a series of stock pickers discussed their bullish bets.

Here’s a rundown of who’s long on which companies, and why:

Barry Rosenstein, founder and managing partner of Jana Partners: Qualcomm

Extolling the virtues of shareholder activism, Rosenstein described what he called a “before and after picture” of investor influence in the boardroom—using as his examples two companies in which Jana Partners had invested in order to push for improvements to the business. “One is working constructively with shareholders, and I think one will in the future,” Rosenstein said.

The first (the “after” picture) was Walgreens, which had floundered until its recent merger with Swiss pharmacy company Alliance Boots. Jana Partners helped accelerate the closing of that merger, pressing for it to wrap up in late 2014 instead of this year as originally expected, Rosenstein said. Since then, the company has also declared a share repurchase program and other measures at Jana’s behest. (The merged company, Walgreens Boots AllianceWBA -1.18% , has seen its stock rise about 10% since the merger was completed, compared with a rise of 3% in the S&P 500.)

The success of that activist campaign has led Rosenstein to bet on QualcommQCOM -0.99% , which is in a similar situation to the one Walgreens was in before Jana got involved, he said—in other words, Qualcomm is the “before” picture to Jana’s activism. “Like the old Walgreens, Qualcomm is an iconic brand that many recognize has lost its way,” Rosenstein said. Already, the company has announced a share buyback and a cost review “at our urging,” Rosenstein said.

Keith Meister, founder and managing partner of Corvex Management: Yum! Brands

Meister, who worked for Carl Icahn before launching the $8 billion Corvex, explained that he’d recently invested $1.5 billion in Yum! BrandsYUM -1.12% —his “second largest investment ever,” Meister said.

The firm owns KFC, Pizza Hut and Taco Bell, and one-third of its business is in China, where those American “iconic brands” are increasingly popular, Meister said. While the China restaurants had suffered a couple of “food scandals” causing Yum’s stock price to stagnate and become “range bound,” Meister said the company is recovering, yet is still undervalued.

In order to unlock more value, Meister is advocating for the company to spin off its China business into a separate company and adopt a franchise structure similar to Yum’s U.S. businesses. Already, 51% of consumers in China name KFC as their favorite place to eat, Meister said, and the new company would benefit as the Chinese middle class expands. “By spinning off China and entering into a franchise agreement, you do what cannot be done—you create your own franchise, run by the same great management that’s been running Yum,” Meister said. “[It] has best-in-class U.S. corporate governance, U.S.-educated China national management, and huge returns on invested capital.”

Leon Cooperman, chairman and CEO of Omega Advisors: Actavis, Citigroup and others

Cooperman, a veteran hedge fund manager known for his winning stock picks, opened his talk with a synopsis of his outlook on the market. Despite investors’ concerns that stocks are overvalued, Cooperman said that he thought the current average price-to-earnings ratio of roughly 17 was “about right,” and that he didn’t see any signs that we were heading for a crash.

“I would observe that bear markets do not emerge out of immaculate conception,” Cooperman said. “If there’s a bubble out there, the bubble is in the fixed income market.”

With an expectation that equities will return 7% to 9% including dividends this year, Cooperman launched into a number of his favorite picks, including pharmaceutical company ActavisACT -1.40% , Citigroup, Dow Chemical, General Motors, Google and Priceline.

A few minutes earlier, a fellow investor had asked Cooperman, whether he was “nervous that Actavis is very heavily owned by hedge fund managers,” but Cooperman said he was very comfortable owning the company. Trading at just 16 times earnings, Cooperman said the company was “selling at a substantial discount.”

CitigroupC -1.51% is also undervalued, given that it’s a “world class franchise selling at nine times earnings” and it’s growing, Cooperman said.

While he didn’t have time to explain all of his positions, Cooperman offered a pick for those who are “contrary in your thinking,” and believe natural gas prices will rise: Gulf Coast Ultra Deep Royalty Trust GULTU 2.20% . While it trades at less than $1 per share, Cooperman said the royalty trust capitalizes on one jackpot of a gusher, and it has the capacity to drill 20 more wells on the same site it already controls.

Larry Robbins, founder and portfolio manager of Glenview Capital Management: AbbVie, Brookdale

A healthcare bull who pitched insurance companies Humana and WellPoint at last year’s Sohn conference, Robbins this year suggested pharmaceutical firm AbbVieABBV -1.27% and elder care company Brookdale Senior Living BKD 0.00% .

Though Robbins made the case for each company on its own, he said that the ongoing M&A trend in the healthcare industry could benefit both businesses. Of AbbVie, he said that “we don’t know if they’re going to be the pill that is swallowed” or the acquirer of another company, “but future combinations offer additional optionality.” (Last year, AbbVie walked away from its proposed acquisition of Ireland-based Shire after the U.S. government announced tougher restrictions on tax inversions—a maneuver by which AbbVie had planned to relocate to Ireland after the deal, thereby lowering its tax rate. “We respect the decision the board made,” Robbins said.)

Meanwhile, the consolidation in health care has put additional pressure on companies like AbbVie to operate more efficiently, Robbins said. “They’re feeling it from the Valeants, Actavises, even Pfizer, and activists like [hedge fund] Pershing Square pushing them to think like owners,” he said.

Brookdale Senior Living had already made some strategic acquisitions, Robbins said, and he expected more in the future. “Looking at their menu of choices is like reading a Cheesecake Factory menu—there are so many choices,” Robbins said.

Mala Gaonkar, co-portfolio manager, Lone Pine Capital: Microsoft

Gaonkar presented what she called “one of our most debated ideas at Lone Pine,” the hedge fund founded by Stephen Mandel. That idea: “The value that’s hidden in legacy tech,” she said, citing MicrosoftMSFT -1.33% as one example of the stocks she likes in that category.

“Microsoft has been the butt of every tech ad joke during the new millennium,” Gaonkar said, showing a slide picturing one of the classic Mac vs. PC commercials. Still, she said, while Apple has wowed creative types and young people with its trendy technology, the bulk of the business world still runs on Microsoft, relying on Outlook for email and other Microsoft core products.

Besides, “new and far stronger management led by Satya Nadella,” its new chief executive, Microsoft has benefited from the constructive influence of activist hedge fund ValueAct Capital. The company is a “super tanker,” but it is slowly turning itself around, Gaonkar said.

While many investors have abandoned Microsoft and other legacy tech companies for fast-growing cloud software companies, which trade at many times Microsoft’s stock valuation, they’re missing a key point, Goankar said. According to her, legacy tech companies like Microsoft already have 85% of the total spending on cloud software—a market that is quickly growing. While 15% of the cloud market is in the hands of the “usurpers,” or newer tech companies, Microsoft and others already have a significant foothold. “Legacy tech remains misunderstood,” she said.

http://www.cnbc.com/id/102645305

Sohn Conference: Stock picks from 5 top hedge fund manager

May 4, 2015, 6:26 PM EDT

AbbVie, Microsoft and Yum! Brands were among the stocks in the spotlight as the managers explained their favorite recent long bets.

On stage at Lincoln Center in Manhattan for the 20th annual Sohn Investment Conference, a slate of renowned hedge fund managers from David Einhorn to Bill Ackman had 15 minutes apiece to pitch their best investment ideas.

Following Einhorn’s presentation on why he is shorting Pioneer Natural Resources and other oil frackers, a series of stock pickers discussed their bullish bets.

Here’s a rundown of who’s long on which companies, and why:

Barry Rosenstein, founder and managing partner of Jana Partners: Qualcomm

Extolling the virtues of shareholder activism, Rosenstein described what he called a “before and after picture” of investor influence in the boardroom—using as his examples two companies in which Jana Partners had invested in order to push for improvements to the business. “One is working constructively with shareholders, and I think one will in the future,” Rosenstein said.

The first (the “after” picture) was Walgreens, which had floundered until its recent merger with Swiss pharmacy company Alliance Boots. Jana Partners helped accelerate the closing of that merger, pressing for it to wrap up in late 2014 instead of this year as originally expected, Rosenstein said. Since then, the company has also declared a share repurchase program and other measures at Jana’s behest. (The merged company, Walgreens Boots AllianceWBA -1.18% , has seen its stock rise about 10% since the merger was completed, compared with a rise of 3% in the S&P 500.)

The success of that activist campaign has led Rosenstein to bet on QualcommQCOM -0.99% , which is in a similar situation to the one Walgreens was in before Jana got involved, he said—in other words, Qualcomm is the “before” picture to Jana’s activism. “Like the old Walgreens, Qualcomm is an iconic brand that many recognize has lost its way,” Rosenstein said. Already, the company has announced a share buyback and a cost review “at our urging,” Rosenstein said.

Keith Meister, founder and managing partner of Corvex Management: Yum! Brands

Meister, who worked for Carl Icahn before launching the $8 billion Corvex, explained that he’d recently invested $1.5 billion in Yum! BrandsYUM -1.12% —his “second largest investment ever,” Meister said.

The firm owns KFC, Pizza Hut and Taco Bell, and one-third of its business is in China, where those American “iconic brands” are increasingly popular, Meister said. While the China restaurants had suffered a couple of “food scandals” causing Yum’s stock price to stagnate and become “range bound,” Meister said the company is recovering, yet is still undervalued.

In order to unlock more value, Meister is advocating for the company to spin off its China business into a separate company and adopt a franchise structure similar to Yum’s U.S. businesses. Already, 51% of consumers in China name KFC as their favorite place to eat, Meister said, and the new company would benefit as the Chinese middle class expands. “By spinning off China and entering into a franchise agreement, you do what cannot be done—you create your own franchise, run by the same great management that’s been running Yum,” Meister said. “[It] has best-in-class U.S. corporate governance, U.S.-educated China national management, and huge returns on invested capital.”

Leon Cooperman, chairman and CEO of Omega Advisors: Actavis, Citigroup and others

Cooperman, a veteran hedge fund manager known for his winning stock picks, opened his talk with a synopsis of his outlook on the market. Despite investors’ concerns that stocks are overvalued, Cooperman said that he thought the current average price-to-earnings ratio of roughly 17 was “about right,” and that he didn’t see any signs that we were heading for a crash.

“I would observe that bear markets do not emerge out of immaculate conception,” Cooperman said. “If there’s a bubble out there, the bubble is in the fixed income market.”

With an expectation that equities will return 7% to 9% including dividends this year, Cooperman launched into a number of his favorite picks, including pharmaceutical company ActavisACT -1.40% , Citigroup, Dow Chemical, General Motors, Google and Priceline.

A few minutes earlier, a fellow investor had asked Cooperman, whether he was “nervous that Actavis is very heavily owned by hedge fund managers,” but Cooperman said he was very comfortable owning the company. Trading at just 16 times earnings, Cooperman said the company was “selling at a substantial discount.”

CitigroupC -1.51% is also undervalued, given that it’s a “world class franchise selling at nine times earnings” and it’s growing, Cooperman said.

While he didn’t have time to explain all of his positions, Cooperman offered a pick for those who are “contrary in your thinking,” and believe natural gas prices will rise: Gulf Coast Ultra Deep Royalty Trust GULTU 2.20% . While it trades at less than $1 per share, Cooperman said the royalty trust capitalizes on one jackpot of a gusher, and it has the capacity to drill 20 more wells on the same site it already controls.

Larry Robbins, founder and portfolio manager of Glenview Capital Management: AbbVie, Brookdale

A healthcare bull who pitched insurance companies Humana and WellPoint at last year’s Sohn conference, Robbins this year suggested pharmaceutical firm AbbVieABBV -1.27% and elder care company Brookdale Senior Living BKD 0.00% .

Though Robbins made the case for each company on its own, he said that the ongoing M&A trend in the healthcare industry could benefit both businesses. Of AbbVie, he said that “we don’t know if they’re going to be the pill that is swallowed” or the acquirer of another company, “but future combinations offer additional optionality.” (Last year, AbbVie walked away from its proposed acquisition of Ireland-based Shire after the U.S. government announced tougher restrictions on tax inversions—a maneuver by which AbbVie had planned to relocate to Ireland after the deal, thereby lowering its tax rate. “We respect the decision the board made,” Robbins said.)

Meanwhile, the consolidation in health care has put additional pressure on companies like AbbVie to operate more efficiently, Robbins said. “They’re feeling it from the Valeants, Actavises, even Pfizer, and activists like [hedge fund] Pershing Square pushing them to think like owners,” he said.

Brookdale Senior Living had already made some strategic acquisitions, Robbins said, and he expected more in the future. “Looking at their menu of choices is like reading a Cheesecake Factory menu—there are so many choices,” Robbins said.

Mala Gaonkar, co-portfolio manager, Lone Pine Capital: Microsoft

Gaonkar presented what she called “one of our most debated ideas at Lone Pine,” the hedge fund founded by Stephen Mandel. That idea: “The value that’s hidden in legacy tech,” she said, citing MicrosoftMSFT -1.33% as one example of the stocks she likes in that category.

“Microsoft has been the butt of every tech ad joke during the new millennium,” Gaonkar said, showing a slide picturing one of the classic Mac vs. PC commercials. Still, she said, while Apple has wowed creative types and young people with its trendy technology, the bulk of the business world still runs on Microsoft, relying on Outlook for email and other Microsoft core products.

Besides, “new and far stronger management led by Satya Nadella,” its new chief executive, Microsoft has benefited from the constructive influence of activist hedge fund ValueAct Capital. The company is a “super tanker,” but it is slowly turning itself around, Gaonkar said.

While many investors have abandoned Microsoft and other legacy tech companies for fast-growing cloud software companies, which trade at many times Microsoft’s stock valuation, they’re missing a key point, Goankar said. According to her, legacy tech companies like Microsoft already have 85% of the total spending on cloud software—a market that is quickly growing. While 15% of the cloud market is in the hands of the “usurpers,” or newer tech companies, Microsoft and others already have a significant foothold. “Legacy tech remains misunderstood,” she said.

谢谢马老师,mua~ mua~ mua~ BABA我昨天又纳入80元以下的200股,成交后我就挂出了200股卖单,呵呵,今天早市貌似在正式开市前就以88.37 元成交了,现在手里还捏着的BABA股票暂时不卖了。================================================================

alibaba也不用急,看机构的操盘节奏,说不定就在公布日震震仓,低开低走造个假破位呢!

最后编辑: 2015-05-07

Similar threads

- 16

2024-06-23有新回复

全楼:0.01

soleil_lee-太阳李

- 23

2024-07-05有新回复

全楼:0.02

Saint.Saens

家园推荐黄页

家园币系统数据

- 家园币池子报价

- 0.0097加元

- 家园币最新成交价

- 0.0101加元

- 家园币总发行量

- 1106666家园币

- 加元现金总量

- 12155.9加元

- 家园币总成交量

- 4098206.67家园币

- 家园币总成交价值

- 384692.02加元

- 池子家园币总量

- 396336.11家园币

- 池子加元现金总量

- 3850.24加元

- 池子币总量

- 35214.19

- 1池子币现价

- 0.2187加元

- 池子家园币总手续费

- 5731.58JYB

- 池子加元总手续费

- 595.28加元

- 入池家园币年化收益率

- 0.40%

- 入池加元年化收益率

- 4.25%

- 微比特币最新报价

- 0.086651加元

- 毫以太币最新报价

- 3.57532加元

- 微比特币总量

- 0.354108BTC

- 毫以太币总量

- 0.219250ETH

- 家园币储备总净值

- 350,370.46加元

- 家园币比特币储备

- 3.4200BTC

- 家园币以太币储备

- 15.1ETH

- 比特币的加元报价

- 86,651.00加元

- 以太币的加元报价

- 3,575.32加元

- USDT的加元报价

- 1.35345加元

- 交易币种/月度交易量

- 手续费

- 家园币

- 0.1%(0.01%-1%)

- 加元交易对(比特币等)

- 1%-2%

- USDT交易对(比特币等)

- 0.1%-0.6%