【房产不快讯】卡尔加里2020年10月房地产市场- 独立屋销量同比大涨35%,价格亦略有回升

卡城老方房地产

不仅仅是房产,还会不定期提供有关卡城教育、生活等实用信息

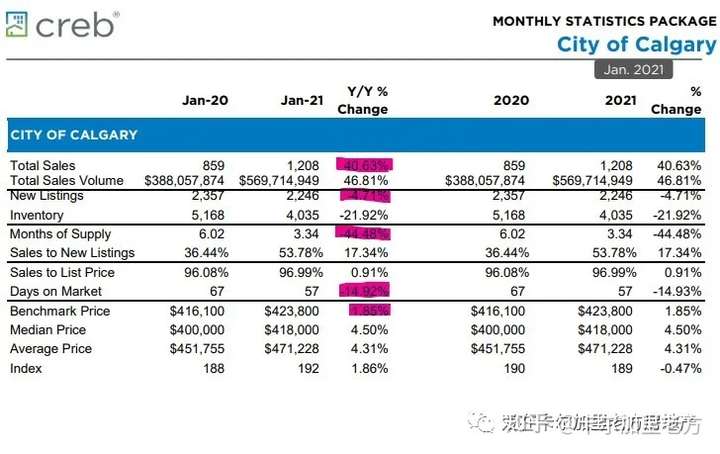

卡尔加里地产经纪管理局11月2日讯:独立屋销量同比大涨

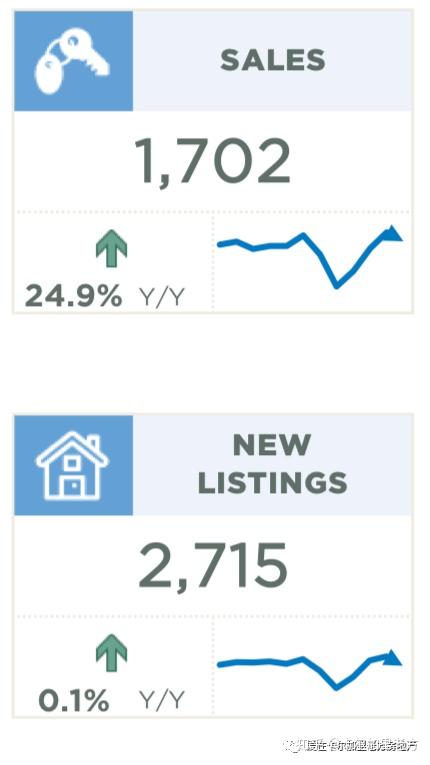

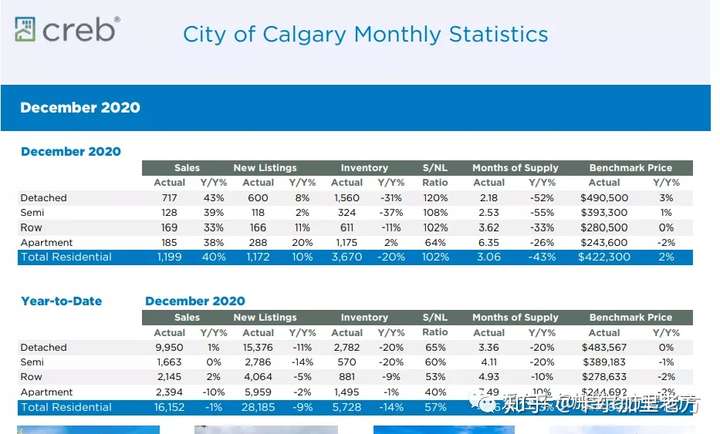

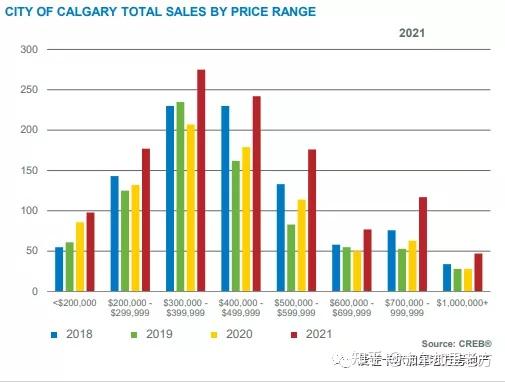

由于独立屋销量大增, 2020年10月卡尔加里共售出房屋1764套,同比大涨23%,远高于长期平均销量。

销量的增长大于新上市量的增长,让市场更趋向平衡,价格也有所回升。

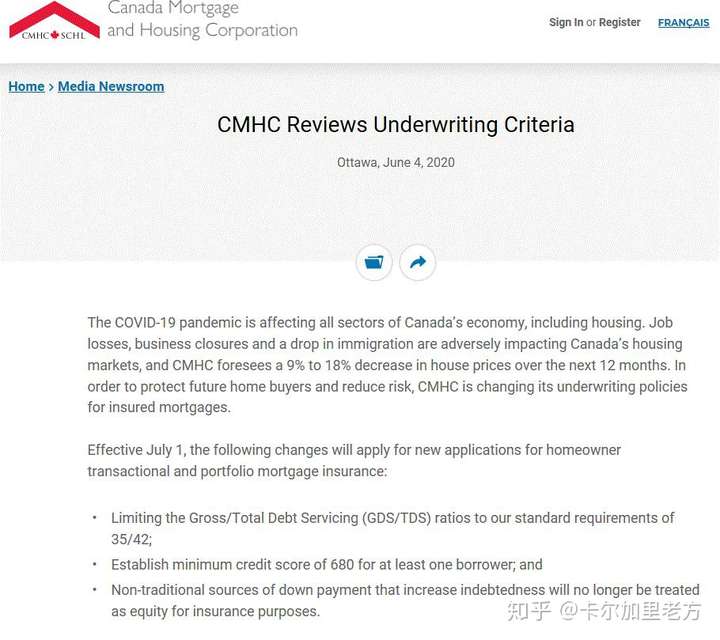

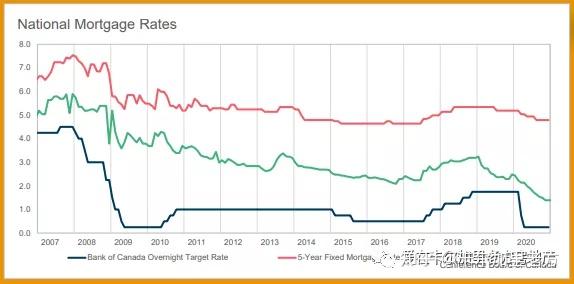

“过去几年里,由于上涨的贷款利率和压力测试,把许多购房者挡在了独立屋市场之外。然而,最近贷款利率的下降,独立屋的价格也降到位,让部分独立屋购房需求得到了释放。这有利于让市场更平衡并且价格回升。不过,并不是所有的房屋类型和价格区间都有改善,未来仍有些风险。”卡尔加里地产经纪协会首席经济师Ann-Marie Lurie这样评价道。

过去4个月以来房屋销量的持续增长并不足以抵消第二季度由于疫情造成的销量剧减,年初至今的房屋销售总量同比去年仍低6%(上个月是9%)。

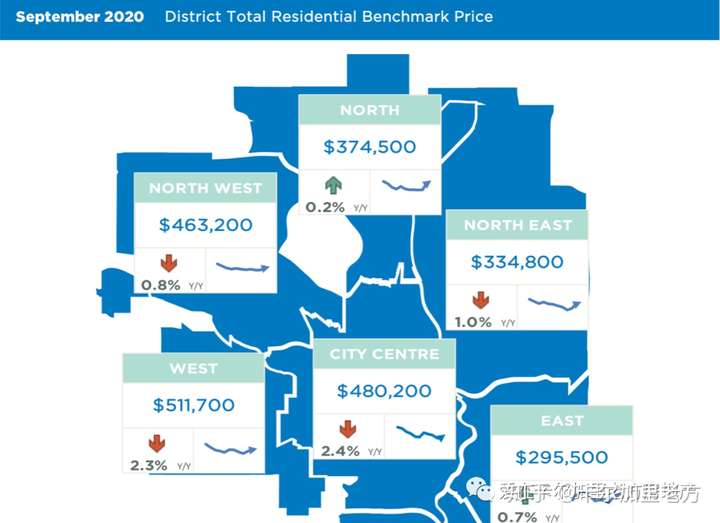

房价的走势也差不多。基准价格已连续4个月略有上扬,2020年10月的价格同比去年略涨。年初至今的总体价格比去年仍低1%,比历史高点低10%。

房产分类数据

独立屋

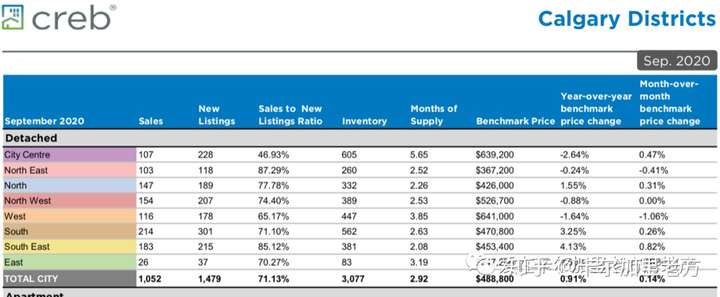

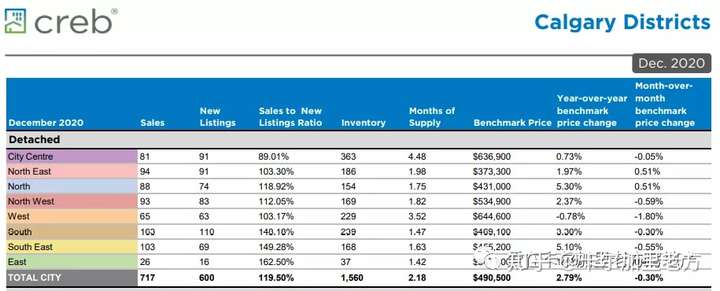

Detached

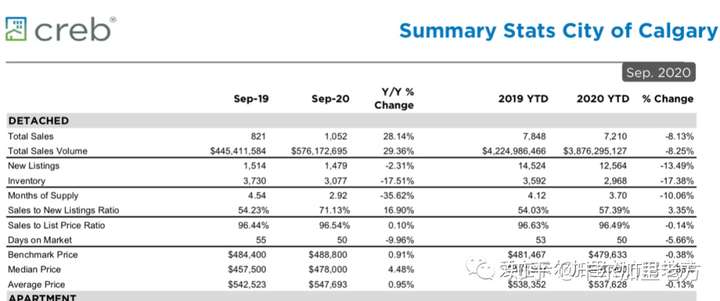

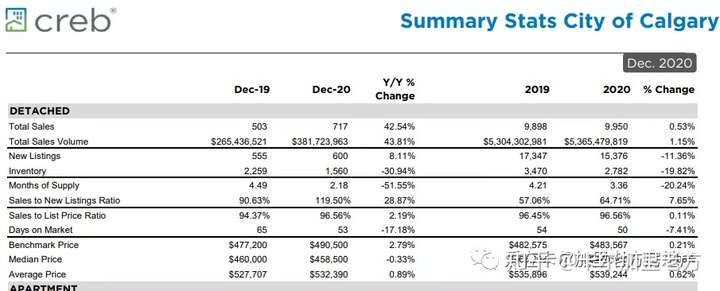

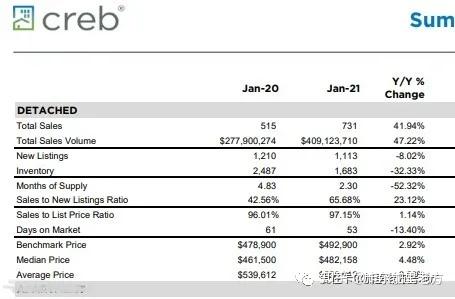

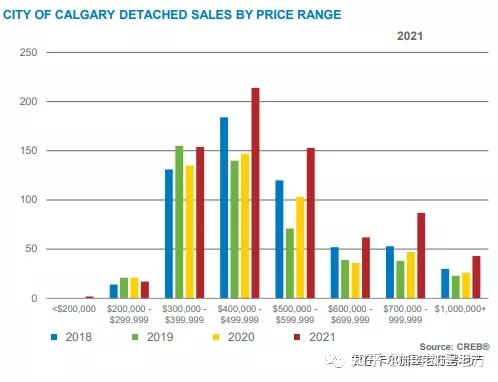

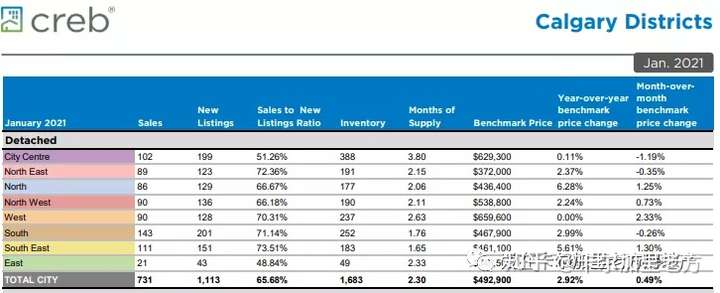

10月独立屋共售出1139套,同比去年大涨35%。

和年初不一样,10月独立屋销量的增长主要是60万以上的房子。也许是价格的下降(到位)促成了高价位房屋销量的上升。

10月独立屋的挂牌量同比去年也是上升的,不过库存还是降低了,使得房屋库存月数降到3以下。这和过去几年动辄4+库存月数相比,算是大有改善了。

但不同的区域和价位区间的状况差异还是很大的。50万以下的独立屋房屋库存月数已经降到2以下,让一些区域的此类独立屋价格涨了一些。

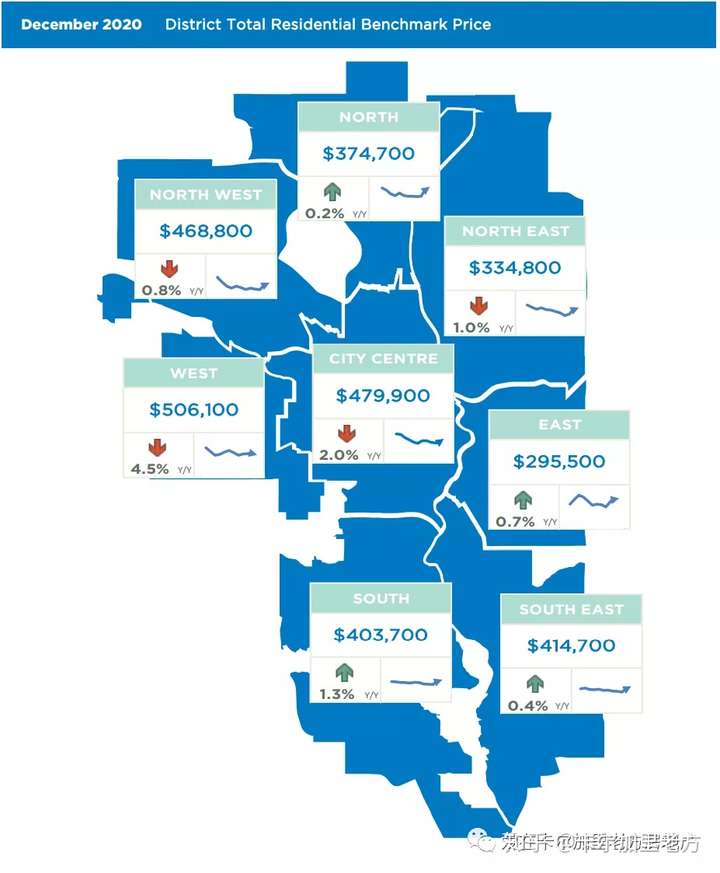

分区域来看价格,只有市中心区的独立屋价格是继续下滑的。南区和东南区的价格同比涨了近4%。尽管最近独立屋价格有所回升,各区的价格还是远低于历史高点,复苏之路仍然漫长。

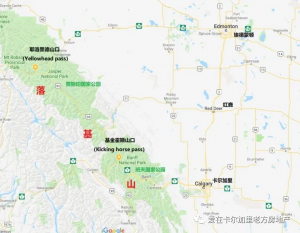

关于卡尔加里的分区,请参考点击老方的文章: 《

卡尔加里社区总体介绍》

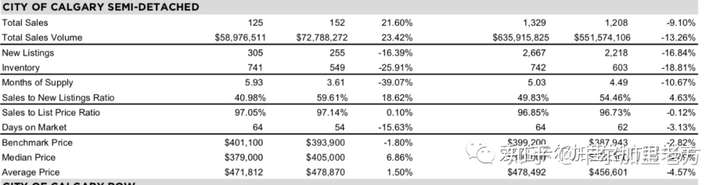

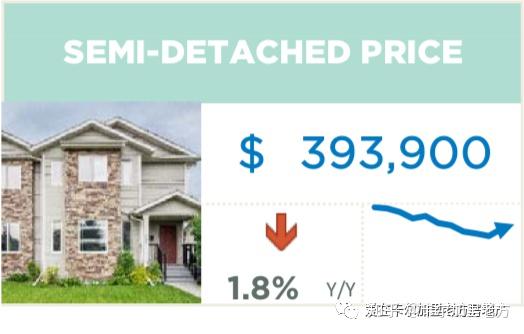

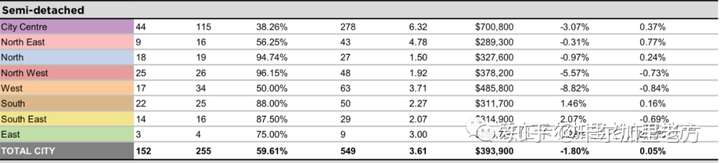

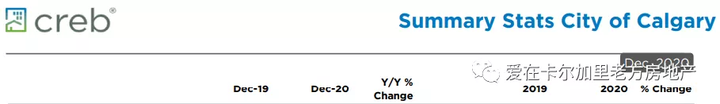

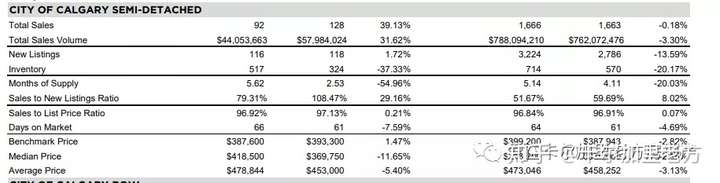

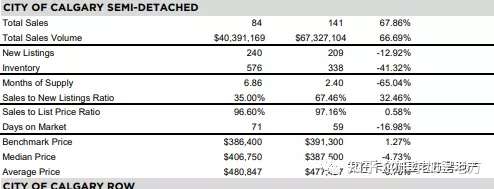

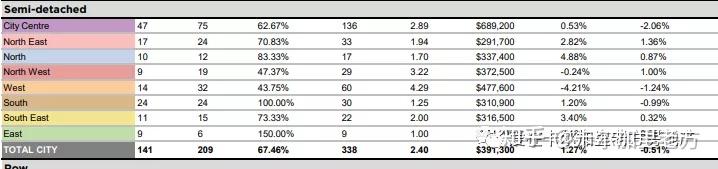

双拼

Semi-Detached

10月双拼销量有所上升,挂牌量下降。

导致库存下降,房屋库存月数也降到了3个月多点。

销量上升、库存下降让价格环比有所回升,不过同比仍低了近1%。但各个区域的情况差异很大,市中心区、西北区和西区的同比价格下降,抵消了其它区域价格的回升。

和独立屋一样,尽管前几个月销量有所回升,年初至今双拼的总销量仍比去年同期低了6%,比长期平均低了7%。销量的不尽如人意主要是因为市中心区、西北区、西区、南区和东区的销量下滑造成的。

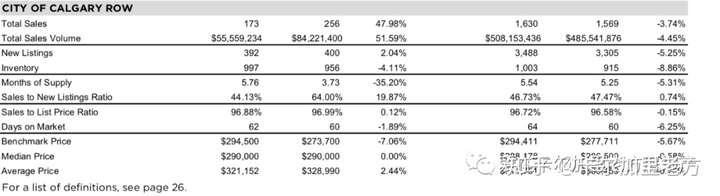

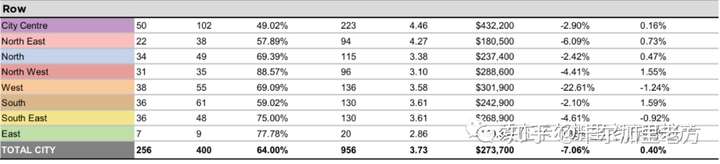

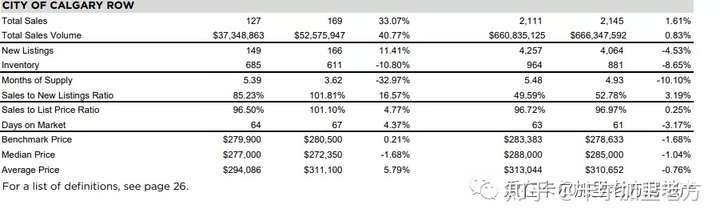

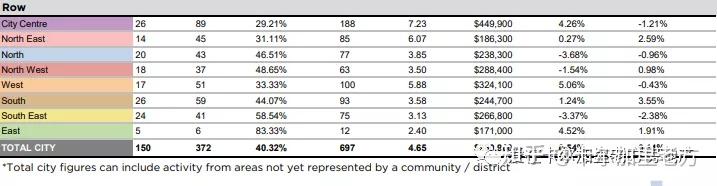

联排

Row

市中心和西区10月的联排销量同比去年大为下滑,不过全市联排的整体销量同比是增长的,年初至今的总销量只比去年同期低了2%。

库存水平相对稳定,房屋供应月数在4左右。

10月联排的基准价格是$274,400,环比略有增加,但同比降了6%,这主要是因为西区的联排价格剧烈下滑造成的。

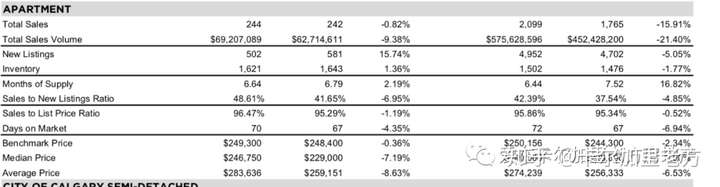

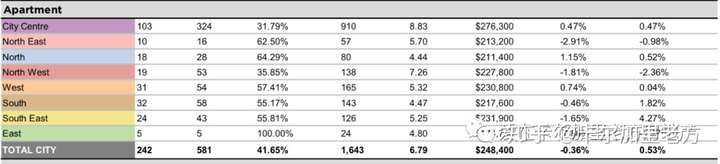

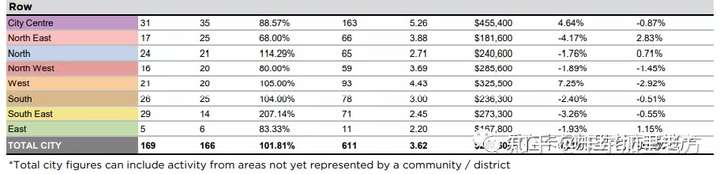

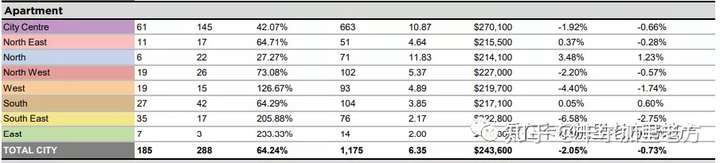

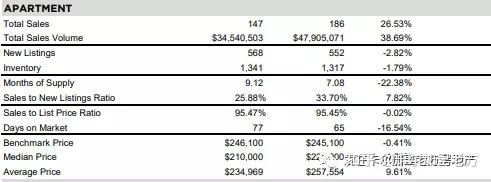

公寓

Apartment Condominium

公寓销量已经连续7个月同比下降,年初至今的总销量是1999套。

这个总销量同比去年下降了15%,比长期平均低了30%。销量上升的只有20万以下的公寓,但这个上升也不足以抵消其它价格区间的销量下降。

公寓整体销量是下降的,不过新挂牌量却在上升,所以库存同比也是增加,对价格继续施压。10月,公寓基准价格是$248,600,环比基本持平,同比低了1%。

总体来说,公寓价格比历史高点低了17%。

关于卡尔加里房产、教育、生活的更多实用信息,请点击以下老方精华帖:

【收藏】2020年10月14日更新老方精华贴汇总-现在精华文章可以点链接直接看啦!!+如何用关键字查询以前的精华贴!!!

常用房地产统计术语:

销售与上市比率(the sales-to-new listings ratio):给定期间的当前销售套数对比新上市套数,一般采用过去30天的数据。此比率一般是一个百分数,如果在40-60%之间,代表市场比较平衡,如果高于60%,一般指卖方市场,如果低于40%,一般代表买方市场。

房屋库存月数(Months of Supply):给定时间段(通常是过去30天)结束时库存总数除以同一时期结束时的销售总数。库存月数是房屋供求平衡的另一重要指标。它代表以目前的销售活动完全清算当前库存需要多长时间。

Media release: Detached homes drive Calgary sales growth in October

by CREB® on November 02, 2020

With strong gains in the detached sector, October sales in the city reached 1,764 units. This is a 23 per cent increase over last year and well above longer-term averages.

The gain in citywide residential sales outpaced the growth in new listings, supporting tighter market conditions and improving prices.

“Over the past several years, higher lending rates and the stress test pushed many out of the detached housing market. However, recent declines in rates, combined with prices that are lower than several years ago, have brought back some of that demand,” said CREB® chief economist Ann-Marie Lurie.

“This is helping support more balanced conditions and price improvements in the market. However, price improvements are not occurring across all product type and price ranges and downside risk still hangs over future conditions.”

Improving sales over the past four months were not enough to offset the pullbacks in the second quarter, leaving year-to-date sales nearly six per cent below last year’s levels.

The same is also true for prices. Benchmark prices have trended up over the past four months and October prices were slightly higher than 2019. On a year-to-date basis, prices are one per cent lower than last year’s levels and nearly 10 per cent below previous highs.

HOUSING MARKET FACTS

Detached

Detached sales totalled 1,139 in October, a year-over-year gain of 35 per cent. Unlike earlier this year, October’s largest gains in sales occurred for homes priced above $600,000. Easing prices for more expensive homes could be supporting this rise in sales.

There were more new listings this month than levels recorded last year, but inventories still eased, causing the months of supply to drop below three months. This is a significant improvement from the four-plus months recorded over the past several years.

There is, however, significant variation by location and price range. Detached homes priced under $500,000 are reporting less than two months of supply, supporting some price gains depending on location.

When looking at price movements by district, the only city district to record further price declines was the City Centre. The South and South East districts recorded year-over-year price gains of around four per cent. Despite recent price movements, prices in all districts remain far from recovery and are well below previous highs.

Semi-Detached

Sales activity trended up over the last month and new listings eased. This is causing inventories to decline and the months of supply to fall to just above three months.

The tighter market conditions continued to support some monthly gains in prices. Despite these gains, the October benchmark price remained nearly one per cent below last year’s levels. However, activity varies significantly based on location. Year-over-year prices eased in the City Centre, North West and West districts, offsetting the price gains in the other districts.

Despite improvements over the past several months, year-to-date sales remain over six per cent below last year’s levels and over seven per cent below long-term averages. Slower sales activity has been mostly driven by pullbacks in the City Centre, North West, South, West and East districts of the city.

Row

There were significant year-over-year declines in the City Centre and West districts, but citywide row sales improved over last year’s levels and year-to-date activity sits only two per cent below last year.

Inventory remained relatively stable this month, keeping the months of supply around four months.

Citywide benchmark prices were $274,400 in October. This is a slight improvement over last month, but nearly six per cent below last year’s levels. The price decline was mostly caused by the significant drop in row prices in the West district of the city.

Apartment Condominium

For the seventh consecutive month, apartment condominium sales eased compared to last year’s levels, resulting in year-to-date sales of 1,999 units.

This represents a 15 per cent decline from last year and is nearly 30 per cent below longer-term averages. The only sector of this market showing signs of improvement is the under-$200,000 segment. Sales have improved in this segment, but it has not been enough to offset declines in all other price ranges.

Citywide sales have been easing, but new listings have been on the rise. This is causing year-over-year inventory gains and is halting positive momentum in prices. As of October, the benchmark price totalled $248,600, similar to last month and over one per cent below last year’s levels.

Overall, apartment condominium prices remain over 17 per cent below previous highs.

Airdrie

With significant gains in the detached sector, sales once again improved this month compared to last year. The increased activity contributed to the year-to-date sales of 1,199 units. This is a 13 per cent increase over last year’s levels.

The year-over-year gain in new listings was not enough to outpace the sales gains. As a result, inventories continue to trend down compared to the previous month and remain well below last year’s levels. This caused the months of supply to remain just above two months.

Citywide year-to-date benchmark prices remained relatively stable compared to last year. However, activity does vary by product type. Detached year-to-date benchmark prices have increased by one per cent, while prices in all the other sectors remain below the previous year’s levels.

Cochrane

Sales activity this month rose compared to last year’s levels, contributing to a year-to-date increase of nearly ten per cent. Meanwhile, new listings have not kept pace with sales, causing reductions in inventory and the months of supply, which dropped to three months.

Tighter housing market conditions are supporting price gains. Benchmark prices trended up for the fourth consecutive month and, as of October, were over two per cent higher than last year’s levels. Despite the recent gains, year-to-date prices remain one per cent below last year’s levels.

Okotoks

Improving sales in October were enough to push year-to-date sales up by one per cent. However, new listings contracted by a significant amount, causing inventory levels to ease and the months of supply to fall below two months.

Persistent tightness in this market is supporting further monthly gains in prices. After five consecutive months of rising prices, October benchmark prices rose above last year’s levels. However, price gains have been driven by improvements in the detached market.

如果觉得文章有帮助,把它分享出去,帮助更多的人,

请扫描下边的二维码,加我微信:

也请点击或者扫描下边的二维码,关注我的公众号:)

有关房地产或者卡尔加里生活方面的问题,可以打电话或者加我微信,知无不言,言无不尽:)

点击原文,可以转到我的网站,上边有更多的资讯,欢迎光临。