加国退休金(Canada Pension Plan,CPP)60岁至70岁申领

老年保障金(Old Age Security,OAS)俗称老人金,加拿大住满10年,65岁申领

入息补助金(Guaranteed Income Supplement,GIS)与老人金同领

入息补助金(Guaranteed Income Supplement,GIS)

Table 1 : 单身OAS领取GIS金额

Amounts for single, surviving spouse/common-law partner or divorced pensioners receiving a full Old Age Security pension

不包含OAS,年收入零的情况下

单身全额OAS + GIS :589 + 880 = 1470 (请按以下计算表键接)

https://www.canada.ca/en/services/benefits/publicpensions/cpp/old-age-security/payments/tab1-1.html

不包含OAS,年收入超过$17,880,则不符合资格领取GIS

Table 2 : 配偶双方OAS领取GIS金额

Amounts for married or common-law partners, both receiving a full Old Age Security pension

不包含OAS,合併年收入零的情况下

毎人全额OAS + GIS : 1119 X 2 = 2238 (请按以下计算表键接)

https://www.canada.ca/en/services/benefits/publicpensions/cpp/old-age-security/payments/tab2-1.html

不包含OAS,合併年收入超过$23,616,则不符合资格领取GIS

Table 3 : 配偶单方OAS领取GIS金额

Amounts for individuals receiving a full Old Age Security pension whose spouse or common-law partner does not receive an OAS pension

不包含OAS,合併年收入为零的情况下:

全额OAS + GIS : 589 + 880 = 1470 (请按以下计算表键接)

https://www.canada.ca/en/services/benefits/publicpensions/cpp/old-age-security/payments/tab3-1.html

不包含OAS,合併年收入超过$42,864,则不符合资格领取GIS

Table 4 :60岁至64岁配偶津贴

Amounts for individuals receiving a full Old Age Security pension and their spouse or common-law partner aged 60 to 64

配偶一方领OAS,另一方配偶60岁至64岁,可申请津贴

不包含OAS,合併年收入为零的情况下:

全额OAS + GIS + Allowance

589 + 530 + 1119 = 2238 (请按以下计算表键接)

https://www.canada.ca/en/services/benefits/publicpensions/cpp/old-age-security/payments/tab4-1.html

不包含OAS,合併年收入超过$33,072,则不符合资格领取GIS 配偶津贴

不包含OAS,合併年收入不超过42,864,可符合资格领取Table 3 GIS

Table 5 :60岁至64岁未再婚鳏寡津贴

Amounts for surviving spouses or common-law partners aged 60 to 64 who have not re married or entered into a common-law partnership

不包含OAS,年收入为零的情况下

60岁至64岁未再婚鳏寡津贴1334 (请按以下计算表键接)

https://www.canada.ca/en/services/benefits/publicpensions/cpp/old-age-security/payments/tab5-1.html

不包含OAS,年收入超过$24,072,则不符合资格领取鳏寡配偶津贴

少量收入能否拿到部分额外增加的 Extra GIS?

非官方资讯,纯属个人揣测:

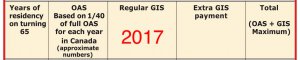

针对低收入+OAS不足人士,Extra GIS 隐含在OAS项目(見下表),以达到最低保障

金额

https://www.canada.ca/en/services/benefits/publicpensions/cpp/old-age-security/payments/tab1-1.html

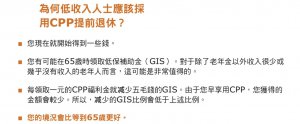

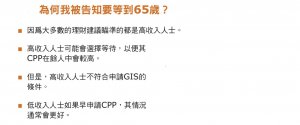

为什么低收入要在60岁领CPP?

Why should a low-income person take early CPP Retirement?

1/ 您可能会在65岁时获得补助金(GIS),对於除了老人金(OAS)以外,没有或仅有少许收入的老年人,会很有帮助。

2/ 届时每10元CPP收入,会减少5元补助金(GIS)。而60岁开始领的CPP金额少,日后的GIS扣除也少。

为什么低收入要在63岁前清空RRSP?

Why would an RRSP hurt me later?

因为64岁那年的收入,会影响65岁的GIS补助

以后,更加不用服食’我怎么会知道’牌子的后悔藥了!

担保移民在担保10年或20年期间不能申请GIS补助金

担保入或死亡或破产或入獄或虐待你罪名成立等等情况下例外

The Old Age Security program toolkit

The Guaranteed Income Supplement and Social Security Agreements

Note: If you entered Canada as a sponsored immigrant, you cannot receive the supplement while you are still being sponsored. Exceptions may be made under specific circumstances (such as if your sponsor dies, is imprisoned for a period of more than six months, is convicted of a criminal offence, or declares personal bankruptcy).

2018起始 65岁即自动享GIS补助 长者无需申请

在新制度下,长者自动列入老人保障金(Old Age Security Benefits 简称OAS)申请名单,

也会自动列入保证入息补助金名单内(Guaranteed Income Supplement 简称GIS)申请名单。

政府查看他们的报税资料,评估有没有资格领取入息补助金。

中国退休金如何报税

退休金在中国不用交税,所以只能填 Line115 , 不能填 Line256 扣税额

领中国退休金要报税 汇率以收款当日计算

加拿大政府狙击“中式移民” 严查老人金补助金违规

GIS 与银行存款有关吗?

GIS 和房产存款有关吗?

取出RRSP $2000 砸了GIS $1000

取出RRSP 如何免税

关于OAS老人金

关于CPP退休金

卑诗长者指南

低收入退休规划

RETIRING ON A LOW INCOME

新表格要申報海外收入華裔耆老放棄領老人金